Market Update

Freight Market Update: January 2, 2019

Ocean, trucking, and air freight rates and trends for the week of January 2, 2019.

Freight Market Update: January 2, 2019

Want to receive our weekly Market Update via email? Subscribe here!

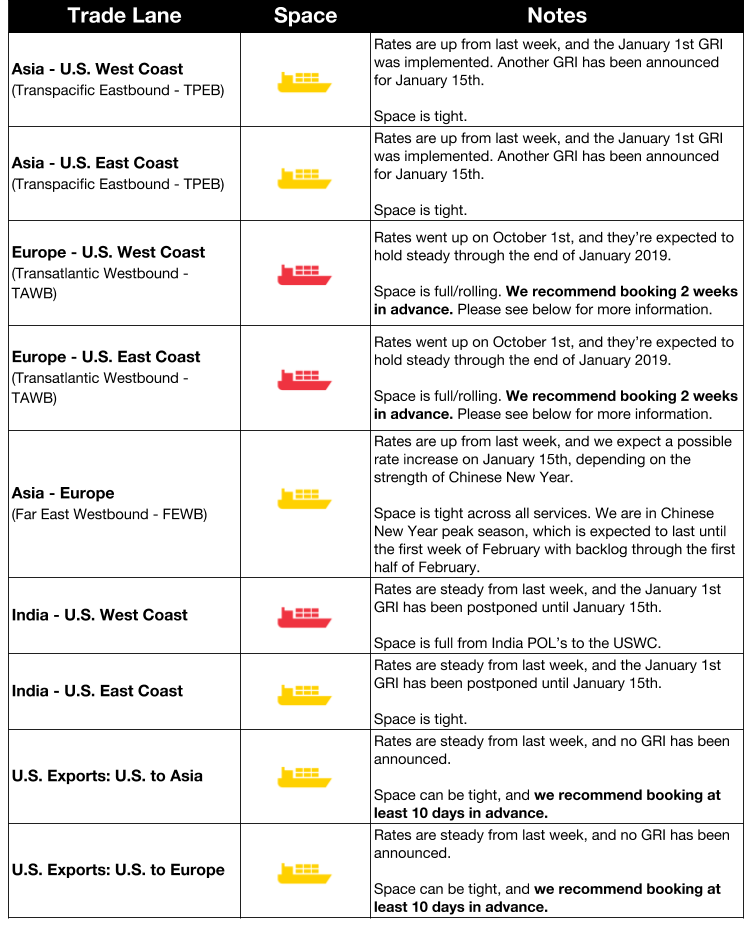

Ocean Freight Market Updates

UK Ports Remain Extremely Congested

UK ports are very congested, which is causing tight trucking capacity and a decline in port productivity. The tight congestion is expected to continue through late January when Chinese New Year cargo will arrive. Rail and road capacity is also tight in Germany due to a surge in volume.

THE Alliance to Improve Asia-Europe Service

THE Alliance has announced that a new service network will begin after Chinese New Year in 2019 and will replace the FE1 Asia-North Europe loop and the PS1 and PS2 Asia-US west coast services. The revamped Asia-Europe service is intended to increase capacity and service quality.

2M Alliance to Improve Asia-Europe Service

The 2M alliance will add six more ultra large container vessels to its 10 Asia-Europe strings and drop eight port of callings starting in March of 2019. The changes are intended to improve schedule reliability, although the alliance noted that vessels are still subject to delays with the extreme port congestion some terminals (like Felixstowe) are experiencing. The trade lane’s capacity will not increase because of anticipated further slow steaming related to IMO 2020 (see below).

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Rates may climb between now and 2020 as a result.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

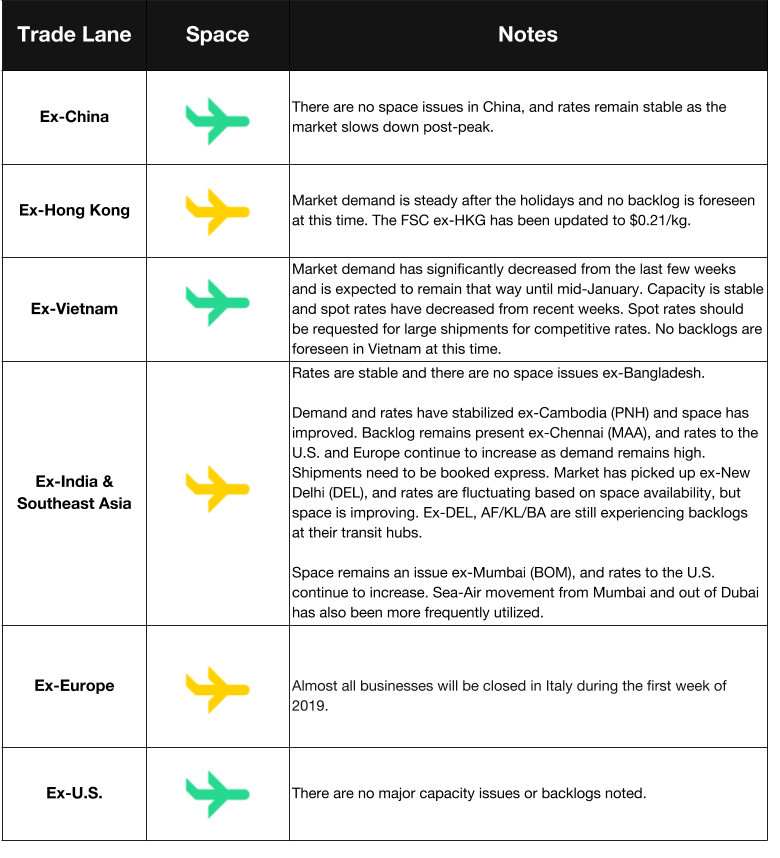

Air Freight Market Updates

ELD Also Affects Air Market

Electronic Logging Devices (ELDs) were mandated for the trucking industry, but it’s also affecting air freight. ELDs have increased rates and transit times for deliveries that are a certain distance from the airport, as well as increased congestion at airports as trucking capacity has been tightened.

2019 Air Freight Predictions

Air Cargo World has put together a list of air freight trends that we can expect to see in 2019. E-commerce volume is expected to increase, and more automated and digitized systems are expected to be introduced. We can also expect to deal with the unexpected, as the air market will have to adapt as necessary to the U.S. and China trade war and Brexit.

Trucking Market Updates

LA Trucking Experiencing Congestion

Fewer longshoremen were working during the holidays and with closures and shortened hours at the ports of L.A. and Long Beach, congestion is expected to continue as the backlog is worked through. However, the port wants to decrease congestion and dwell times in the future by finding a solution to chassis shortages and fixing truck appointment systems.

UK Trucking Faces Number of Critical Issues

The Road Haulage Association (RHA) warns that ignoring the current trucking problems will lead to disaster for the market in the future. A shortage of truck drivers, high costs to train new and younger drivers, and constricting regulatory practices are stifling the UK trucking market and will lead to a “catastrophic cocktail of disaster” if not addressed. Trucking currently needs to be booked 15 days in advance.

Trucking is also expected to be severely impacted if the UK leaves the EU without a negotiated trade deal in place. An abandoned airfield in Southern England will be used as a holding area for trucks in anticipation of a massive traffic jam.

UK Warehousing Storage Space Running Out

Companies are stockpiling goods in the UK in anticipation of possible border disruptions after Brexit. A trade deal may not be negotiated before the UK’s planned exit from the European Union in March, so businesses are putting together stock and import plans to avoid a shutdown.

Truck Trailers Used as a U.S. Warehousing Shortage Solution

Warehouse availability in the U.S. is at an all-time low of 4.3%, so U.S. companies are using truck trailers as a short-term storage solution. Holiday season inventory and the rush to import goods into the U.S. in advance of the tariffs have strained warehousing so these trailers are stocked with goods and parked in warehouse lots or behind stores, to be used until some of that inventory is cleared out.

California’s Hours-of-Service Laws Overruled

The Federal Motor Carrier Safety Administration (FMCSA) has prohibited California from enforcing their meal and rest break laws for truckers. Previously, these laws, to take a meal break every five hours and a rest break every four hours applied to trucking carriers, but the FMCSA ruled that these laws posed a safety risk and decreased productivity. The federal hours-of-service rules will apply instead, which include a limit on daily driving time and require a 30-minute break after eight hours.