Market Update

Global Logistics Update: November 27, 2024

Updates from the global supply chain and logistics world | November 27, 2024

Global Logistics Update: November 27, 2024

Trends to Watch

Happy Thanksgiving!

We want to take a moment to express our gratitude for your continued trust and support. In a world where change is constant, the supply chain sector is no exception — from shifting trade policies to volatile freight markets and labor disputes. We're here to help you navigate these complexities with one simple mission: making global trade easy for everyone. Without further ado, let’s dive into today’s edition.

[Tariff Watch]

- On Monday, November 25, President-elect Donald Trump announced via Truth Social that he plans to impose sweeping tariffs immediately upon taking office. On Day 1, Trump intends to implement a 25% tariff on all products from Mexico and Canada, alongside a 10% tariff on products from China.

- Trump stated that the tariffs are part of his strategy to address the flow of drugs—particularly fentanyl—and illegal immigration across the U.S. border. “Both Mexico and Canada have the absolute right and power to easily solve this long-simmering problem,” he said. “It’s time for them to pay a very big price.” In a separate post, he also accused China of smuggling fentanyl into the U.S.

- These proposed tariffs could conflict with the U.S.-Mexico-Canada Agreement (USMCA), a trade pact Trump himself signed into law in 2020, which largely promotes duty-free trade among the three nations.

- Want to know what these tariffs could mean for your business and how to stay ahead? Read our live blog for the latest updates, insights, and actionable strategies.

[Ocean - TPEB]

- Floating rates: Rates remain manageable on the West Coast, with space availability open, particularly in the Pacific Southwest and Pacific Northwest. Meanwhile, East and Gulf Coast rates are steady, supported by full-service strings through mid-December.

- Carrier focus: Carriers are preparing for a potential General Rate Increase (GRI) on East Coast routes effective December 1, pending final confirmation. West Coast rates are being extended without immediate adjustments.

- Peak Season Surcharge (PSS): Initial reductions in PSSs are being applied to West Coast routes beginning December 1st, while no changes are planned for East or Gulf Coast routes at this stage.

[Ocean - FEWB]

- Demand fluctuations: Demand picked up slightly in the second half of November, driven by anticipation surrounding the upcoming December GRI. A stabilization is expected in the second half of December due to the holiday season in Europe.

- December GRI: Carriers announced a December GRI at $6,000–$6,200 per TEU, with proactive adjustments based on vessel projections. Some reductions are expected.

- Shanghai Containerized Freight Index (SCFI) movements: The SCFI dropped slightly by $31/TEU in Week 48, reflecting FAK extensions for the second half of November. With the December GRI in effect, the SCFI is expected to rebound in Weeks 49 and 50.

- Equipment availability: Occasional equipment shortages have been reported at China's main ports, but remain manageable. Premium options are available for those requiring firm space on earlier estimated times of departure (ETDs) or specific service/transit times.

[Ocean - TAWB]

- Demand levels: Demand remains strong for both North and South Europe, with heightened activity in the West Mediterranean. Clients aiming for ETAs before January 15 are prioritizing earlier sailings.

- Blank sailing impact: The blank sailing program for Weeks 47–52 is creating a backlog, as it cannot fully accommodate the increased demand for earlier sailings.

- Equipment availability: Equipment levels are generally good, with some exceptions in hinterland areas where equipment is primarily released on carrier haulage.

- Rate stability: December rates remain stable across most carriers, continuing the trends observed in November for both North and South Europe.

[Air - Global] Mon 11 Nov - Sun 17 Nov 2024 (Week 46):

- Europe to Americas rate surge: Spot rates surged +57% to Brazil and +36% to South America in two weeks, driven by severe congestion and a temporary cargo embargo at São Paulo’s GRU. Transatlantic rates to the USA climbed +33% over two weeks, fueled by reduced capacity from winter schedules and Thanksgiving demand.

- Global spot rate trends: Worldwide spot rates increased +4% WoW and are +25% higher YoY, reflecting strong demand and constrained capacity in key regions. Rates from the Middle East & South Asia remain elevated (+73% YoY).

- Asia-Pacific stability: Rates from the Asia-Pacific to Europe rose +11% (China), while USA routes dipped -4% WoW. Advance planning has tempered peak season volatility, preventing a significant capacity crunch.

- Europe origins: Rates from Europe rose +10% WoW to $2.71 per kilo, now +23% higher YoY, bolstered by high load factors and seasonal demand.

- Market drivers: Rate increases are driven by reduced airline capacity, holiday-related demand surges, and operational disruptions like congestion at major hubs. Effective capacity planning in Asia is mitigating sharper rate hikes globally.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Webinars

Air Market Predictions for 2025

Tuesday, December 3 at 8:00 am PT / 11:00 am ET / 16:00 GMT / 17:00 CET

Global Logistics Outlook: Key Trends, Technology, and Strategies for 2025

Wednesday, December 4 at 8:00 am PT / 11:00 am ET / 16:00 GMT / 17:00 CET

Unboxing Holiday Trends: Learnings from Black Friday & Cyber Monday

Thursday, December 5 at 9:00 am PT / 12:00 pm ET

Flexport Customs: Navigating T86, Section 321, and Potential Regulatory Changes

Tuesday, December 10 at 10:00 am PT / 1:00 pm ET

North America Freight Market Update Live

Thursday, December 12 at 9:00 am PT / 12:00 pm ET

This Week in News

Trump Pledges Tariffs on Mexico, Canada and China

President-elect Donald Trump has pledged to impose steep tariffs on Mexico, Canada, and China, signaling his intent to follow through on his campaign rhetoric. He announced a 25% tariff on all imports from Mexico and Canada, and a 10% tariff on Chinese goods, citing concerns about drug trafficking, illegal immigration, and fentanyl production. These measures could disrupt the USMCA trade agreement, which facilitated $1.8 trillion in trade in 2022, and raise consumer prices.

Port of Los Angeles Sees Sustained Import Surge Ahead of Tariffs

The Port of Los Angeles processed 905,000 containers in October, a 25% increase from last year, as businesses rush to import goods ahead of potential tariff hikes and labor disruptions at other ports. The Port of Long Beach also saw near-record volumes, with the two ports handling a combined 950,303 import containers. This surge, part of an extended peak season, is expected to continue through the year due to strong consumer demand and concerns over tariffs and labor issues. The Port of Los Angeles is on track to reach 10 million TEUs by the end of 2024.

Tightening Europe decarbonization measures will raise shipper costs: carriers

Carriers are warning that Emissions Trading System (ETS) surcharges will rise significantly in 2025 as the European Union expands its carbon tax to cover 70% of carrier emissions, up from 40% in 2024. This increase in ETS costs will be compounded by the new FuelEU Maritime regulation, which requires carriers to use more expensive low-emission fuels starting January 1, 2025. The ETS, which operates under a "cap-and-trade" system, will require carriers to purchase EU allowances for CO2 emissions from journeys starting or ending in the EU. By 2026, carriers will be responsible for 100% of emissions from these voyages.

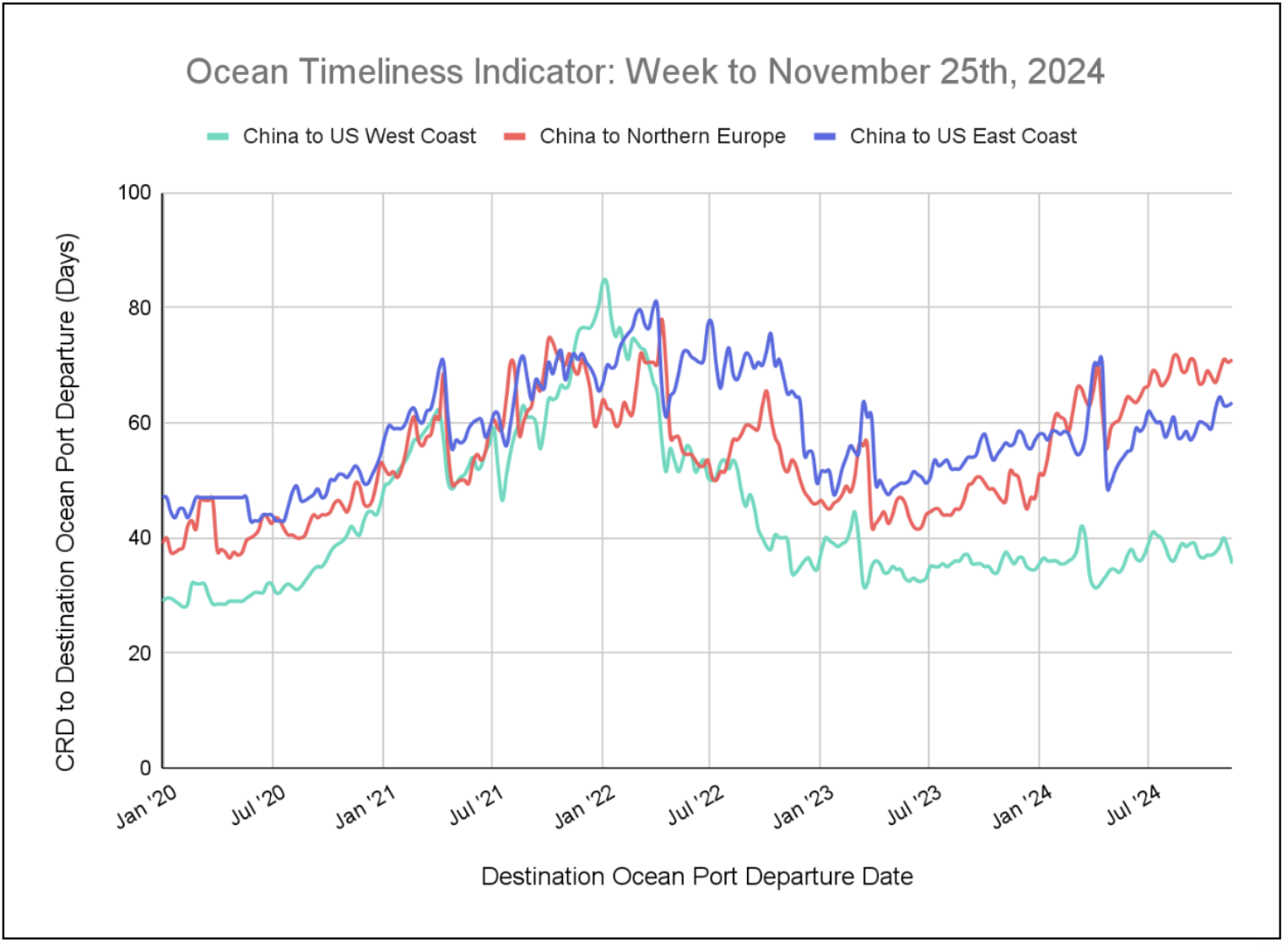

Flexport Ocean Timeliness Indicator

__This week, the Flexport OTI is showing a drop from China to the U.S. West Coast, while China to Northern Europe and China to the U.S. East Coast continues their gradual ascent. __

Week to November 25, 2024

This week, the Ocean Timeliness Indicator (OTI) has dropped for China to the U.S. West Coast, falling from 38 to 35.5 days. Meanwhile, China to Northern Europe and China to the U.S. East Coast have each added 0.5 days to their OTI, moving from 70.5 to 71 days and 63 to 63.5 days, respectively.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?