Market Update

Global Logistics Update: February 27, 2025

Updates from the global supply chain and logistics world | February 27,2025

Global Logistics Update: February 27, 2025

Trends to Watch

[Tariffs Update]

- On Wednesday, President Donald Trump threatened to impose 25% tariffs on imports from the European Union, the U.S.'s third-largest trading partner alongside China.

- Last Friday, the U.S. Trade Representative (USTR) published a proposal to impose steep fees on Chinese shipping companies and Chinese-built ships entering U.S. ports.

- Operators with a U.S.-built vessel may receive a refund of up to $1 million per U.S. port call. China manufactures 70% of the world’s green ships, while the number of container ships built in the U.S. is relatively small. Currently, there are 18 U.S.-built vessels, with 3 more on order.

- Container ships typically make 2-3 U.S. port calls per loop. Under this proposal, they could face additional fees of over $3 million per trip—a significant expense compared to the typical revenue of $10-15 million per journey. This would equate to $250-$300 per TEU.

- Some carriers and operators may be able to avoid these proposed fees through network redesign. Currently, the impact on individual companies will be difficult to predict, as it depends on the carrier mix behind the supply chain and the strings they ship on.

- Read our live blog for more details on the proposal, as well as live tariff and trade policy updates.

[Ocean - TPEB]

- Capacity and market: Capacity is recovering after Chinese New Year (CNY), currently at over 90%. Demand is also increasing, but hasn't yet reached pre-CNY levels. Currently, there is ample space available compared to before CNY. This suggests that things are normalizing after the holiday slowdown, but demand is still somewhat soft.

- Rates trends: Floating rates are decreasing rapidly for the rest of February and into March. General Rate Increases (GRIs) are unlikely for March. This indicates downward pressure on pricing, likely due to increased capacity and relatively lower demand. On the fixed contract side, the Peak Season Surcharge (PSS) is being mitigated for March, while floating rates are trending downward.

- Equipment: Equipment availability has improved, and is now sufficient at most Asian gateways compared to pre-CNY. This is a positive sign, suggesting that logistical bottlenecks related to equipment are easing.

[Ocean - FEWB]

- Space outlook: Bookings from late February through early March have not been significantly affected by the GRI. Week 9 volume remains at 75%-85% of pre-CNY normal weekly volume. Early March blank sailings have had little impact on capacity, as demand remains flat. No significant demand increases have been observed, and bookings continue smoothly with no reported space or equipment issues.

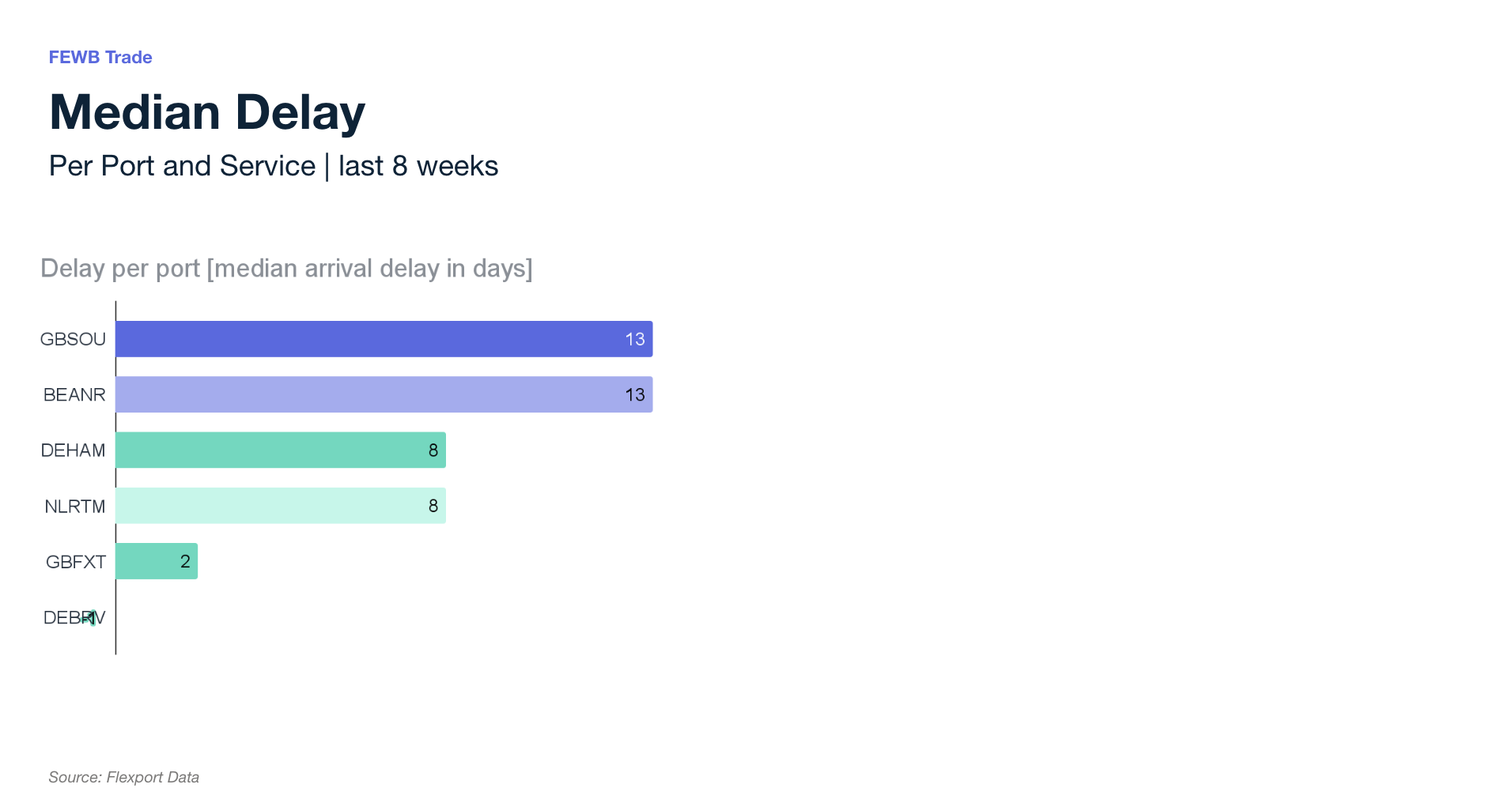

- Destination port congestion: Congestion at most destinations has eased. However, the Route to Market (RTM) is still facing anchor berth waiting times for on-water shipments, which may lead to transshipment or arrival delays. Additionally, the Belgium rail strike on February 13 likely reduced yard turnover efficiency, which could affect vessel call efficiency in the coming weeks.

- Market outlook: Most carriers have announced a GRI for early March in an effort to raise rates, despite limited market demand to support the increase. At the same time, carriers continue to seek cargo for this period. Historically, there have been instances where carriers aligned to set higher-than-expected rates, ultimately succeeding in pushing up the market's Freight All Kinds (FAK) rates. As of February 25, no cancellations or reductions of the March GRI have been reported.

- You can also find our weekly update on ocean dwell time at UK and European ports below:

[Ocean - TAWB]

- Capacity/demand: Blank sailings are decreasing, and we expect more stable capacity in March. The majority of carriers are experiencing good utilization in both North and South Europe, with fewer signs of overbooking, which had been driven in recent weeks by the U.S. administration’s tariffs on steel and aluminum.

- Rates: Most carriers have decided to postpone the March PSS to April. Some carriers have mitigated this by planning to implement the PSS for the U.S. East Coast and U.S. Gulf. March FAK rate levels show signs of skepticism regarding a potential peak season charge.

- Equipment: Equipment shortages persist in parts of Central Europe, particularly in Austria, Slovakia, Switzerland, Hungary, and Southern/Eastern Germany, where carrier haulage is recommended. Meanwhile, Southern European ports are not currently facing any equipment issues.

[Air - Global] Mon 10 Feb - Sun 16 Feb 2025 (Week 7) (Source: worldacd.com):

- Global recovery: After a -13% decline during the Lunar New Year period, global air cargo tonnages rebounded with two consecutive +3% week-on-week (WoW) increases, in contrast to 2024’s steeper -20% drop and subsequent +15% rebound.

- Asia-Pacific rebound: Tonnages from Asia-Pacific origins recovered sharply with a +15% WoW increase in Week 7, following a -35% drop in Week 5—much milder than the nearly -60% decline seen during the equivalent LNY phase last year.

- China/Hong Kong trough: For China and Hong Kong, the lowest point in the LNY dip occurred in Week 6, with a -45% decline relative to two weeks earlier, compared to a -66% fall in Week 7 during 2024.

- Cargo to the USA: Cargo from China and Hong Kong to the USA saw significant Week 7 rebounds (+40% and +27% WoW, respectively), yet these volumes remain approximately 20%–30% below their January averages.

- Spot rate movements: In Week 7, Asia-Pacific spot rates averaged $3.54 per kilo (+2% WoW, +9% YoY), while rates from the Asia-Pacific to the USA increased +4% WoW to $4.81 per kilo. Meanwhile, China-to-USA rates continued to decline (-6% WoW), though Japan and South Korea rates saw a notable rise (+28% and +13% WoW).

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Upcoming Webinars

[Live Broadcast] The Future of Logistics: Something Big is Coming

Thursday, February 27 @ 8:00 am PT / 11:00 am ET/ 16:00 GMT / 17:00 CET

North America Freight Market Update Live

Wednesday, March 12 @ 9:00 am PT / 12:00 pm ET

News This Week

Flexport releases onslaught of AI tools in a move inspired by ‘founder mode’

Flexport is rolling out a suite of AI-powered products and features, marking the first in a series of semi-annual announcements. Among the highlights of this release are Flexport Intelligence, which provides real-time shipment insights in response to natural language prompts, and Control Tower, which enables real-time visibility and control across entire logistics networks. These AI-driven tools are designed to complement—not replace—human customer relationships. Flexport is also streamlining operations by testing out AI-powered voice agents for truckers, warehouses, and other partners.

Trump’s proposed port call fees against China a ‘big deal’: Flexport CEO

The U.S. Trade Representative (USTR) has proposed imposing hefty port fees on Chinese ships. Flexport CEO Ryan Petersen explained on NewsNation that 'there’s pretty much no way around this,' as China produces about 70% of the world’s container ships. Petersen noted that even if a shipping company primarily uses non-Chinese vessels, owning just one Chinese-made ship would still possibly trigger a $500,000 fee per port call.

Trade groups renew push for ocean carrier movement on digitization

Nearly three dozen trade groups are urging shipping lines to speed up the adoption of digital standards for the benefit of shippers, forwarders, and customs brokers. The call, made in a letter to members of the Digital Container Shipping Association (DCSA), follows a similar plea from 11 months ago. The DCSA recently released new standards for booking and electronic bills of lading. The letter urges carriers to align their implementation plans, collaborate with other DCSA members, and involve customers in development. Signatories, including major industry associations, call for progress updates starting in mid-2025.

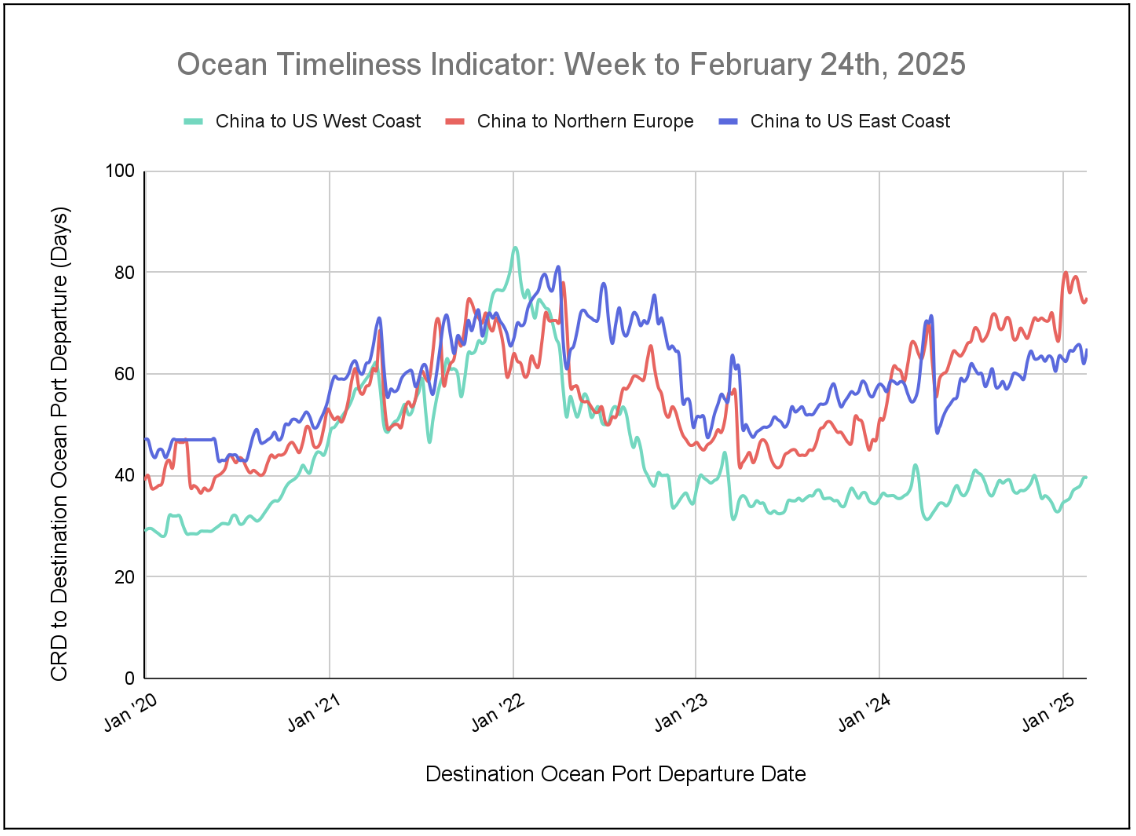

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI plateaued for China to the U.S. West Coast, while increasing for China to North Europe and China to the U.S. East Coast.

Week to February 24, 2025

This week, the Ocean Timeliness Indicator (OTI) for China to the U.S. West Coast has plateaued at last week’s level: 39.5 days. Meanwhile, China to the U.S. East Coast jumped from 62 to 65 days, while China to North Europe also showed an uptick, increasing from 74 to 75 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?