September 5, 2023

General Average: Navigating Hidden Maritime Costs and Cargo Delays

Tags:

General Average: Navigating Hidden Maritime Costs and Cargo Delays

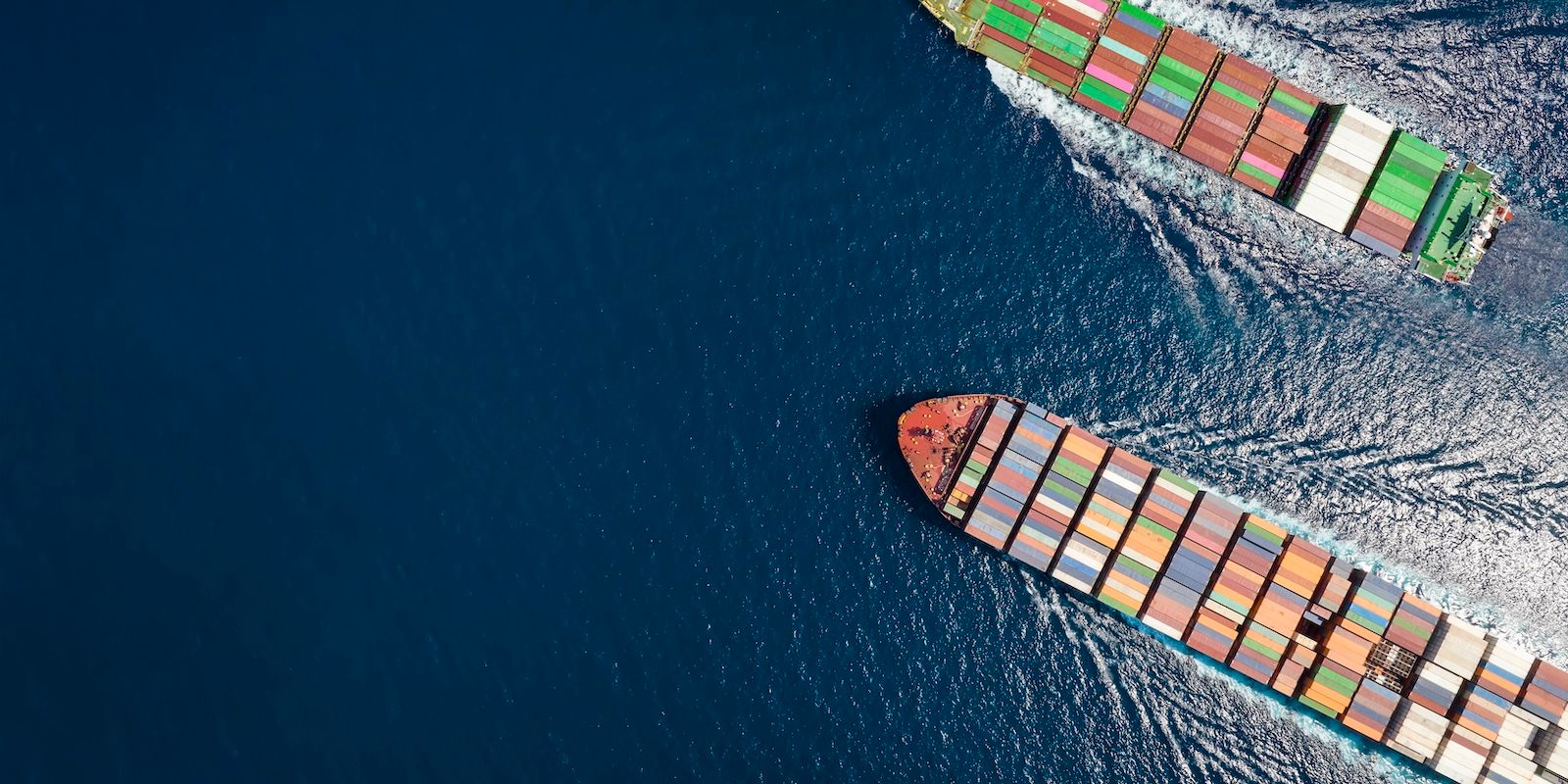

In March 2021 the Evergreen cargo container ship the MV Ever Given got wedged in the middle of the Suez Canal. The incident resulted in the temporary closure of the canal and caused a significant backlog of ships waiting to transit rather than circumnavigating Africa while the salvage operation was underway.

Facing huge losses, the ship’s owners declared general average. General average is a centuries-old principle of maritime law that allows a vessel owner to force cargo owners to share the financial loss to a ship or that were caused by a ship. Each cargo owner will be required to share the financial costs based on its “interest” in the “voyage,” which typically is defined as that owner’s cargo’s commercial invoice value relative to the value of the ship and all other cargo on the ship.

This can be a complex process, as it requires all parties—cargo owners, the ship owner, the other injured parties, and all their insurance companies—assess the value of the cargo, the value of the ship, and the extent of the damages and/or other losses incurred. It can take years.

During this long, slow process, all the cargo from the ship can be held as ‘security’ to insure that each cargo owner pays its portion of the general average fund. Generally, the only way to get your cargo is to post cash or a bond to secure your portion of the general average fund. This is also very complex and it might involve parting with tens of thousands of dollars just to get back the cargo that you have already paid for.

You can insure against this risk. Some cargo insurance policies include coverage for general average which will obligate the insurer to post a bond to secure the release of cargo. This kind of coverage allows the insured to avoid a potentially crippling blow to its cash flow. The per shipment cargo insurance offered through Flexport Insurance Solutions includes coverage for general average.

Carriers often limit their liability for cargo loss so you may be sold down the river with your current coverage, if you have it, so take action today to protect yourself. Flexport Insurance Solutions is an insurance broker that specializes in placing coverage for your cargo. By leveraging Flexport’s cutting-edge technology and data, we’re able to provide flexible coverage options with affordable and transparent pricing—all with superior customer service and fast claims handling. Contact us today to learn more about how we can help protect your cargo.

Insurance is offered through Flexport Insurance Solutions, LLC ("FIS"), a licensed insurance producer (Illinois License No. 3001047128, California License No. 6001029). Insurance is not available in all countries. Check with a licensed FIS representative for availability.

For term coverage, FIS acts as an insurance broker and seeks quotes from multiple insurance carriers with A.M. Best ratings of “A” or higher who actually underwrite and issue coverage. Per shipment coverage is underwritten and issued by Navigators Insurance Company.

The contents of this blog are made available for informational purposes only and should not be relied upon for any legal, business, or financial decisions. We do not guarantee, represent, or warrant the accuracy or reliability of any of the contents of this blog because they are based on Flexport’s current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. This blog has been prepared to the best of Flexport’s knowledge and research; however, the information presented in this blog herein may not reflect the most current regulatory or industry developments. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this blog.