January 29, 2020

Understanding the Intersection of Dangerous Goods and Cargo Insurance

Understanding the Intersection of Dangerous Goods and Cargo Insurance

What do essential oils, e-cigarettes, cell phone covers, and fake eyelashes have in common?

Believe it or not, they can all be classified as dangerous goods.

While chemicals, flammable aerosols, hazardous items, and radioactive substances are obvious, any substance or article that can harm a person, property, or the environment qualifies as dangerous.

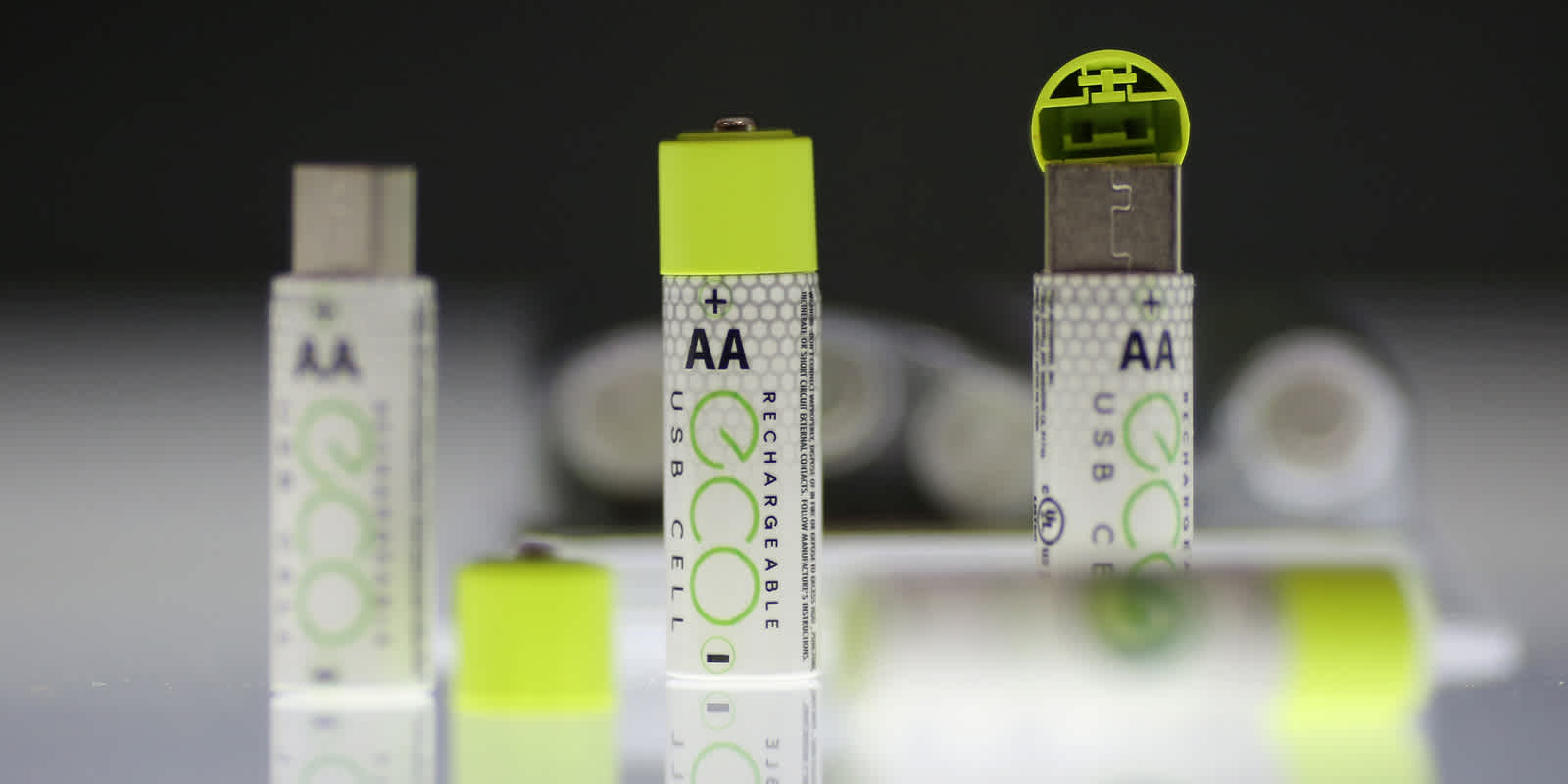

Some products might be perfectly safe for one transport mode, but not be for another. For instance, while lithium cell phone batteries are considered non-dangerous when shipped by ocean, it’s a different story when they’re shipped by air.

If labeled improperly, these goods can lead to onboard disasters. And, for those who don’t have insurance—or the right insurance—the fallout can be calamitous.

It turns out that in most incidents tied to dangerous goods, cargo damage results from lapses in security during the packing process.

And when freight becomes banged up or destroyed, ocean carriers are only legally liable for up to $500 per container—leaving businesses with thousands of dollars in uncovered damage and loss.

So, even if you're not shipping dangerous goods, it's still important to ensure you are covered.

To illustrate, consider general average. If a mishap occurs and freight has to be jettisoned for the safety of those on board, general average dictates that all parties involved in ocean shipments will proportionately share the losses of cargo and ship.

Meaning, without adequate insurance coverage, you could face long waits to access and assess your goods and limited carrier liability in terms of payout—even if your cargo didn’t cause the damage, and even if your own freight is not damaged.

Why Insurance Should Not Be an Afterthought

Mitigating risk with insurance and being prepared for the unexpected should be considered as important as all the other details involved in moving goods from Point A to Point B.

To that point, a recent Maersk study reports that 55% of randomly selected ocean containers were deemed potential fire hazards; and more than two-thirds of containers coming into the US with dangerous goods were improperly identified.

Similarly, according to The US Department of Transportation’s dangerous goods report, there were 19,868 incidents, 20 hospitalizations, 6 fatalities, and more than $110 million in damages in 2018.

Insurance offers protection from loss due to onboard disasters caused by dangerous goods. But, not all insurance provides the same depth and breadth of coverage. Understanding what is included and excluded in a policy is critical to avoid financial fallout of lost or damaged freight.

In addition, consider the impact that damaged or missing cargo will have on the business. Below are four key questions to ask when exploring insurance policies:

- What level of general average coverage does your insurance provide?

- Can your business continue without the goods or the revenue they generate?

- Will your claim be filed and resolved in a timely manner?

- Does your policy exclude concealed damage due to dangerous goods?

Whether or not a business ships dangerous goods, precautionary measures can protect it from indefinite loss of product and associated revenue.

Register for a free consultation to learn more about cargo insurance. To navigate dangerous goods and understand required documentation, watch “Shipping Dangerous Goods: Avoid 5 Common Mistakes.” Or, talk to one of our experts.