Economic Outlook: Week of May 10, 2021

Every week, Flexport Chief Economist Phil Levy gathers the most relevant news for the global trade community.

Track major world economies, see what the latest indices reveal, and keep up with the facts and figures that could impact your business.

Here’s the economic news you need for the week of May 10, 2021.

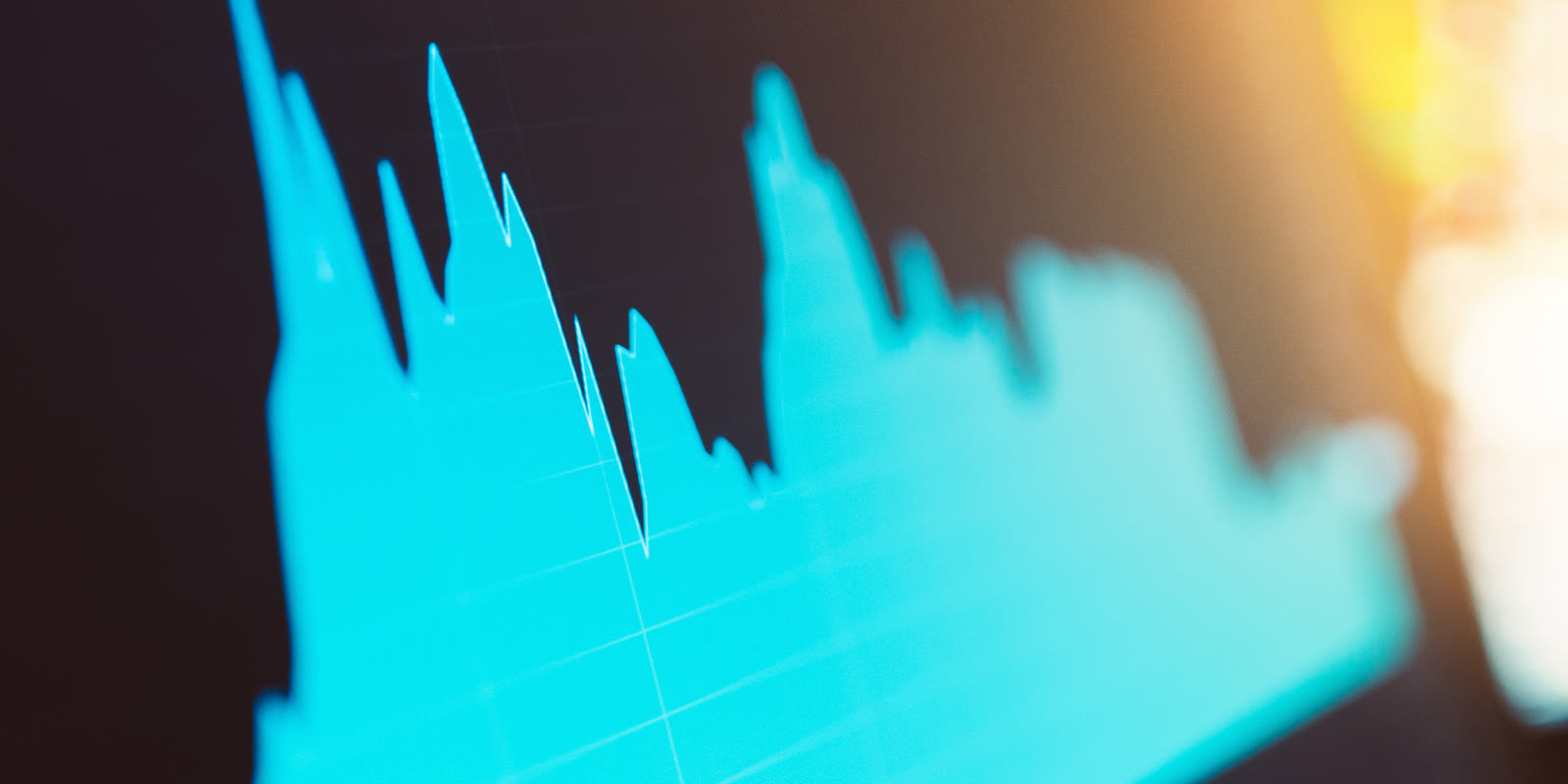

Let’s start with a chart. This week, it's the US Civilian Unemployment Rate.

The most striking data release of the week was the April employment situation: 266K new jobs and an unemployment rate of 6.1%.

Source: Bureau of Labor Statistics and St. Louis Fed FRED.

These numbers were dramatically weaker than expectations, which called for roughly 1m new jobs and an unemployment rate falling to 5.8%, rather than notching up from last month’s 6.0%.

Both the size of the labor force and the employment-population ratio were up slightly, each a weakly positive sign of recovery.

The numbers seemed to contradict the narrative of an incipient economic boom and a rapid recovery.

In its statements, the Federal Reserve Board has said the economy remains far from its maximum employment goal. The latest figure of 9.8m unemployed is 5.7m above February 2020. If that is the size of the employment gap, it would take almost 2 years to close at 266K new jobs per month (and that would assume no labor force growth).

There is sampling variation in employment numbers, but this miss was substantially greater than the +/- 110K confidence interval.

The chart above shows how the movement of the unemployment rate in the pandemic recession differs from that of the global financial crisis. In the current recession, unemployment spiked more quickly, hit a higher high, and has dropped more quickly.

One thing that is not novel is to have the unemployment rate blip upward for a month while generally trending down. That happened for 31 of the 124 months between the October 2009 peak rate of 10.0% and the February 2020 trough of 3.5%.

The April 2021 increase in the unemployment rate is the first since the rate began dropping in May 2020.

The unexpectedly weak employment numbers sparked a policy debate about the impact and merits of additional stimulus and unemployment benefits.

Economic Developments

US Trade Growth Shoots Up

A burst of US trade growth in March set new records. Imports of goods and services were up 6.3% over February, while exports were up 6.6%.

Within those seasonally adjusted numbers, goods trade grew faster, with imports up 7.0% and exports up 8.9%. March goods imports at $233b were the highest on record, while goods exports at $142b were the highest since May 2018.

On an unadjusted census basis, imports and exports each grew by 22% from February.

US Manufacturing Index Grows, but Slowly

The Institute for Supply Management's US Manufacturing Index shows slower expansion than expected in April. One of the biggest monthly component drops was in imports, showing only slow growth.

Chinese Exports Surge in April

Chinese exports went up 32.3% from a year earlier, easily beating analyst estimates.

US Productivity Rises in Q1

US labor productivity was up 5.4% (seasonally adjusted annual rate). The implicit price deflator was up 4.4% (one measure of inflation). For the year, productivity was up 4.1%.

Political Developments

Bipartisan Congressional Pressure on Trade Policy

A bipartisan Senate letter urged USTR Katherine Tai to reconsider US withdrawal from TPP. Separate bipartisan Senate and House letters pushed for a new China 301 tariff exclusion process.

About the Author