February 23, 2021

Tariff Changes Persist, but Structured Data Can Help Capture Duty Savings

Tariff Changes Persist, but Structured Data Can Help Capture Duty Savings

Staying ahead of customs costs has been tough the past few years. Supply shortages, more complex rules of origin, and general tariff turbulence threaten continuity and compliance.

Even proclamations meant to return stability to volatile markets—like this month’s reversal of quotas on United Arab Emirates’ aluminum—require companies to reassess supply chains. Again. But supply chain technology and customs expertise can cast a light on how to minimize duty spends and cultivate agility in the process.

Know Your Supply Chain

It’s no longer enough to know a product’s origin. Now, companies need visibility into variants, parts, components, or materials, including their origins. When businesses know their supply chain details—and structure them for easy reference—they’re able to deploy smarter tariff strategies.

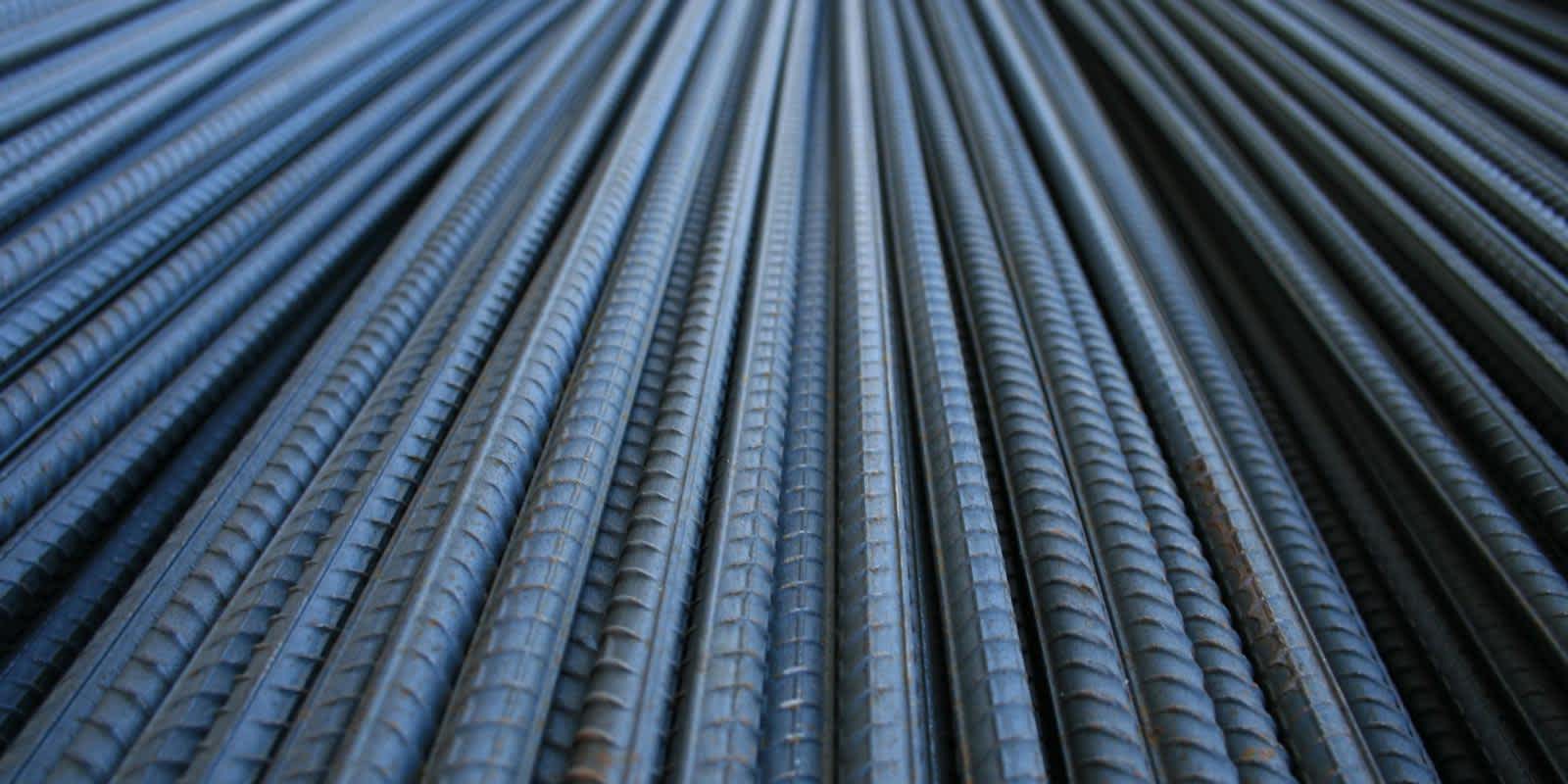

For example, steel and aluminum importers have adapted to a parade of tariffs and quotas over the past few years. Rules shift suddenly, based on extreme specificity: certain types of metals or a derivative; express countries of origin; and exemptions with equally granular stipulations.

Nearly all industries have these quirks. In apparel, men’s shirt importers could reduce duties when an update to HTS codes comes into effect at the end of the year. If pockets are below the waist or the bottom hem tightens, a different classification code applies at a lower duty rate.

End-to-End Planning

To take advantage of fluctuating circumstances, companies need to get a line on relevant intel and act swiftly. Two components help: trade advisory expertise and data.

By communicating regularly with brokers, businesses can receive direct updates in time for quarterly business reviews or when opportunities arise. Expert guidance can also help businesses prevent the consequences of non-compliance, like loss of goods—and sales. For instance, as of last year, apparel importers risk detainment of shipments if they use cotton that comes from a region of China known for forced labor.

Customs expertise becomes more powerful when tied to data visibility. With the right analytics available, companies or their brokers can figure out if a rule applies by referencing product data. In Flexport’s platform, a product library allows for custom attributes and image and link uploads. This information follows products across the library for visual scanning or other verification.

To prepare for the HTS schedule change, an apparel importer could comb its inventory for men’s shirts with pockets to see if any fall below the waist—or could—with an easy design tweak. Product images and descriptions, plus a field for URLs to dig deeper or confirm detail, help a broker perform due diligence and devise a strategy. Then, by adjusting designs as necessary, duty exposure is reduced for that item.

Companies with sophisticated enough insights can continue to make beneficial decisions, even when the market gets rocky. And, with comprehensive order visibility, a buyer could take additional measures, like substitute similar products, divert shipments, or order goods earlier or later.

With expertise and structured data in place, identifying and capturing duty and tax savings can reduce landed costs and eliminate compliance risks. To learn more about tariff and trade management, contact a Flexport trade advisory expert.