Global Logistics Update

Liberation Day Tariffs & End of De Minimis: Key Trade Updates

Updates from the global supply chain and logistics world | April 3, 2025

Global Logistics Update: April 3, 2025

Trends to Watch

Talking Tariffs

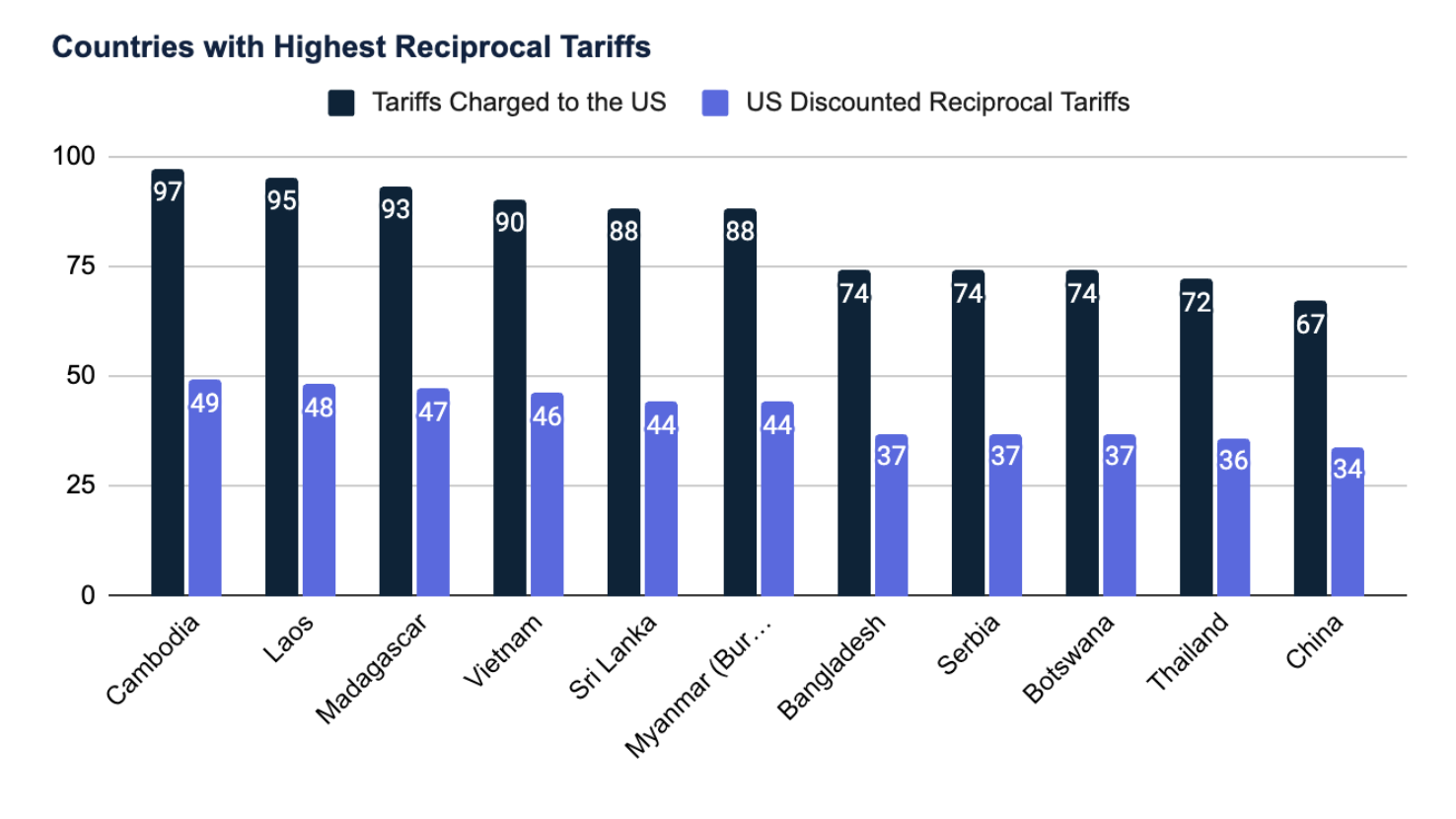

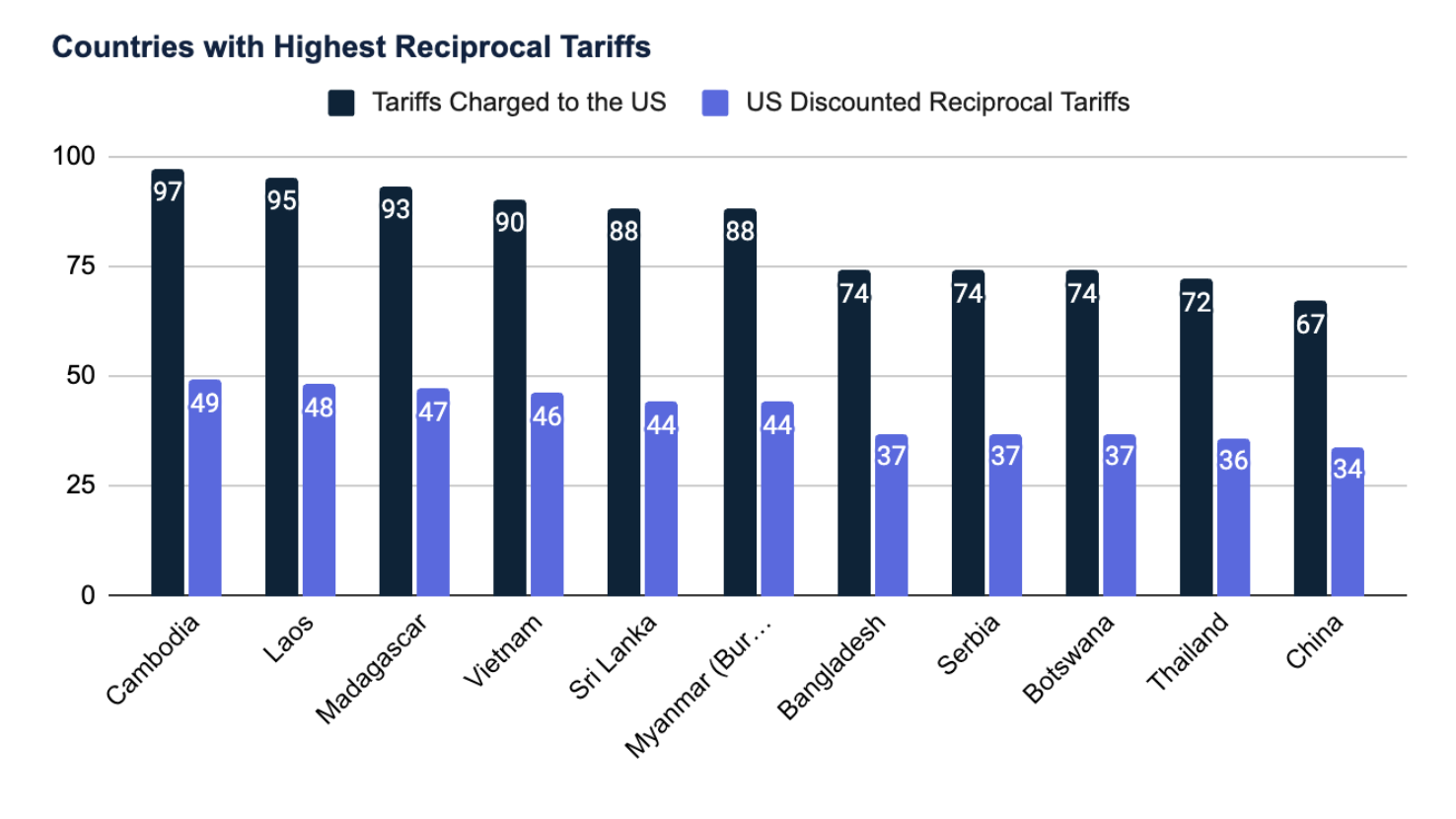

- Yesterday, President Donald Trump announced a universal 10% baseline tariff on all imports, effective April 5. He also announced country-specific reciprocal tariffs, effective April 9.

- The country-specific reciprocal tariffs will mean higher duties on trade partners like China, Japan, and the European Union. These tariffs will be set at half the rates those countries currently charge the U.S., according to White House calculations.

- Most reciprocal tariffs will be about half the rate the Trump administration claims the U.S. faces. However, some trade partners, like the U.K. and Australia, will see tariffs equal to what they impose on the U.S. due to the 10% baseline tariff.

- Cumulatively, China will face some of the highest tariffs, including a new 34% reciprocal tariff, in addition to Section 301 tariffs, a 20% IEEPA tariff from March, and baseline U.S. tariffs.

- Yesterday’s executive order does not affect the existing 25% tariffs on Canada and Mexico. Duties on imports compliant with the United States-Mexico-Canada Agreement will remain suspended, except for steel and aluminum and automobiles’ non-U.S. content. Follow our live blog on the latest updates.

- Meanwhile, duty-free “de minimis” shipping will be eliminated from all countries once the necessary systems are in place.

- In early February, President Trump announced plans to eliminate de minimis treatment for imports from China. Shortly after, he stated that de minimis would remain in effect until systems were fully prepared to efficiently process and collect tariff revenue. According to yesterday’s executive order, those systems are now in place, and de minimis treatment for imports from China and Hong Kong will officially end on May 2, 2025.

- Flexport CEO Ryan Petersen noted that the ripple effects of this change will be massive, with major implications for the air freight industry, DTC ecommerce merchants, and consumers. Read Ryan’s blog post for more details.

Ocean: Trans-Pacific Eastbound (TPEB) Update

- Capacity and demand: April demand is higher than in March, with an uptick in volume supporting increased cargo liftings compared to March.

April capacity remains similar to March, with some blank sailings implemented for East Coast (EC) and Pacific Southwest (PSW) routes. - Equipment: Equipment supply is adequate at most origin gateways, with no significant shortages anticipated.

- Freight rates: Floating market rates increased in April as the General Rate Increase (GRI) came through. The Peak Season Surcharge (PSS) will not be reinstated in April, leading to an increase in fixed volume for the month.

Ocean: Far East Westbound (FEWB) Update

- Capacity and demand: The Gemini Cooperation reported three additional blank sailings in the first two weeks of April compared to the previous week, indicating a slight tightening of capacity in the first half of the month. However, in the latter two weeks, capacity deployment rebounded, exceeding 310,000 TEU. Supply is expected to remain relatively high compared to demand. MSC reintroduced its 23,000-TEU mega-vessels to the FEWB Lion Service in late March and early April, while the OA alliance has also increased its capacity allocation.

- Demand outlook: President Trump's tariffs may trigger panic shipping on the Trans-Pacific trade lane as buyers rush to avoid taxes before the effective dates, potentially pulling some cargo away from the FEWB trade lane. With the Qingming Festival (April 4) and the upcoming Labor Day holiday, shipping demand may slightly decrease further as factories take breaks.

- Freight rates: There is still excess capacity and insufficient cargo for a significant price rebound in April. Rates will most likely remain stable in the coming weeks.

Ocean: Trans-Atlantic Westbound (TAWB) Update

- Capacity and demand: April blank sailings in Southern Europe are primarily driven by congestion and vessel delays in the region. Congestion at the ports of Piraeus, Mersin, and Valencia in the Mediterranean, as well as Hamburg, Antwerp, and Rotterdam in Northern Europe, is impacting schedules.

- Equipment: Equipment shortages persist in parts of Central Europe, particularly in Austria, Slovakia, Switzerland, Hungary, and Southern/Eastern Germany. Carrier haulage is recommended for these origins. In the East Mediterranean, Mersin is beginning to experience equipment challenges.

- Freight rates: The implementation of the PSS for exports from Spain, Italy, Portugal, and Southern France has been postponed by some carriers to April 14, while others have delayed it until May due to high demand and vessel delays. The PSS for North Europe has been canceled, and there is no update for a PSS in the East Mediterranean, where demand remains flat.

Air Freight Update (March 17 - March 23, 2025 Week 12):

- Air cargo rates rebound post-Lunar New Year: Average worldwide spot rates rose +5% week-on-week (WoW) to $2.69/kg in Week 12 (Mar 17–23), with contract rates up +3%. This brings the full-market average to $2.45/kg, which is +3% higher year-on-year (YoY). This rebound comes despite a slight -1% WoW drop in global chargeable weight, which remains +3% YoY.

- China to USA spot rates surge: Spot rates from China to the USA jumped +12% WoW to $4.53/kg, the second-highest weekly level of 2025. This is part of a broader +5% WoW increase in Asia-Pacific to USA rates, driven by demand from key markets like South Korea (+13%), Vietnam (+6%), and Hong Kong (+5%).

- Asia-Pacific to Europe stabilizing: Week 12 marked the sixth straight WoW tonnage increase since LNY, albeit a modest +2%. Spot prices also rose +2% WoW, led by +6% from China, South Korea, and Taiwan. China-Europe spot rates hit $4/kg, still about -5% below January levels.

- MESA to Europe demand normalizes: Spot rates edged up +2% WoW, with Dubai (+6%) and India (+4%) offsetting drops from Colombo. However, YoY rates remain significantly lower (-23%) compared to 2024 post-Red Sea crisis, especially from India (-32%) and Bangladesh (-34%).

- What does this mean overall?: Rising rates from China to the USA and steady recovery post-LNY signal tightening capacity and growing demand. Clients should secure space early, particularly for U.S.-bound shipments, and monitor rate developments closely in China, Vietnam, and South Korea.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

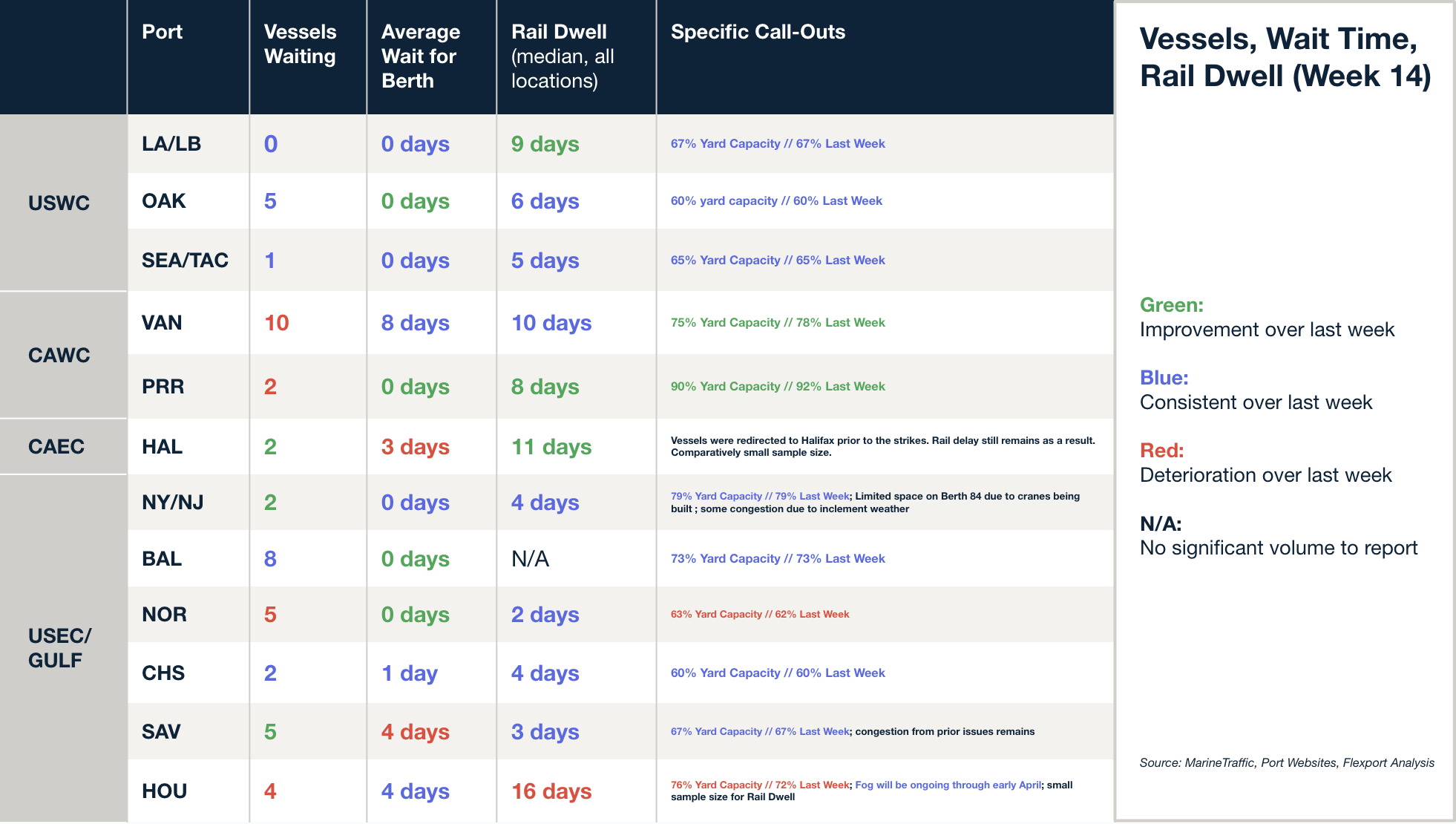

North America Vessel Dwell Times

Upcoming Webinars

European Freight Market Update Live

Tuesday, April 8 @ 16:00 CEST / 15:00 BST

Tariff Trends 2025: Expert Insights on the New U.S. Customs Landscape

Wednesday, April 9 @ 9:00 am PT / 12:00 pm ET / 17:00 BST / 18:00 CEST

North America Freight Market Update Live

Thursday, April 10 @ 9:00 am PT / 12:00 pm ET

Related content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?