Market Update

Global Logistics Update: March 13, 2025

Updates from the global supply chain and logistics world | March 13, 2025

Global Logistics Update: March 13, 2025

Trends to Watch

[Tariffs Update]

- Starting Wednesday, a 25% tariff has hit all steel and aluminum imports, including derivative products outside Chapters 73 and 76, regardless of compliance with USMCA or other FTAs (like KRFTA).

- The announcement followed a whirlwind of decisions on Tuesday when President Trump initially declared a steep 50% tariff on Canadian steel and aluminum—only to reverse the move just hours later. In retaliation, Canada and Europe quickly announced their own countermeasures.

- Follow our live blog to stay updated on the latest developments.

[Ocean - TPEB]

- Capacity and market: Flat demand: March demand remains stagnant, showing no growth since after Chinese New Year. Capacity: Shipping capacity has returned to near full recovery (almost 100%).

- Rate trends: Declining floating rates: Market rates continue to decrease steadily.Narrowing rate gap: The difference between fixed and floating rates is shrinking, driven by falling floating rates and abundant capacity.PSS mitigation/removal: Multiple carriers are reducing or eliminating Peak Season Surcharges (PSS).

- Equipment: Ample equipment supply is available across most origin gateways, with no significant shortages anticipated.

[Ocean - FEWB]

- Capacity outlook: This week, capacity changes were minimal, with no new blank sailing announcements for April. MSC downsized vessels on the FEWB main power string, Lion, reducing capacity by 5k TEU per week. However, new fleets, primarily from HPL, have partially offset this. Overall, March's capacity changes have been limited.

- April GRI announcement: MSK has led the way in announcing a General Rate Increase (GRI) for April, marking the start of a new round of rate hikes. However, the success of this GRI depends on market trends in late March.

- Historically, GRIs signal potential long-term cost increases, prompting shippers to advance shipments and driving up rates. However, with current demand trends, cargo growth momentum may be insufficient, and if demand doesn’t pick up in mid-March, the GRI may not be implemented, similar to this month.

- Booking behavior recommendations: Since late February, GRIs for March have been canceled, extending the period of lower market rates. On the Asia side, factories are fully operational, and production is on track. While February saw weak demand, the current market isn’t facing a true demand shortage. Logistical challenges are slowing transportation, and once destination inventory levels are resolved, we expect a surge in export demand. Port congestion at destination ports is causing delays and accelerating inventory reductions. If inventory levels reach a critical point soon, a market rebound is possible. We recommend moving cargo early to capitalize on the current low-rate window and mitigate potential rate increases.

[Ocean - TAWB]

- Capacity/demand: Blank sailings are being reduced, leading to more stable capacity in March, particularly in South Europe services (East Mediterranean). Most carriers in North and South Europe have good utilization, with some reaching 100% utilization. This indicates increased demand, especially in North Europe.

- Rates: For North Europe, PSS implementation is mixed. Some carriers have implemented a mitigated PSS in March, while most have postponed it to April, with some now considering canceling the April PSS. In the Mediterranean, certain carriers are planning a PSS for April, mainly in the West Mediterranean, with rates around USD 700-800/40' ex West Mediterranean and USD 900-1000/40' ex North Europe.

- Equipment: Equipment shortages continue in parts of Central Europe, especially in Austria, Slovakia, Switzerland, Hungary, and Southern/Eastern Germany, where carrier haulage is recommended. Southern European ports are currently not facing equipment issues.

[Air - Global] Mon 24 Feb - Sun 02 Mar 2025 (Week 9) (Source: worldacd.com):

- China-to-USA weakens amid trade uncertainty: Air cargo volumes fell -10% YoY, with spot rates dropping to $3.80/kg (-9% YoY, -11% MoM). De minimis uncertainty cut ecommerce flights, while ocean imports surged 41% as shippers faced trade restrictions.

- China-to-Europe outperforms the USA market: Shipments grew +4% YoY, and spot rates surged to $4.58/kg (+17% YoY, -2% MoM), showing resilience compared to the U.S. market.

- Global Air Cargo grows despite post-LNY softness: February saw a +5% YoY increase in worldwide tonnage, with Asia-Pacific and South America leading at +8% YoY, while Middle East & South Asia (MESA) declined -6% YoY post-Red Sea crisis peak.

- Market stabilizing, but trade policies loom: Air cargo demand rose for four consecutive weeks, with global spot rates at $2.57/kg (+10% YoY), signaling recovery post-Lunar New Year. However, U.S. tariffs, potential $1M port fees, and trade uncertainty may disrupt supply chains, potentially shifting more cargo to air.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

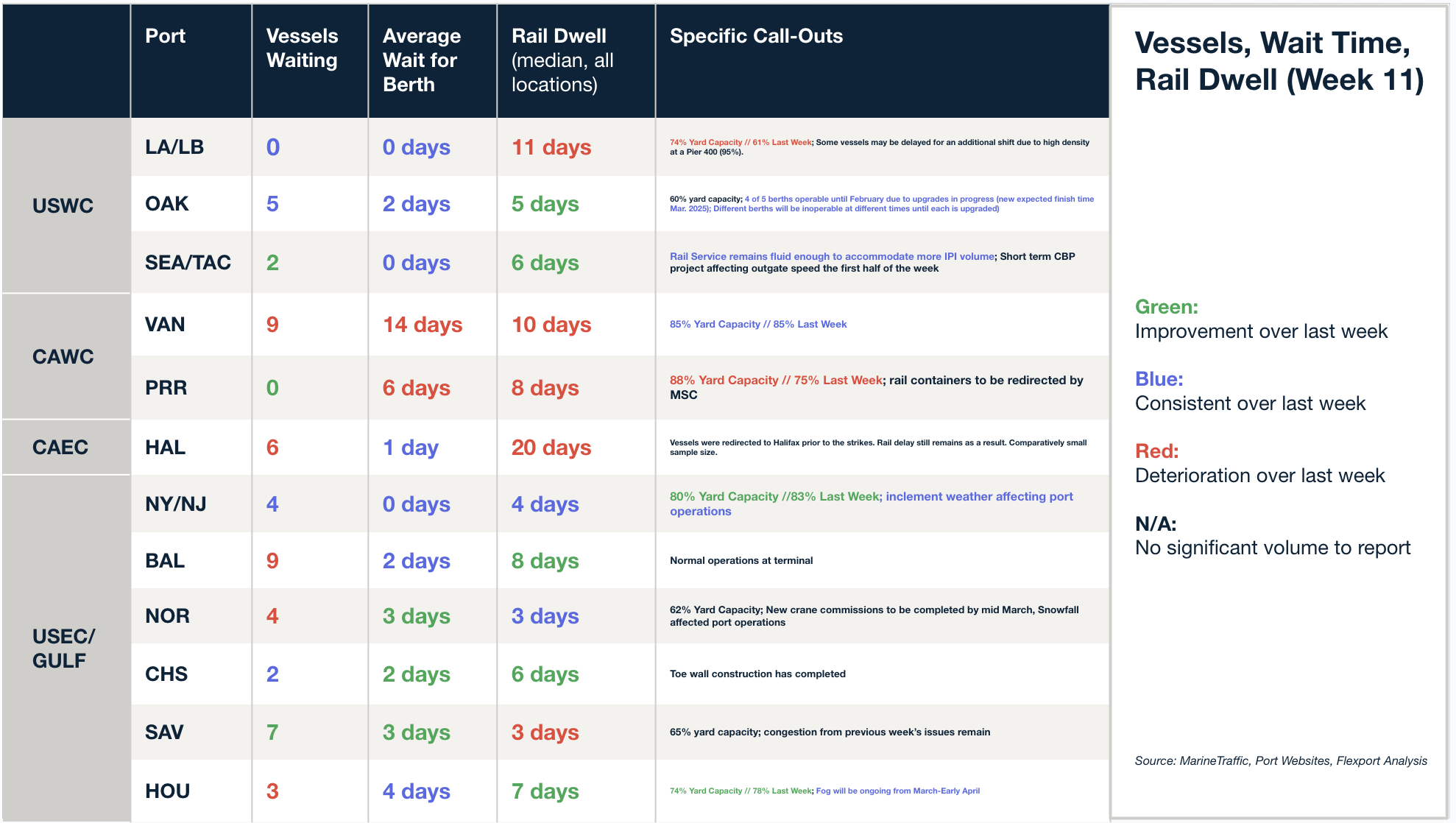

North America Vessel Dwell Times

Upcoming Webinars

Tariff Trends 2025: Expert Insights on the New U.S. Customs Landscape

Tuesday, March 18 @ 8:00 am PT / 11:00am ET / 15:00 GMT / 16:00 CET

News This Week

Flexport CEO: ‘Efficiency Is a Byproduct’ of Successful AI Implementation

Flexport launched new AI-driven tools to enhance supply chain visibility and automation, including route planning, data analysis, and duty drawback processing. While scaling automation, Flexport plans to grow its workforce. Future priorities include automating standing rates and improving trade advisory tools.

Tariffs Put Us in a Carrot-and-Stick Situation, Says Flexport CEO Ryan Petersen

On Wednesday, Flexport CEO Ryan Petersen joined Bloomberg Surveillance to discuss recent tariff and trade developments—including impacts on U.S. manufacturing and exports, how businesses are responding to recent changes, and last month’s U.S. Trade Representative (USTR) proposal. “The United States is reindustrializing relatively quickly, but it’s too soon to say whether it’s happening as a result of the Trump administration,” Ryan said.

Tariff uncertainty prompts US retailers to downgrade spring import forecast

US retailers have lowered their Q2 import projections amid tariff uncertainties between the Trump administration and key trading partners. The National Retail Federation (NRF) and Hackett Associates report decreased forecasts for April through July due to ongoing tariff challenges and high inventories from cargo frontloading. Import volumes for April and May are projected to grow year-over-year but at a slower pace than previously expected, while June and July are anticipated to decline, with July imports down 13.9% from last year. The NRF cites concerns over increased tariffs on Chinese goods and potential new fees on Chinese tonnage at US ports, which could raise costs for cargo owners and consumers.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?