Market Update

Global Logistics Update: January 9, 2025

Updates from the global supply chain and logistics world | January 9, 2025

Global Logistics Update: January 9, 2025

Trends to Watch

[ILA - USMX Labor Dispute Update]

- In a statement released yesterday evening, the ILA and USMX announced they have reached a tentative agreement on a new six-year master agreement, averting a strike.

- The agreement comes just one week before the parties’ existing contract extension expires on January 15. Formal negotiations resumed on Tuesday (January 7) of this week, preceded by a secret meeting two days earlier, where ILA and USMX representatives intended to make headway on the central issue of automation, CNBC reported. A document from Sunday’s meeting indicated “a focus on the creation of new human jobs to complement any new port technology.”

- The ILA and USMX will continue to operate under their current contract until the new contract is ratified. More details will be released after ILA and USMX members approve the final document.

- Get the full breakdown on our live ILA-USMX blog.

[Ocean - TPEB]

- Rates: With Lunar New Year around the corner, ocean carriers have implemented a General Rate Increase (GRI) effective January 1, along with mitigation starting this second week of January.

- Multiple carriers had announced and planned for ILA-disruption-related charges with varying amounts, start dates, and methods of charging. In light of the tentative agreement, many carriers (including Maersk, ONE, ZIM, and EMC) have begun canceling these surcharges.

- Peak Season Surcharges (PSSs) remain, as there have been no changes yet since the January 1 announcement.

- Equipment: No significant equipment issues have been reported at origin. But with Lunar New Year around the corner, we will start to see pressure on equipment and truckers—especially in light of potential new tariffs.

- Space: Amid the pre-Lunar-New-Year rush, space remains constrained. However, there are some strings with open space, especially to the West Coast.

- Carriers have planned some blank sailings for Lunar New Year.

[Ocean - FEWB]

- Lunar New Year factory closures are expected to be concentrated around Weeks 3-4. This will slightly lower market demand; however, the impact will be mitigated by ongoing carrier equipment shortages. As a result, we anticipate that market Freight All Kinds (FAK) rates will remain stable with slight downward adjustments.

- Market prices remain high, hovering around $4,800-$5,000/FEU. The earlier-than-usual Lunar New Year this year, combined with the short period between Christmas and Lunar New Year, has significantly narrowed the production and transportation window. Consequently, the expected pre-Lunar-New-Year shipment rush has not been observed, and is unlikely to occur before Lunar New Year.

- Carriers are prioritizing profitable space utilization over simply increasing overall utilization. This approach, coupled with equipment limitations, is the basic motivation behind carriers’ higher rate levels.

- Before carrier changes and string service upgrades in February, we predict carriers will establish rolling pools to ensure a smooth transition by late January. This is a typical carrier space management measure during Lunar New Year to ensure lifting balances as well.

- Some carriers may prefer to deploy their own operating vessels during this period. Please remain flexible regarding cargo ready date (CRD) and estimated time of departure (ETD) schedules, or substitute equipment options to minimize space release/delay risk.

[Ocean - TAWB]

- Many carriers had announced ILA disruption charges. In light of the tentative agreement, many (including Maersk, ONE, ZIM, and EMC) have begun canceling these surcharges.

- Additionally, some carriers had planned to implement GRIs on January 15 in light of the now-averted strike. We will share more details as carriers finalize changes.

- Blank sailings are continuing in January, with almost all alliances announcing blank sailings until Week 5.

- New services will start in February.

[Air - Global] (Source: Baltic Air Freight Index)

- Global trends:

- The Baltic Air Freight Index dropped 3.7% by January 6, reflecting a decline in air freight rates.

- Despite the dip, the index remains 25.9% higher year-over-year, showcasing resilience in the market.

- China export routes:

- Rates from Hong Kong fell by 11.1% week-over-week, but are still up 14% compared to last year.

- Shanghai experienced a 6.8% week-over-week drop, yet rates remain 37.6% above last year’s levels.

- Southeast Asia developments:

- Rates to Europe increased from Bangkok and Vietnam.

- Vietnam-to-U.S. rates saw a decline.

- India witnessed slight rate decreases in both export and import directions.

- European market shifts:

- Frankfurt’s outbound rates surged 19.8% week-over-week, translating to a 40.8% year-over-year increase.

- London’s North-America-bound rates rose, but overall rates fell 5.8% week-over-week, remaining 19.4% higher than the previous year.

- U.S. market activity:

- Chicago’s outbound rates rebounded post-holiday, climbing 16.3% week-over-week and 30.9% year-over-year.

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Upcoming Webinars

European Freight Market Update Live

Tuesday, January 14 @ 16:00 CET / 15:00 GMT

North America Freight Market Update Live

Thursday, January 16 @ 9:00 am PT / 12:00 pm ET

This Week in News

Limited disruption likely as new carrier alliances roll out: Alphaliner

Ocean carriers are set to launch new global networks on February 1, 2025, involving major alliances like Gemini Cooperation, Premier Alliance, and MSC. While some disruption is expected, key factors will limit its impact, such as the resolution of the ILA-USMX dispute. The Lunar New Year slowdown will also give carriers time to adjust. Though there will be some skipped sailings, most ships are already positioned, and repositioning of vessels from trans-Pacific services will help mitigate capacity shortages.

Trump aims tariffs at Denmark, an exporter of insulin and hearing aids

Donald Trump threatened to impose "very high" tariffs on Denmark if the country resists his offer to buy Greenland, a move that would likely strain trade relations. While Denmark is a relatively small trading partner for the U.S. (ranked 41st), such tariffs could impact industries that rely on Danish imports, especially pharmaceuticals and hearing aids. More than 75% of U.S. insulin imports by value and a significant portion of hearing aids come from Denmark.

Transportation pricing index hits highest level since freight recession began

In December, transportation price growth rates saw a significant surge, reaching their highest point in over two years, according to the Logistics Managers’ Index (LMI). Transportation capacity, on the other hand, showed modest growth—far behind the rise in prices. Additionally, both upstream and downstream companies expect inventories to rise significantly over the next year.

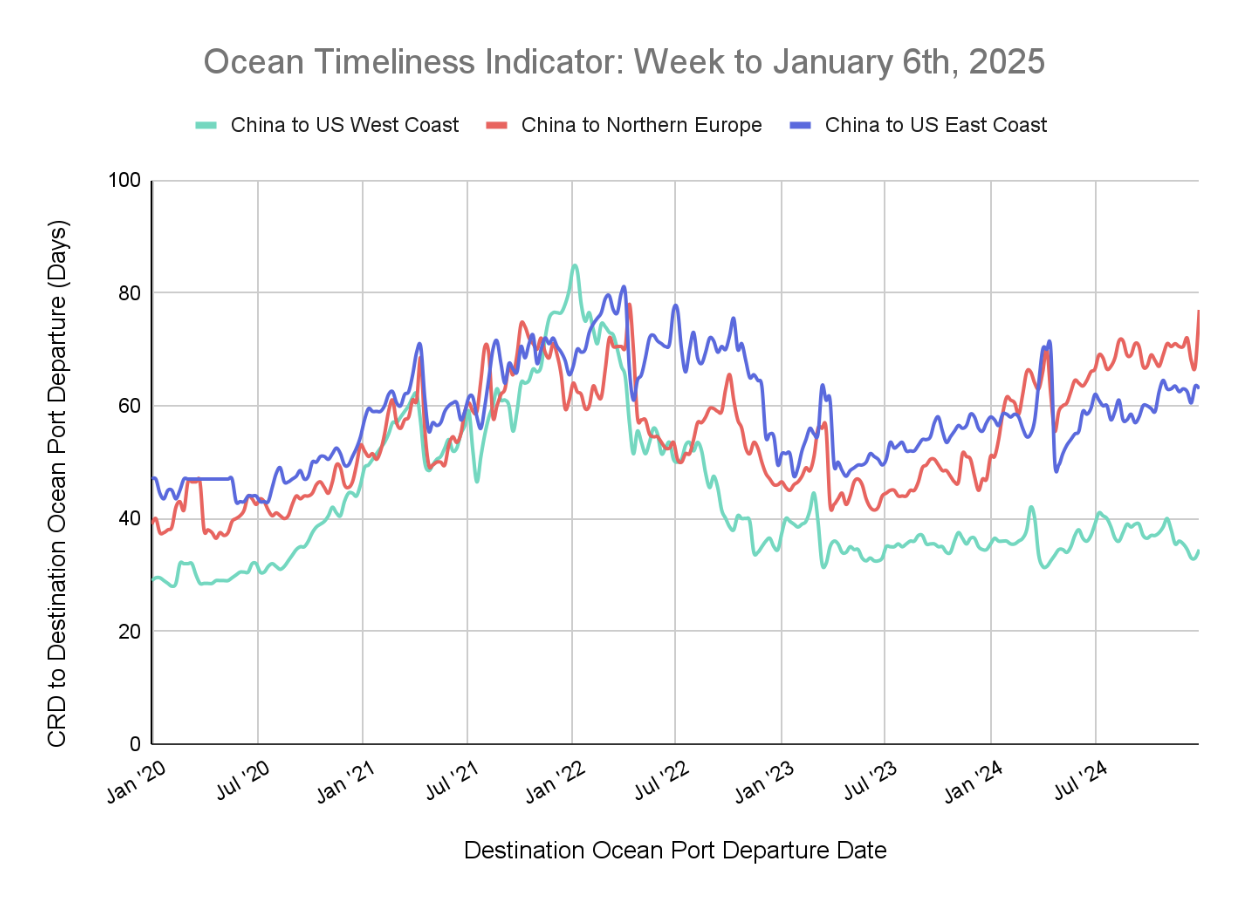

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI jumped for China to North Europe, and stabilized for China to the U.S. East Coast. Meanwhile, China to the U.S. West Coast broke its descent.

Week to January 6, 2025

This week, the Ocean Timeliness Indicator (OTI) has jumped to a new high for China to North Europe, rising from from 67 to 77 days. Meanwhile, China to the U.S. West Coast broke its descent by moving from 33 to 34.5 days. China to the U.S. East Coast plateaued at 63 days, falling from 63.5 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?