June 11, 2025

Blank Sailing Spike After Tariffs: What It Means for Your Supply Chain

Tags:

June 11, 2025

Update:

In light of the 90-day U.S.-China trade agreement announced May 12, demand from China to the United States has surged, with volumes expected to continue increasing throughout June. Those volumes are further supported by existing backlogs and the lead-up to peak season.

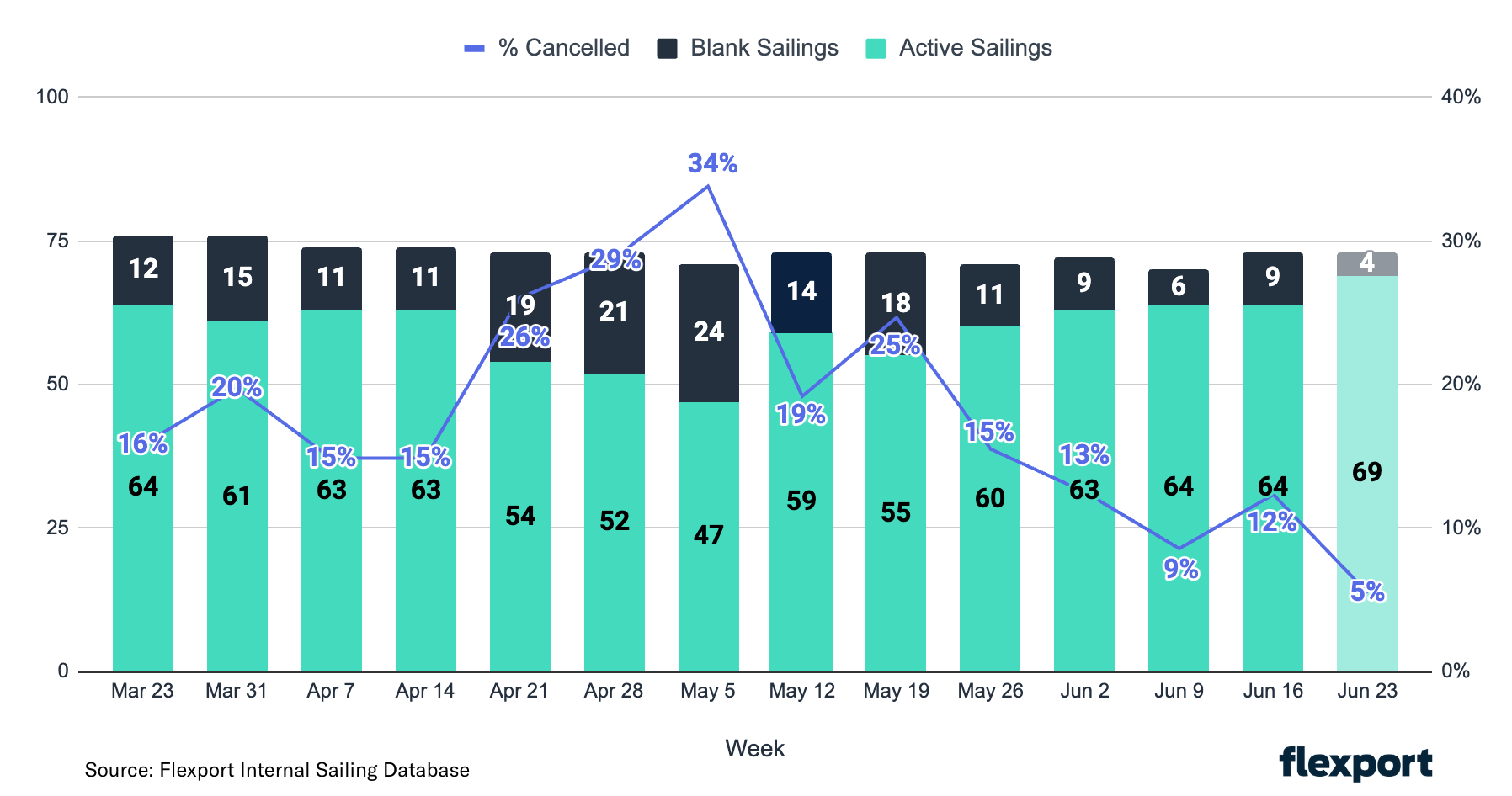

Capacity has increased significantly, with full capacity expected to return by the end of June. Blank sailings have decreased in recent weeks: the cancellation rate fell to 15% (-10% WoW) the week of May 26, and is projected at 10% the week of June 9—the fewest blank sailings since late March.

Many carriers have already announced continuations of suspended service loops, which are resuming as soon as this week (Week 22). See the updated table and chart below.

Table 1: Suspended Transpacific Eastbound Service Loops (Updated May 27, 2025)

| Carrier / Alliance | Service Loop | Suspension Period |

|---|---|---|

| Ocean Alliance | PRX / CP1 / PCS1 / PRX / AAS2 | Will resume Week 22 |

| Ocean Alliance | SEA3 / PSX | Week 18 - 23 |

| Ocean Alliance | CPS / AAC2 / HBB / PCN3 | Will resume Week 22 |

| Ocean Alliance | CBX / ECC3 / AWE7 / CBX | Will resume Week 25 |

| Mediterranean Shipping Company | ORIENT | Will resume Week 23 |

| ZIM | ZX2 | Will resume Week 22 |

| Premier Alliance | PN4 | Scheduled to begin in May, suspended until further notice |

| Premier Alliance | PS5 | Will resume Week 23 |

| Mediterranean Shipping Company / ZIM | PELICAN / ZSL | Week 19 until further notice |

| Mediterranean Shipping Company / ZIM | EMPIRE / ZNS | Will resume Week 24 |

Blank Sailings (Updated June 11, 2025)

Originally Published April 30, 2025:

Transpacific Eastbound Trade: Carriers Cut Capacity in Response to Tariffs

Ocean carriers are withdrawing capacity in the Transpacific Eastbound trade at faster rates than COVID in anticipation of reduced demand following new tariffs on shipments from China to the US.

Calculate and analyze tariff impacts in real time with the new Flexport Tariff Simulator. Get started here.

Carriers are reducing capacity by deploying smaller vessels, blanking (cancellation) scheduled sailings, and even the suspension of entire service loops. For context, a service loop is like a bus route. It’s a set schedule that ships follow every week, stopping at the same ports in the same order.

Ocean Alliance (CMA CGM, COSCO, Evergreen, and Orient Overseas Container Liner), Premier Alliance (ONE, HMM, YML), and ZIM/MSC have completely suspended ten of their weekly service loops. See Table 1 below. Additionally, more services are blanked for several weeks across alliances/carriers, with further blank sailing announcements expected. In late April and early May (Weeks 17-19), more than 25% of weekly service-loops are already cancelled. In comparison, Week 19 of 2020, during the early stages of COVID, had a 24% cancellation rate. Carriers are closely monitoring market developments and may announce additional blank sailings depending on changes to demand.

Table 1: Suspended Transpacific Eastbound Service Loops (Updated May 13, 2025)

| Carrier / Alliance | Service Loop | Suspension Period |

|---|---|---|

| Ocean Alliance | PRX / CP1 / PCS1 / PRX / AAS2 | Week 17 - 26 |

| Ocean Alliance | SEA3 / PSX | Week 18 - 23 |

| Ocean Alliance | CPS / AAC2 / HBB / PCN3 | Will resume Week 22 |

| Ocean Alliance | CBX / ECC3 / AWE7 / CBX | Week 16 - 24 |

| Mediterranean Shipping Company | ORIENT | Week 16 until further notice |

| ZIM | ZX2 | Will resume Week 22 |

| Premier Alliance | PN4 | Scheduled to begin in May, suspended until further notice |

| Premier Alliance | PS5 | Scheduled to begin in May, suspended until further notice |

| Mediterranean Shipping Company / ZIM | PELICAN / ZSL | Week 19 until further notice |

| Mediterranean Shipping Company / ZIM | EMPIRE / ZNS | Week 20 until further notice |

How will this impact your supply chain?

The initial impact will be felt in mid-May (Weeks 20-22). For businesses shipping from major Chinese ports such as Yantian, Ningbo, and Shanghai, these disruptions often translate to tighter capacity and reduced availability one to two weeks after initial blank sailings—potentially removing up to 50% of anticipated allocation. This will make it harder to secure bookings, and drive up the risk of delays, rolled cargo, and higher costs.

The ripple effect will hit consumers soon—and hard.

Most summer goods are already on shelves, but inventory for peak retail seasons like Back to School and the holidays is at risk. Products heavily reliant on Chinese manufacturing—like toys—could face widespread stockouts. As of 2025, 77% of toys sold in the U.S. are imported from China [Investopedia]. Even if production shifts elsewhere, it won’t match China’s scale—meaning lower supply and higher prices. For many families, that could mean fewer gifts under the tree this Christmas.

What Can Businesses Do to Mitigate These Challenges?

- Move Faster Than the Market with Better Data. You can’t predict the future—but you can prepare for it. With real-time visibility and AI-powered planning, Flexport helps you adapt as conditions shift. While others are stuck in legacy systems, you’ll have the speed and clarity to outmaneuver disruption—and avoid costly delays and stockouts.

- Don’t Bet on One Carrier. Stay Flexible. When blank sailings hit, relying on a single carrier can leave your cargo stranded. An open booking strategy spreads your risk—giving you more options, more space, and fewer delays. Flexport works with every major ocean carrier on the Transpacific, using tech and centralized planning to quickly reroute shipments and keep your supply chain moving.

- If Inventory Matters More than Cost, Don’t Wait. Book Early. Some businesses are holding shipments, hoping tariffs will change. But if your inventory needs to move, book now. Delays and cancellations are piling up. The earlier you act—and the closer you stay in touch with your logistics partner—the better your odds of avoiding disruptions.

- Reroute to Stay Ahead. Be ready to shift plans. That might mean using different ports, routes, or even switching from ocean to air. Flexport’s end-to-end network helps you adapt fast—finding faster, cheaper paths from factory to customer when the unexpected hits.

Blank sailings will disrupt global trade, but they don’t have to derail your business. With the right strategy and a logistics partner who sees around corners, you can stay one step ahead. Flexport’s experts are tracking every cancellation, every shift, every day—so you don’t have to. Get in touch with our team today by emailing amer.isdr@flexport.com.

About the Author

June 11, 2025