Help Center Article

How Do I Know the HTS Code of My Product?

Tags:

You can try to find your HTS code using the Harmonized Tariff Schedule.

How Do I Know the HTS Code of My Product?

The HTS is the key to many things during the import of your product. It can have an effect on duty rates, anti-dumping orders, tariff reductions or additional duties, government agency requirements, etc. Your supplier may have provided you with the HTS Code, but the importer is always liable for any issues that arise from using an incorrect HTS. If you don’t know the HTS Code of your product, you can try to determine the HTS Code using the general rules of interpretation (GRI’s) to find the HTS that best fits your product. There is a searchable function on the USITC site (shown below) or Flexport's HS Code Lookup Tool.

Calculate and analyze tariff impacts in real time with the new Flexport Tariff Simulator. Get started here.

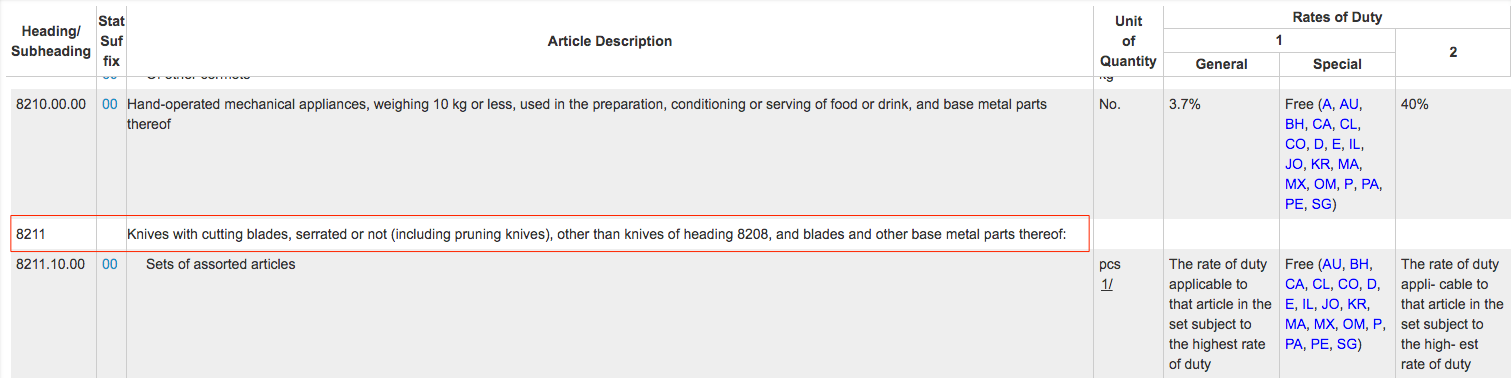

Be aware that the many rules and exclusions make correct classification difficult. For example, you may sell a kitchen knife and search “knife” and find section 8211:

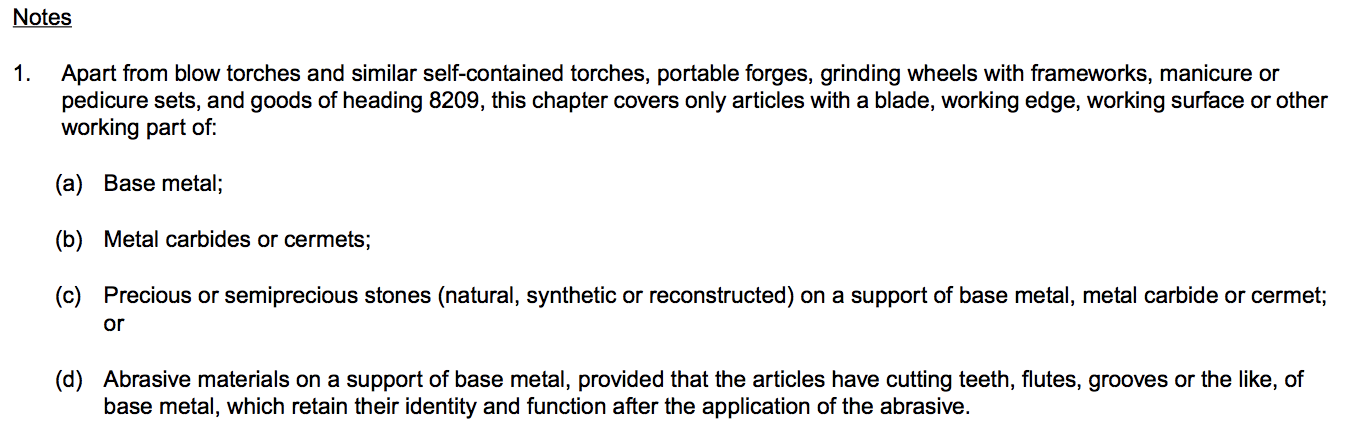

However, if your knife has a ceramic blade, it won’t be classified under section 8211, because Chapter 82 Note 1 excludes blades made of ceramic.

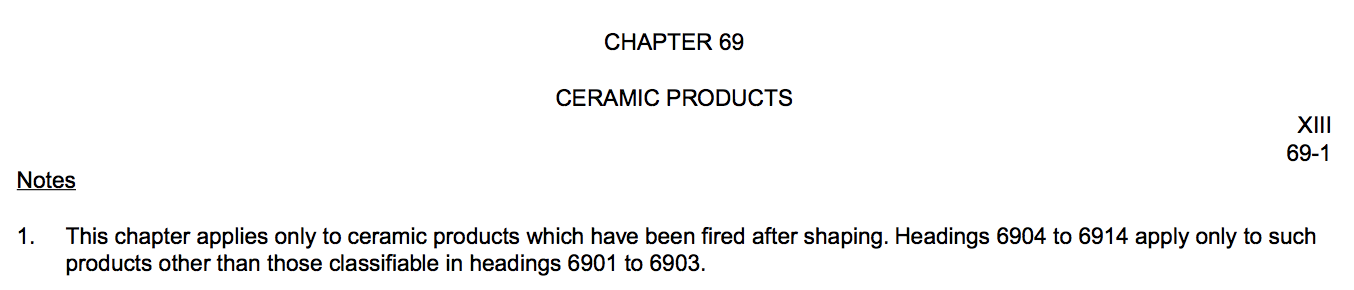

Your product would actually be classified under Chapter 69: Ceramic Products:

Read more about product classification in the United States International Trade Commission's FAQs.

Correctly identifying your product’s HTS Code on your own can be tricky, but your customs broker may help correctly classify your product. If you still can’t figure out how to classify the product with your broker you can reach out to U.S. Customs and Border Protection through a binding ruling that will make the final determination of what the correct classification is.

With the correct HTS Code, you can estimate the customs duties you will need to pay upon importing.