Global Logistics Update

Brace for New Tariffs; TPEB Rates Stabilize as FEWB Demand Picks Up

Updates from the global supply chain and logistics world | March 20, 2025

Global Logistics Update: March 20, 2025

Trends to Watch

Tariffs Talk

- We’re just a little less than two weeks away from April 2, 2025 — the date President Donald Trump reaffirmed that new reciprocal tariffs will take effect.

- On that day, Trump will give a reciprocal tariff “number” to each trading partner that represents their tariffs, non-tariff trade barriers, currency practice, and other factors, according to Treasury Secretary Scott Bessent.

- Meanwhile, Canadian and Mexican goods will continue to be eligible for de minimis treatment until “adequate systems are in place to fully and expeditiously process and collect tariff revenue.”

- Follow our live blog to stay updated on the latest developments.

Ocean: Trans-Pacific Eastbound (TPEB) Update

- Capacity and demand: March demand has remained stagnant, showing no growth since after the Chinese New Year (CNY). Forecasted demand has not met expectations, or has not materialized as projected. Capacity: Shipping capacity remains healthy, with deployment staying above 80% from the rest of March into April.

- Equipment: Ample equipment supply is available across most origin gateways, and no major shortages are expected.

- Freight rates: Floating market rates: There has been a slowdown in floating market rates this week, with rates stabilizing at current levels. April GRI and rate stabilization: Carriers have announced their General Rate Increase (GRI) for April. PSS removal: The Peak Season Surcharge (PSS) has been removed by most carriers for the remainder of March.

Ocean: Far East Westbound (FEWB) Update

- Capacity and demand: Capacity for the second half of March remains stable, with no additional blank sailings announced for April, though ongoing congestion in Rotterdam, Netherlands, is causing some rolling cases. To mitigate port congestion impacts, transshipment arrangements will be managed at origin. Demand has shown a slight uptick, and with the downsizing of vessels on the pre-arrival service, the market is moving toward a more balanced supply-demand equilibrium. Space for new bookings remains generally available, and the booking release process is running smoothly, but rolling issues may still occur.

- Equipment: Equipment supply is sufficient, though carriers are occasionally substituting 40-foot containers with 40 High Cube containers, which are restricted for Rotterdam discharge. If a 40HW is assigned on the Equipment Interchange Receipt (EIR), we recommend requesting the yard to exchange it for a 40-foot or 40 High Cube container that is empty and ready to be loaded with goods.

- Freight rates: The Shanghai Containerized Freight Index (SCFI) decline was driven by the rollback of the March GRI, leading to rate stabilization. Focus has now shifted to the April GRI, with major carriers announcing increases while others wait to assess market conditions. The success of implementing April’s GRI remains uncertain, largely depending on market volume in the second half of March. Flexport recommends moving shipments before potential increases, as carriers aim to maintain a pricing floor.

Ocean: Trans-Atlantic Westbound (TAWB) Update

- Capacity and demand: Blank sailings have been reduced, and we expect more stable capacity in March. These blank sailings are mainly in South Europe services. There is congestion at the Ports of Piraeus, Mersin, and Valencia, causing delays in services.

- Equipment: Equipment shortages persist in parts of Central Europe, particularly in Austria, Slovakia, Switzerland, Hungary, and Southern/Eastern Germany. Carrier haulage is recommended for these origins. In Southern Europe, ports have not experienced any equipment issues at this time.

- Freight rates: The majority of carriers have canceled the implementation of the North Europe PSS, as they expect demand to remain flat in April, in contrast to the South of Europe. In the Mediterranean, certain carriers are pushing for the implementation of a PSS for April, focusing on the West Mediterranean. The surcharge ranges between USD 700-1,000 per 40-foot container due to continued high demand and overbooked utilization.

Air Freight Update (March 3 - March 9, 2025 Week 10):

- Overall market stability with YoY growth: Global air cargo demand remained stable week-on-week (WoW), but saw a +2% year-on-year (YoY) increase in Week 10. Across Weeks 9 and 10, total tonnages were up +4% YoY, driven by a +8% increase from Asia-Pacific origins, partially influenced by Lunar New Year timing.

- Asia-Pacific recovery driving regional trends: Asia-Pacific chargeable weight rebounded +5% WoW, returning to mid-January levels. Tonnages from the Asia-Pacific to Europe increased +4% WoW, with strong growth from China (+5%), Hong Kong (+6%), Japan (+7%), Taiwan (+7%), Thailand (+9%), and Singapore (+9%). Spot rates from the Asia-Pacific to Europe fell -3% WoW, but remain +20% higher YoY due to strong increases from key markets (e.g., China +14%, Hong Kong +22%, Thailand +38%).

- Rates trending up YoY but mixed short-term: Average worldwide air freight rates were +5% higher YoY in Weeks 9 and 10, rising +1% WoW to $2.33 per kilo. Globally, spot rates held steady at $2.55/kg WoW, but are +8% higher YoY (Asia-Pacific spot rates +11% YoY). Spot rates from China and Hong Kong to the U.S. stayed stable at $3.78/kg WoW.

- MESA and Dubai see declines: Middle East & South Asia (MESA) to Europe held steady at $2.42/kg, but demand fell -4% WoW, potentially due to Ramadan. Dubai-Europe tonnages dropped -15% WoW, following a -17% drop the previous week. As a result, spot rates fell -12% in Week 10 to $1.88/kg.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Upcoming Webinars

Control Costs, Improve Quality, and Boost Revenue: Implementing Tech & AI in Your Supply Chain

Thursday, March 27 @ 8:00 am PT / 11:00 am ET / 15:00 GMT / 16:00 CET

North America Freight Market Update Live

Thursday, April 10 @ 9:00 am PT / 12:00 pm ET

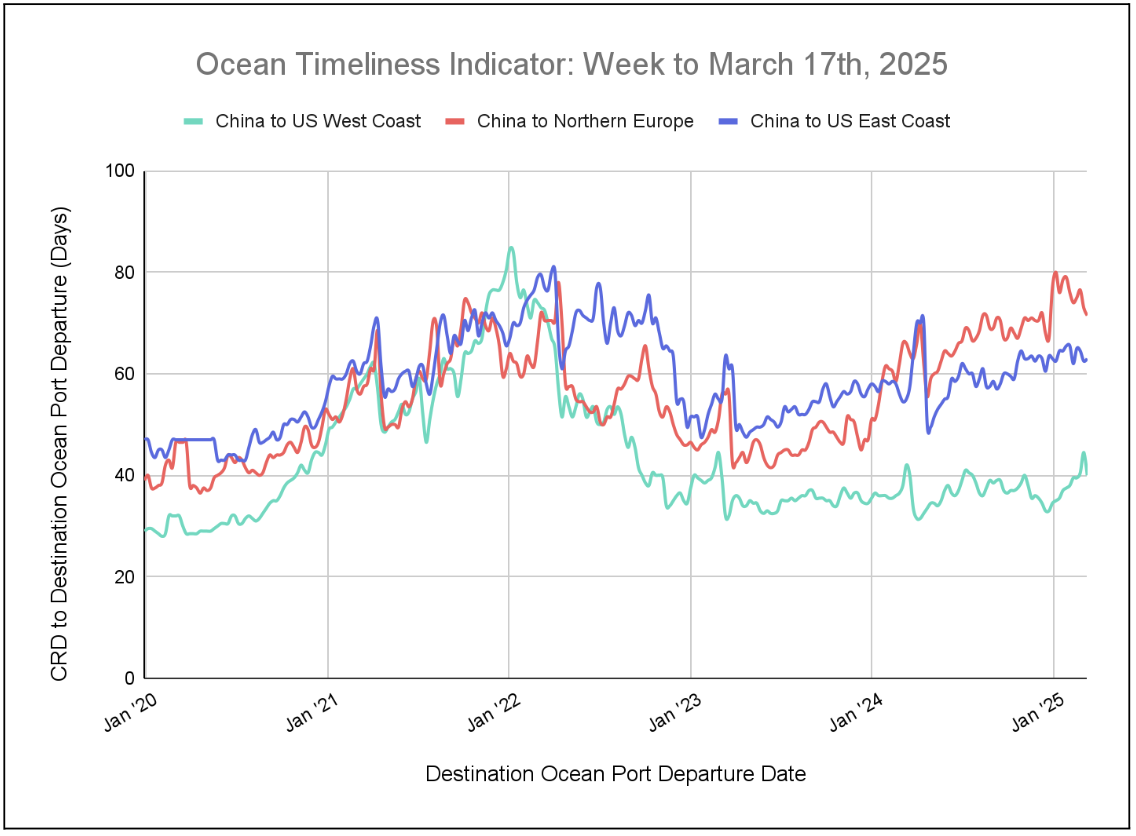

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI is increasing for China to the U.S. East Coast, and decreasing for China to the U.S. West Coast and China to North Europe.

Week to March 17, 2025

This week, the Ocean Timeliness Indicator (OTI) for China to the U.S. West Coast has decreased from 44.5 to 40 days. China to North Europe also showed a downtick, falling from 73 to 71.5 days. Meanwhile, China to the U.S. East Coast increased from 62.5 to 63 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related content

Sign up for Global Logistics Update

Why search for updates when we can send them to you?