May 27, 2022

New Report - Apparel Manufacturers Face Host of Supply Chain Disruptions

New Report - Apparel Manufacturers Face Host of Supply Chain Disruptions

The apparel industry has weathered multiple disruptions since the onset of COVID lockdowns, and there are new challenges on the horizon. In a new two-part report, Flexport Research looks at recent data for apparel supply chains and identifies several high-impact factors. From increased commodity prices to upcoming sales risks, part one of the report dives into the key challenges. In part two, the team pivots to identifying strategic options for addressing these concerns: logistics strategies, shifts in inventory priorities, and even reshoring get a look.

Read on for a high-level summary of the report, then dive in to discover the numbers behind the recommendations.

Apparel’s No Different From Other Trade-Dependent Industries

Like most manufacturing industries the ongoing congestion in logistics networks has slowed the delivery of finished products. That can be particularly acute for fashion retailers that have had to rely on expensive air freight to ensure seasonal product lines are available on time in the face of slower—but more economical—ocean freight.

Commodity Prices at Decade Highs

Raw materials prices have surged during the pandemic in response to elevated demand across the energy, metals and agriculture sectors—most recently because of the conflict in Ukraine as discussed in recent Flexport research. That’s been exacerbated by a surge in export protectionism across the commodity groups.

Pandemic Related Factory Closures

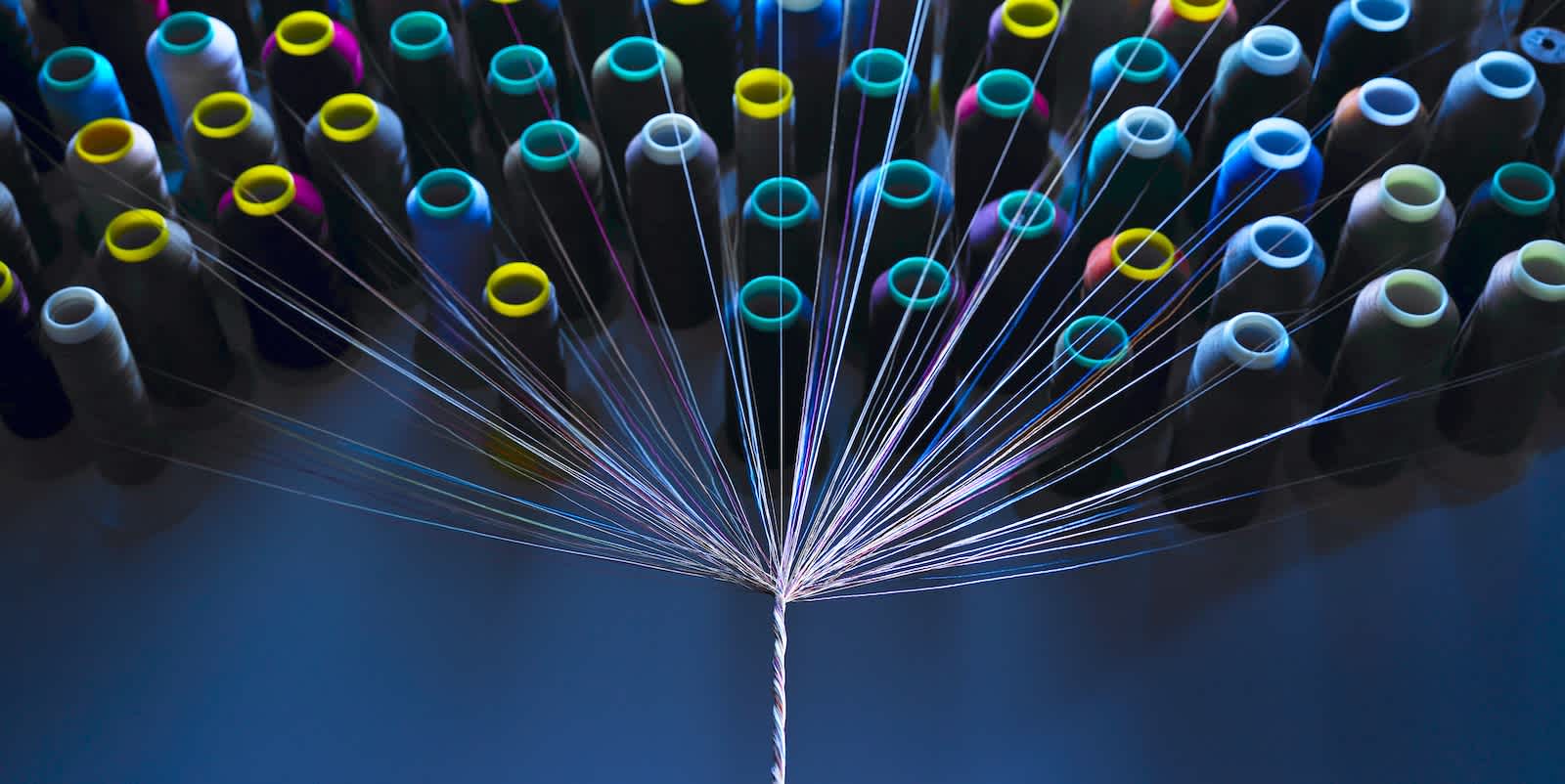

More recently, the pandemic has also had a direct impact on apparel supply chains because of factory closures among manufacturers of both components (yarn, fabric and fasteners) and finished products. For example, a local industry association has noted that apparel factories in Vietnam are facing a shortage of raw materials due to factory closures in China. That followed a similar round of factory closures in Vietnam in 2021 linked to pandemic cases.

U.S. Retail Sales Risks

Clothing retailers have had to deal with store closures during the pandemic, driving many to adopt omnichannel strategies by expanding their direct-to-customer and ecommerce strategies. Compared to the pre-pandemic period though, U.S. retail sales at clothing stores increased by 17.2% in April 2022 versus April 2020 in nominal terms, and by 15.5% when adjusting for inflation. Note that the apparel category of the Consumer Price Index fell by 7.1% in May 2020 versus February 2020 before subsequently recovering.

Flexport’s Post-Covid Indicator also shows that consumer preferences for spending on nondurable goods, which include apparel, may fall rapidly heading into Q3 of 2022 in favor of spending on services.

The apparel supply chain has been faced with many of the same challenges as the larger global supply chains. Sourcing interruptions due to pandemic-related facility closures, the ensuing logistics congestion, and elevated commodity prices among them.

Tactical Sourcing Opportunities

As part of a seasonal industry, apparel suppliers depend critically on receiving goods in a timely manner. An uncertain sales outlook combined with pandemic- and logistics-linked issues have led many firms to make tactical changes in their sourcing strategies. Shifting from ocean to air freight to avoid port congestion and stock outs, addressing fluctuations in inventory to walk the fine line between those stock outs and overages requiring disposal or discounting, and exploring reshoring manufacturing and warehousing to address trade lane delays are among the tactics being adopted across sectors.

Tariffs and Long-Term Sourcing Strategies

Apparel retailers may choose to make some of their tactical sourcing decisions more permanent. Doing so also needs to take into account longer-term factors such as shareholder returns, risk mitigation, environmental responsibility and managing exogenous factors such as politics.

Taking the U.S. as an example, the impact of tariffs on imports from China applied during the Trump administration are still being felt today. As outlined in recent Flexport research the Biden administration may be considering adapting some of these tariffs to offset rising inflation.

Apparel supply chains have faced myriad challenges over the past three years. They now face risks from declining sales. Options for dealing with these challenges include the mix of transportation modes, inventory management, and reshoring of sourcing. For more details, and to see the numbers in our latest research, please see part 1 and part 2 of this report. And when you’re ready to speak with one of our freight experts, please contact us here.