May 13, 2016

The History of the Shanghai Containerized Freight Index (SCFI)

The History of the Shanghai Containerized Freight Index (SCFI)

May 13, 2016

The Shanghai Containerized Freight Index (SCFI) is a highly cited metric used to discuss the health of global trade. In the past 30 days alone, news outlets and industry journals have published over 100 articles referencing the SCFI. Carriers, such as global shipping giant Maersk, have referenced the SCFI in their annual reports since the index’s inception.

Aside from the fact that it’s cited frequently by major media outlets, what makes the SCFI so important? What real world impact does it have on exporters and importers? How does it differ from the similarly popular China Containerized Freight Index (CCFI)?

This article seeks to explain the impact of the SCFI in today’s market and highlight its relevance to ocean carriers, freight forwarders, merchants, and consumers alike. Ultimately, we’ll see how its original purpose was to stabilize and protect Chinese shipping markets by promoting the use of derivatives, even if that goal was never achieved.

Creating A More Efficient Market

Created by the Chinese government in 2005, the SCFI was intended to address a few distinct needs within the market.

First, the government wanted a simple index of prices to help attract more buyers and sellers to local markets. By aggregating the movement of several market securities into one easy-to-read benchmark, an index can help efficiently match supply and demand by communicating the health of a market. The SCFI moves up and down based on the spot rates of the Shanghai export container transport market based on data compiled from 15 different shipping routes.

The second purpose of the SCFI was to provide a platform upon which merchants and shippers could shield their businesses against peaks and valleys in market prices. “One major purpose behind the SCFI was to help create a derivatives market to better offset industry risks,” says Gordon Downes, CEO of the New York Shipping Exchange.

Once the index was established, market participants could trade derivatives against its movements, protecting them from volatile price swings. For example, if your business is hurt by falling shipping rates (as in the case of a freight carrier), you can buy derivative contracts that benefit you if the SCFI declines. Conversely, if you profit from lower shipping rates, you can buy contracts that protect you if the SCFI moves higher.

Historically, the Shanghai export market has experienced rapid expansions and contractions. By allowing for a derivatives market to form, the SCFI intended to bring stability to an otherwise volatile industry.

Past Economic Events and Risk Management

A derivatives market for Shanghai freight prices would go a long way in enabling trade in the region. By buying derivatives that guarantee a certain price for freight, buyers and sellers could eliminate uncertainty, making it easier to invest in their businesses.

In the past few years alone, the ocean freight market has gone through several price shocks that have affected exports out of Shanghai, a trend that is not expected to cease any time soon.

One such moment was in 2008 when the European Union repealed EC Regulation No. 4056/86, ending the anti-trust immunity that many groups of shipping lines had long enjoyed. Previously, shipping companies could legally fix prices and coordinate capacity on trade lanes. Since the repeal, fierce competition has created persistent volatility. According to Downes, “In 2009, the industry was facing its worst results in history. However, in 2010 the markets turned and carriers recorded some of their best results in history. It’s a hypercompetitive and volatile market with more shocks to come.”

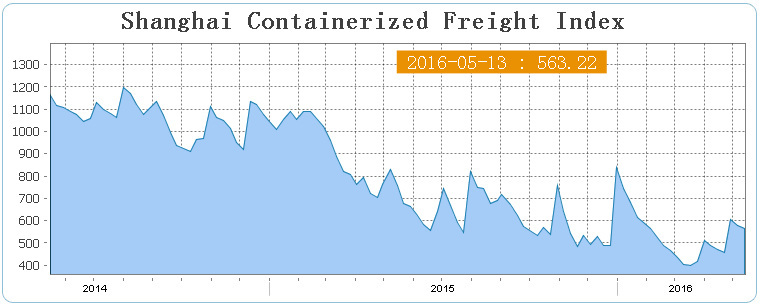

Currently, the ocean freight market is in a freefall, down 50% in just 12 months. Indeed, in the history of humankind the price of ocean freight has never been lower. “Carriers haven’t collectively made a profit since 2010,” says Mike Wackett, a former shipbroker and current editorial consultant at The Loadstar.

(Source: Shanghai Shipping Exchange)

The Underdeveloped Derivatives Market

With the creation of the SCFI, exporters and shipping companies finally had a reliable metric to trade derivatives against, which in theory would allow them to mitigate the extreme volatility mentioned earlier. While this was one of the primary goals behind the index’s creation, a derivatives market never got off the ground.

Backlash from the industry’s major players doomed the process from its infancy. Many carriers worry that a derivatives market would quickly be overrun by speculators. Today, the SCFI is mainly used as a backwards-looking barometer for the markets health. Because few operators are formally offsetting risks through derivative contracts, volatility will likely persist.

Gordon Downes further highlights some possible events that could trigger even greater volatility: “Things could move from a shipper’s market to a carrier’s market fairly quickly. If one of the major carriers isn’t able to pay their bills, their ships could risk being arrested. Just the risk of ships being arrested may cause volumes to rapidly shift onto the remaining carriers, pushing up prices.” Conversely, there are some outstanding risks that could add to the carriers’ troubles. “In 2015 most carriers benefitted from strong tailwinds as their fuel costs declined faster than their fuel related revenues decreased” he explains. “However, if fuel prices increase, it will take the carriers 30 to 90 days before they can increase their fuel related revenues.” Since fuel is a large percentage of the carriers’ operating costs, these headwinds could put even more carriers at risk if they haven’t hedged their fuel costs effectively.

An Important, Albeit Imperfect System

The SCFI failed at creating a proper derivatives market, but that hasn’t stopped industry analysts from tracking it closely. With so many indices out there — the Shanghai Shipping Exchange tracks nine of them alone — it’s easy to get confused.

When discussing the SCFI, there are a few major mistakes that even market experts make. “Most importantly”, says global shipping analyst Wolf Richter, “the SCFI is based on spot rates from Shanghai to the ports in the index. The much broader China Containerized Freight Index (CCFI) is based on the price of containers leaving from all major ports in China, and is a composite of spot rates and contractual rates.”

In other words, it’s important to remember that the SCFI is limited to a much narrower scope than nearly every other freight index: it only tracks exports (not imports) from a single market (Shanghai) and it relies upon weekly spot rates, which can deviate from long-term contract rates. By comparison, roughly 75% of the global market actually runs on contracted rates, so while the SCFI is useful in gauging the current state of the market, it’s not necessarily an accurate reflection of the price being paid by the majority of shippers.

It’s also important to note that the SCFI’s spot rate fluctuates not on real-time rates, but on what carriers intend to charge. The final rate is subject to change, and because of this, one large carrier told us that they don’t participate in the index because they don’t consider it to be a useful measure. This deficiency hinders the SCFI’s ability to become a reliable market indicator.

Another common mistake is correlating changes in the SCFI with shifts in volumes. “The index covers rates only, not shipping volumes,” says Richter. “So it’s the current oversupply of capacity (ships) bringing rates down more than volumes.” For example the SCFI dropped roughly 50% in 2015 even though volumes grew 3.7%. That is, prices are weak because too much capacity is chasing too little cargo; supply and demand levels are incongruous.

—

In a long term sense, it’s difficult to say what will become of ocean freight prices, especially out of Shanghai. The market is dealing with several structural issues affecting both supply and demand.

The importance of tracking the SCFI, however, will likely remain given it provides governments, exporters, carriers, and analysts insight into the health of the world’s largest port. Still, unless its fledgling derivatives market takes root, the SCFI will have only achieved some of its goals outlined in its 2005 creation.

About the Author

May 13, 2016

More from Flexport

![GettyImages-723523781 1199x800]()

Blog

The End of the EU’s Duty-Free Exemption for Low-Value Goods: Timelines, Upcoming Changes, and Impacts on Ecommerce Brands