Market Update

Global Logistics Update: February 13, 2025

Updates from the global supply chain and logistics world | February 13, 2025

Global Logistics Update: February 13 , 2025

Trends to Watch

[Tariffs Update]

- On Monday, President Trump announced a 25% tariff on all steel and aluminum imports, set to take effect on March 12. Tariffs on these metals “may go higher,” he added, and will not be eligible for duty drawback. The complete product list subject to the upcoming tariff is pending, and will be published in the Federal Register.

- Canada, Brazil, and Mexico are the top three suppliers of steel to the U.S. From March 2024 to February 2025, the three countries accounted for nearly 50% of U.S. steel imports, according to the International Trade Administration.

- CBP will prioritize reviews of imported steel and aluminum, and will impose maximum penalties for any misclassification found to be circumventing duties.

- Stay updated on tariff changes by following our live blog.

[Ocean - TPEB]

- Demand remains weak post-Lunar New Year in February, with floating rates declining further. By Weeks 9 and 10, we’ll be able to see a slow recovery.

- Capacity: By Week 9 and 10, shipping lines will restore a large portion of available capacity. If the rate decline continues, we will probably see more announced blank sailings to stabilize the market.

- Rates: Steamship lines (SSLs) are further adjusting spot rates to all destination gateways in North America. At the same time, Peak Season Surcharges (PSSs) are being adjusted to stimulate more demand and balance short- and long-term rates.

- Equipment: No shortages have been reported.

[Ocean - FEWB]

- Market & space outlook Post-Lunar New Year cargo recovery remains slow. However, more cargo and market activity will pick up after Week 9 (early March). No new blank sailings have been announced for late February, resulting in an oversupply of space. This could potentially lead to a further market decline, as demand remains weak. Despite soft market conditions, carriers are maintaining rates at firm levels. We predict more last-minute vessel voiding may occur to counteract excess capacity.

- Rate development: The Shanghai Containerized Freight Index (SCFI) experienced a significant decline in Week 7, following two weeks of stability during LNY. While current Freight All Kinds (FAK) rates are expected to decrease in the short term until recovery volumes pick up, carriers are likely to implement further measures to prevent a significant market downturn. Although there are rumors circulating of exceptionally low offers, we do not anticipate the market continuing in this direction.

- Strategy & recommendations: Flexport’s shared spot offers remain highly competitive in the market, and we welcome more volume during this recovery period. An earlier recovery volume could provide better space availability in Weeks 8-9. Continuing to wait may not guarantee better price advantages—the best time to ship is now.

- Key market factors & expected recovery: Historical data suggests that the market typically normalizes 2-3 weeks post-LNY, which means a potential price stabilization may occur by late February.

[Ocean - TAWB]

- Rates: Some carriers have lowered their FAK rates from North Europe and the West Mediterranean to the U.S., Mexico, and Canada. However, more carriers are implementing a PSS from March on North Europe to North America routes, anticipating higher demand following recent U.S. tariff developments.

- Demand has remained stable throughout February.

[Air - Global] Mon 27 Jan - Sun 02 Feb 2025 (Week 5) (Source: worldacd.com):

- Tonnage growth slows amid Lunar New Year impact: Global air cargo tonnages rose +2% YoY in January, significantly below last year’s +11% growth, due to more moderate ecommerce volumes and an earlier Lunar New Year. In Week 5 (Jan. 27-Feb. 2), tonnages fell -12% WoW, driven by a -33% WoW drop from the Asia-Pacific as factories closed for LNY.

- Regional divergences in volume trends: The Asia-Pacific saw a -29% YoY drop in Week 5. Meanwhile, Central and South America (+16% WoW) and Africa (+11% WoW) benefited from flower demand ahead of Valentine’s Day. North America (+4% WoW) showed resilience, but Europe (-7% YoY) and the Middle East and South Asia (-5% YoY) declined.

- Air cargo rates still rising YoY, despite short-term decline: January’s average global rate: $2.44/kg (+7% YoY), led by MESA (+33%), the Asia-Pacific (+10%), and Africa (+10%). Week 5’s global average price dipped -2% WoW to $2.42/kg due to lower Asia-Pacific volumes, despite regional price increases. Spot rates from MESA surged +58% YoY, while China-Europe (-1% WoW) held firmer than China-U.S. (-8% WoW).

- China-U.S. ecommerce uncertainty amid Section 321 suspension: Outbound tonnages from CSA soared +17% WoW in Week 4, with a +62% increase in the first four weeks of 2025, mainly driven by flower shipments ahead of Valentine’s Day. Flower shipments more than doubled (+114%), with 92% destined for North America.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

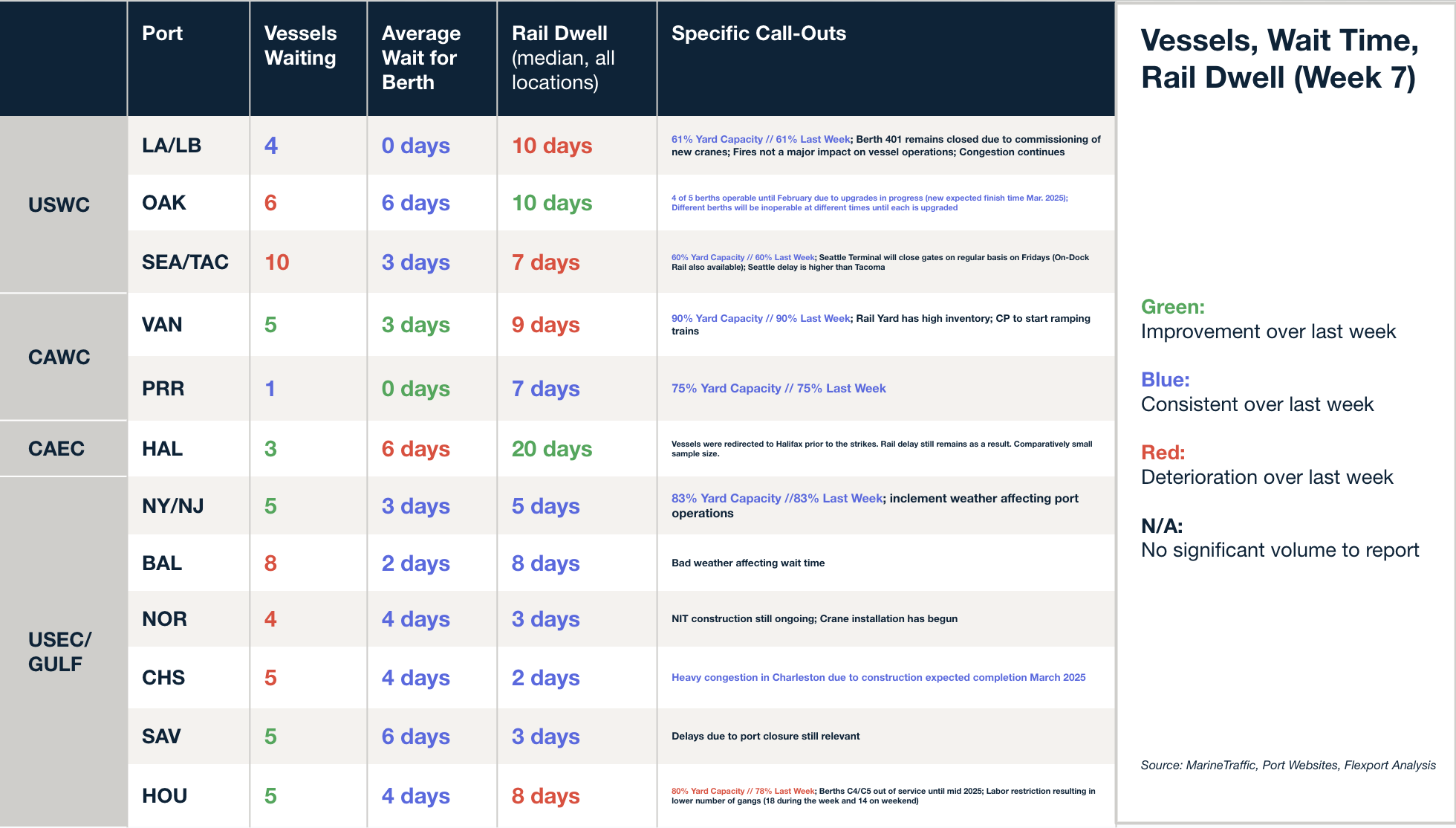

North America Vessel Dwell Times

Upcoming Webinars

North America Freight Market Update Live

(Today) Thursday, February 13 @ 9:00 am PT / 12:00 pm ET

Navigating the 2025 RFP Season: An Advanced Guide to Upscaling Your RFP

Wednesday, February 19 @10:00 am PT / 1:00 pm ET

Tariff Trends 2025: Expert Insights on The New U.S. Customs Landscape

Thursday, February 20 @ 8:00 am PT / 11:00 am ET/ 16:00 GMT / 17:00 CET

European Freight Market Update Live

Tuesday, February 25 @ 16:00 CET / 15:00 GMT

This Week in News

Air Cargo Rates Set to Sink as De Minimis Gets the Axe

Thomas Kempf, Senior Director of Global Air Freight Development at Flexport, sees a big shake-up coming. With de minimis gone, he expects a quick drop in demand for small parcel air cargo from China to the U.S., which will drive shipping rates down. Some shippers might cut back on volume or switch to alternative models, like sea-to-air shipping.

Looking ahead, Kempf thinks things could stabilize if ecommerce companies start shipping in bulk rather than sending individual packages directly to consumers. But there’s a catch—higher costs could still force some players out, pushing rates even lower in early 2025.

Strikes, storms and record volumes adding to North Europe port delays

European ports are experiencing increasing congestion as a surge of Chinese exports from December continues to arrive, further delaying operations already impacted by severe winter storms and labor strikes. According to Container Trades Statistics, a record 835,000 TEUs were shipped from China to North Europe in December, and these containers are now contributing to the backlog at major ports.

Suez Canal Expects ‘Further Stability’ in Coming Weeks

The Suez Canal Authority has expressed optimism about the stability of the Red Sea region and has been in talks with Maersk and other global carriers, urging them to consider returning to the Suez Canal. However, shipping giants like Maersk, MSC, and Hapag-Lloyd have continued to avoid the area due to the ongoing risk of attacks by Yemen-based Houthi militants, which escalated following the Israel-Hamas war. Though attacks have slowed in recent months, war-risk insurance premiums remain high, and carriers are still rerouting vessels around Africa's Cape of Good Hope.

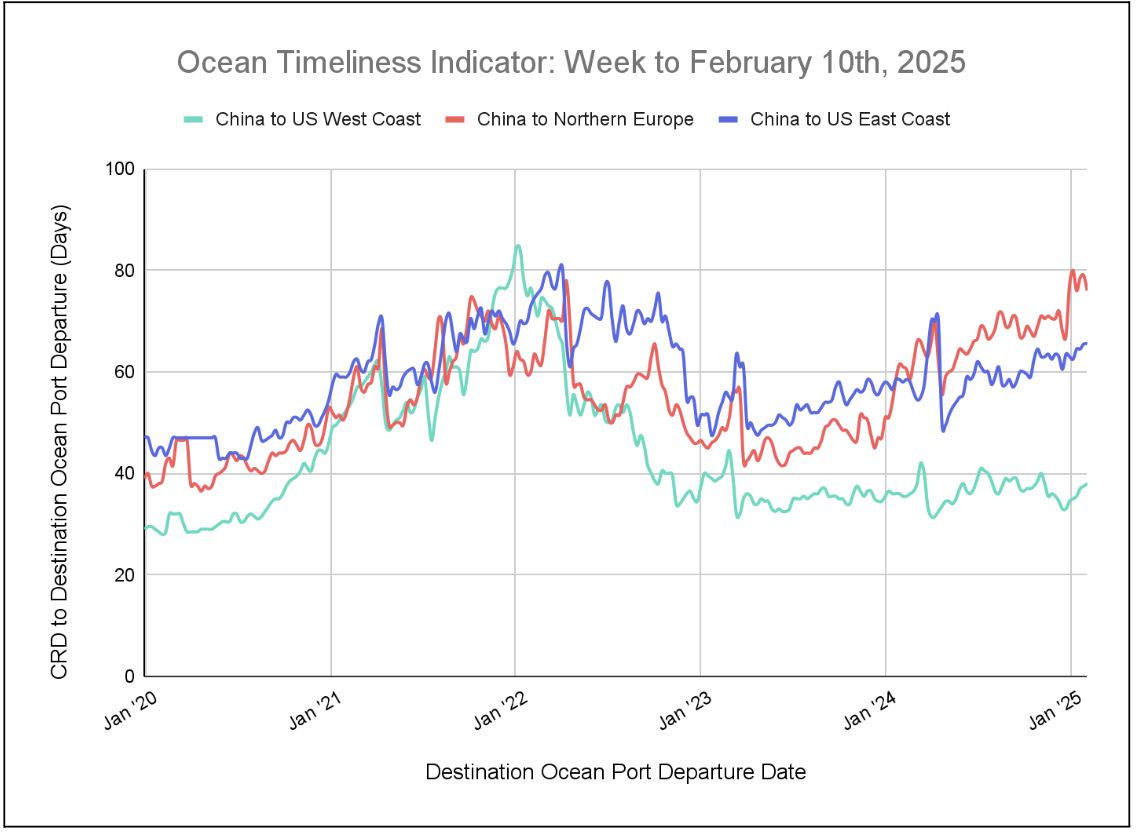

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI is on the rise for China to U.S.-bound lanes, while a small downtick has been noted for China to North Europe.

Week to February 10, 2025

This week, the Ocean Timeliness Indicator (OTI) for China to North Europe is showing a decrease of 3 days, falling from 79 to 76 days. In the meantime, China to the U.S. West Coast has risen from 37.5 to 38 days, and China to the U.S. East Coast has plateaued at 65.5 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?