Global Logistics Update

90-Day Tariff Truce (Excluding China): What's Ahead?

Updates from the global supply chain and logistics world | April 10, 2025

Global Logistics Update: April 10, 2025

Trends to Watch

Talking Tariffs

- On Wednesday, President Donald Trump announced a 90-day suspension of country-specific reciprocal tariffs for all trade partners except China—less than 24 hours after they were implemented. This means that all other countries (except for China) now have reverted to the universal baseline tariff of 10%, originally set on April 5, for the duration of the pause.

- China, however, has now faced a tariff rate of 125%, up from the 84% rate that took effect on Wednesday.

- In response to the escalating tariffs imposed by the U.S., China has announced an 84% reciprocal tariff on U.S. goods, effective April 10. Meanwhile, the European Union is suspending its retaliatory tariffs following President Trump’s reversal of the country-specific tariff policy.

- On the same day, the White House also released an Executive Order titled "Restoring America’s Maritime Dominance," outlining a strategy to rebuild the United States' commercial shipbuilding capacity and strengthen the maritime workforce.

- A key part of the Executive Order is aimed at fixing a loophole in how the Harbor Maintenance Fee (HMF) is applied. The HMF is a fee meant to help maintain U.S. ports and waterways. However, many shippers have been avoiding this fee by unloading cargo at ports in Canada or Mexico, then trucking or railroading the goods into the U.S. instead of shipping directly into U.S. ports. This workaround let them bypass paying the fee, even though the goods still ended up in the U.S.

- The Executive Order is trying to close this loophole, so that shippers can’t avoid the fee just by using non-U.S. ports and crossing the border by land.

- All foreign-origin cargo arriving by vessel must clear U.S. Customs and Border Protection (CBP) at a U.S. port of entry for full assessment of duties, taxes, and fees, including the HMF.

- To address this issue, the order instructs the Department of Homeland Security to ensure the following:

- All foreign-origin cargo arriving by vessel must clear U.S. Customs and Border Protection (CBP) at a U.S. port of entry, where it will be subject to full assessment of duties, taxes, and fees—including the Harbor Maintenance Fee (HMF).

- Foreign cargo entering North America through Canada or Mexico and then transported into the U.S. by land—without undergoing substantial transformation—will be charged the same fees, plus a 10% service fee to cover additional CBP processing costs.

- Follow our live blog for real-time updates.

Ocean: Trans-Pacific Eastbound (TPEB) Update

- Capacity and demand: Shipping capacity has been significantly reduced for April, with approximately 20% of market capacity removed due to a rise in blank sailings. Additionally, some services have been altered or temporarily suspended, further tightening available space.

- The recent tariff increases are beginning to significantly impact demand this week and are expected to continue doing so. This points to a potential decline in shipping volumes and an increase in upcoming cancellations.

- Equipment: Shipping equipment availability, including containers, remains sufficient at most origin ports, with no major shortages anticipated in the near term.

- Freight rates: Floating freight rates have been extended through the end of April.

- The Peak Season Surcharge will not be implemented in April and will remain at $0 throughout the month.

Ocean: Far East Westbound (FEWB) Update

- Supply-demand dynamics overview: Some shippers are diverting orders to European markets, resulting in a slight uptick in volumes. However, the full impact of these tariff measures remains uncertain, and stakeholders are advised to monitor developments closely.

- Carrier capacity adjustments: To address the capacity oversupply, the Ocean Alliance has announced several blank sailings starting in mid-April.

- Additionally, Premier Alliance has removed some capacity as of Week 19. Shippers are advised to closely monitor late-April sailing schedules and secure space early to minimize risks from potential ad-hoc port omissions.

- Freight rates: This week, the Shanghai Containerized Freight Index remained stable for the fifth consecutive week. Despite the absence of a significant demand surge, carriers' proactive capacity-tightening strategies have led to vessel utilization rates rising to 85–90%.

- Rates are expected to remain stable, with minor upward adjustments anticipated in the coming week.

Ocean: Trans-Atlantic Westbound (TAWB) Update

- Capacity and demand: Blank sailings in April have significantly decreased compared to March, primarily affecting East Mediterranean to U.S. services. Congestion at the Port of Piraeus, Mersin, and Valencia in the Mediterranean, as well as at Hamburg, Antwerp, and Rotterdam in Northern Europe, is impacting schedules.

- Equipment: Equipment shortages continue in parts of Central Europe, particularly in Austria, Slovakia, Switzerland, Hungary, and Southern/Eastern Germany. Carrier haulage is recommended for shipments from these regions. Additionally, Mersin in Southern Turkey is facing equipment challenges.

- Freight rates: In Northern Europe exports, the Peak Season Surcharge (PSS) has been canceled by most carriers, with some postponing it until June. In the West Mediterranean, carriers have deferred their April PSS to May. Meanwhile, in the East Mediterranean, particularly Turkey, certain carriers have implemented a PSS for May, anticipating an increase in demand from the region.

Air Freight Update (March 24 - March 30, 2025 Week 13):

- Moderate Q1 Growth Year on Year: Global air cargo tonnages rose by +3% year on year (YoY) in Q1 2025, with average rates up +4% YoY. This is a significant slowdown from last year’s double-digit YoY growth in Q1 2024 (+11%), reflecting market uncertainty amid new US tariffs and de minimis rule changes affecting shipments from China and Hong Kong.

- March Recovery After Lunar New Year: On a month-on-month (MoM) basis, March tonnages jumped +19% compared to February, driven by post-Lunar New Year factory restarts. On a YoY basis, March tonnages were up +5%, with strong contributions from Asia Pacific (+9%), North America (+6%), and Africa (+6%). Average rates in March increased to $2.38/kg (+4% MoM, +2% YoY).

- Week-on-Week Volatility in Asia Pacific: In week 13 (Mar 24–30), Asia Pacific spot rates rose +3% week on week (WoW) to $3.80/kg, up +8% YoY, even though tonnages from the region dipped -3% WoW. Notably, spot rates to the USA surged +6% WoW to $5.49/kg (+11% YoY), despite a -3% WoW decline in Asia-to-US tonnages. Routes to Europe continued their 7-week climb, with tonnage up +2% WoW, +16% YoY.

- Middle East Softness vs. Strength in Asia & Americas: While rates from the Middle East & South Asia (MESA) rose +5% WoW, they remain -19% below last year’s inflated levels. Meanwhile, tonnages and rates from Asia Pacific, North America, and Central/South America show resilience and recovery, reinforcing a shift in origin strength away from MESA.

- Implications for customers: The US tariff changes and de minimis adjustments will further disrupt existing supply chain models. Shippers should consider pre-emptive volume shifts, optimize routing diversification, and explore alternative sourcing bases.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

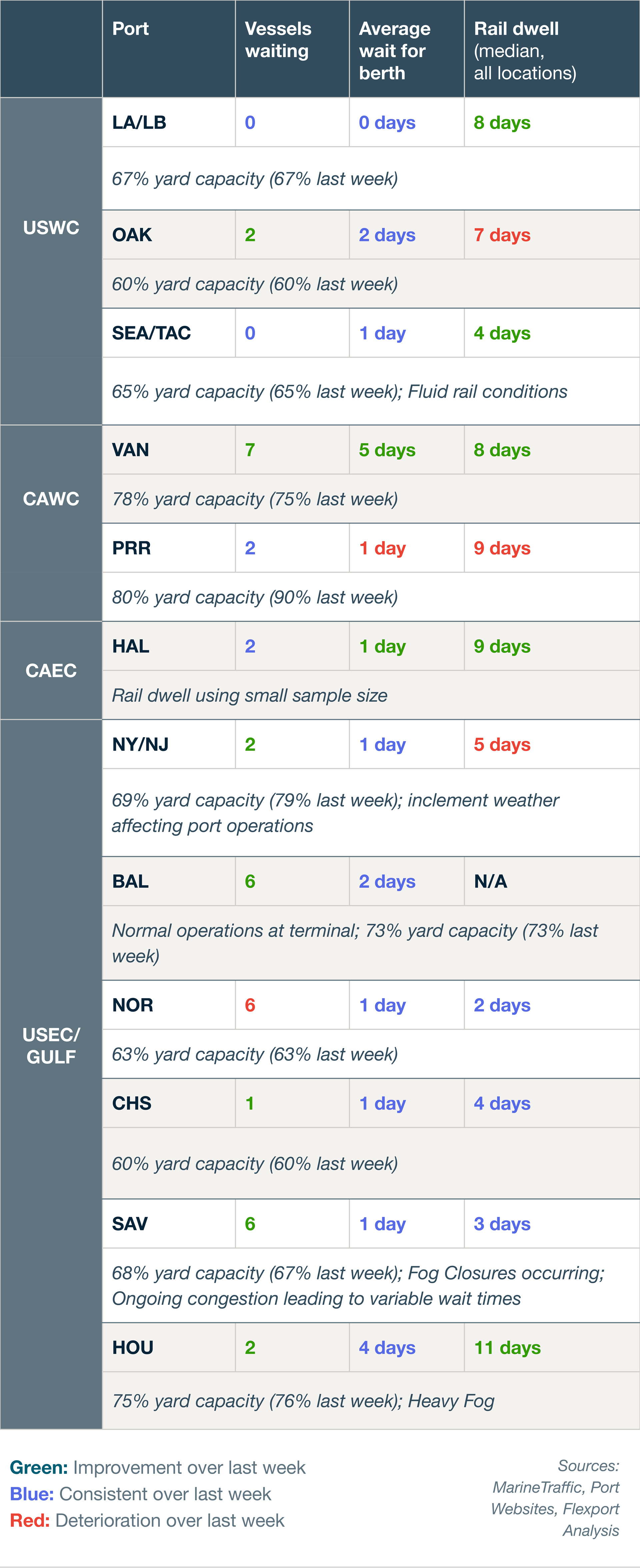

North America Vessel Dwell Times

Upcoming Webinars

North America Freight Market Update Live

Thursday, April 10 @ 9:00 am PT / 12:00 pm ET

The Control Tower Advantage: Visibility, Agility, and Smarter Decisions

Tuesday, April 29 @ 16:00 CEST / 15:00 BST / 7:00 am PT / 10:00 am ET

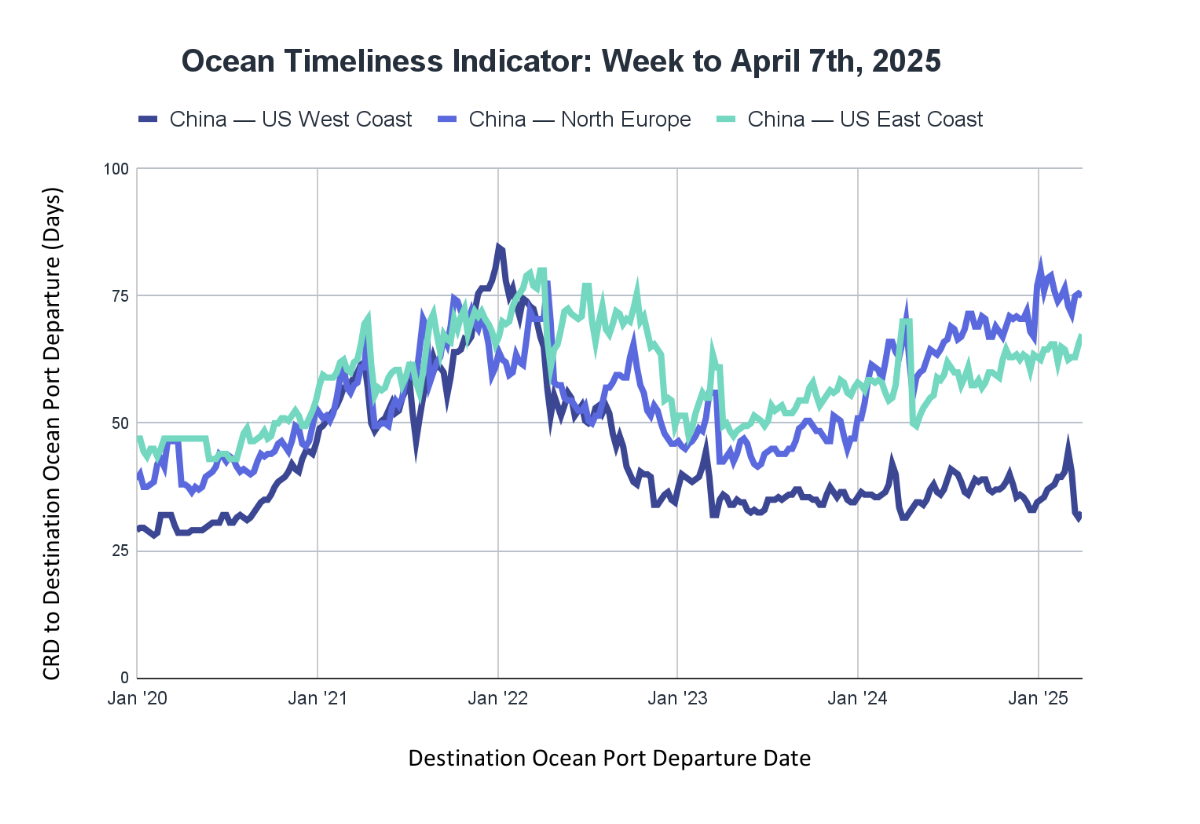

Ocean Timeliness Indicator

This week, the Flexport OTI for China to the U.S. West Coast showed a small uptick after previously exhibiting a significant drop, increased for China to the U.S. East Coast, and decreased for China to North Europe.

Week to April 7, 2025

The Ocean Timeliness Indicator (OTI) for China to the U.S. West Coast has shown a small uptick, rising from 31.5 to 32.5 days. Meanwhile, China to North Europe fell from 75.5 to 75 days. The biggest increase this week came from China to the U.S. East Coast, jumping from 65.5 to 67.5 days.

Related content

Ready to get started?

Learn how Flexport’s supply chain solutions can help you capture greater opportunities.