Market Update

Freight Market Update: April 17, 2019

Ocean and air freight rates and trends; trucking and customs news for the week of April 17, 2019.

Freight Market Update: April 17, 2019

Want to receive our weekly Market Update via email? Subscribe here!

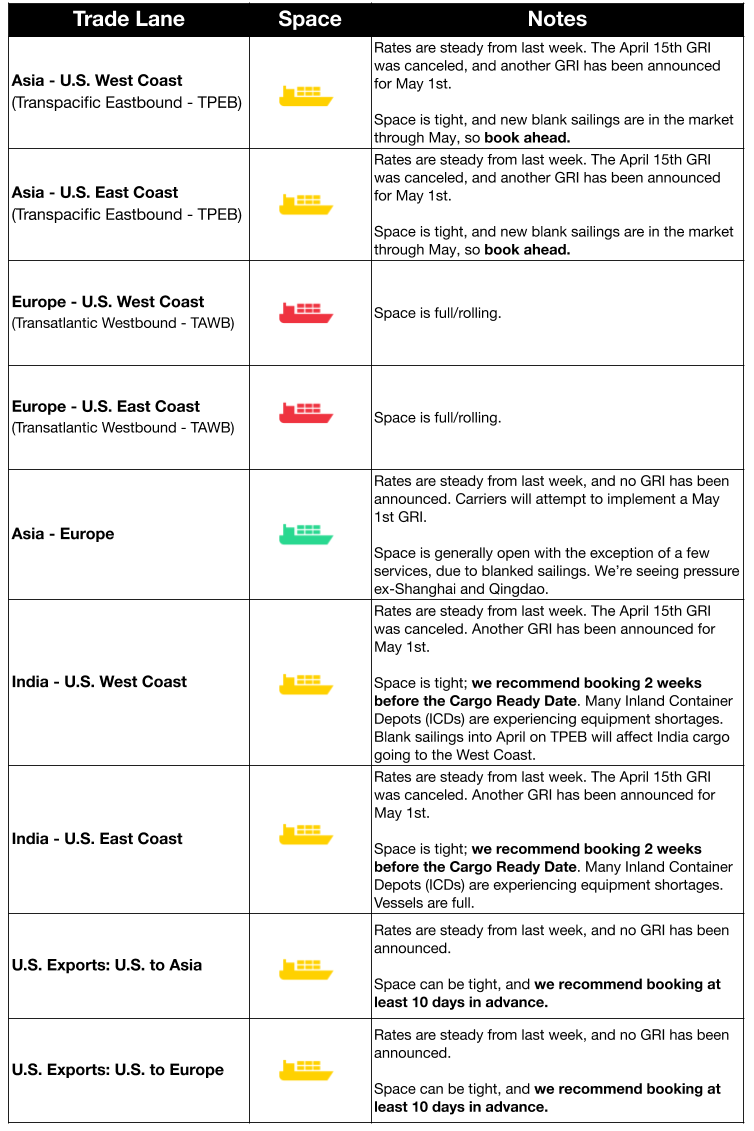

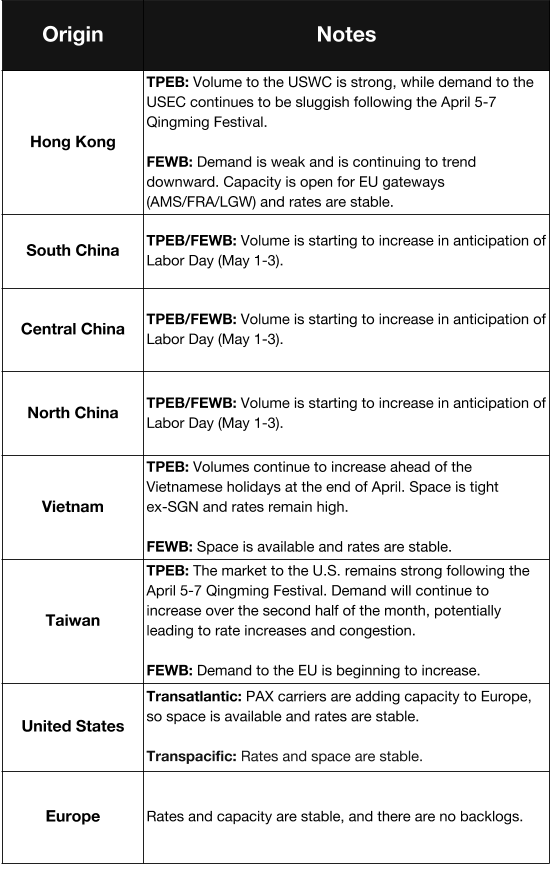

Ocean Freight Market Updates

Easter Holidays to Affect Ports and Terminals

The approaching Easter holidays in Europe will cause less available haulage and barge capacity. India ports will be closed on Friday, April 19th. Some New York and New Jersey terminals will also be closed Friday, as well as the Port of Houston. Ports and terminals will likely experience delays next week, as is typical after a long weekend.

Weight Restrictions on Panama Canal Shipments

The Panama Canal restricts the draft (how deep the hull goes into the water) of vessels based on the amount of water available in Gatun Lake, which varies based on rainfall, amount of vessels and other factors. The current draft restriction is for no more than 44’ from a maximum of 49’. Ships must be lighter to meet the draft requirement, so they need to carry less cargo/ballast/fuel or offload cargo to the Panama Canal Railway.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Freight rates may climb between now and 2020 as a result.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

Air Freight Market Updates

Portugal Strike Causing Air Delays

Fuel truck drivers are on strike in Portugal, causing a fuel shortage. Portugal airlines are receiving rationed fuel from the government as a result. Expect delays as ex-Portugal flights are being affected.

Delta Air Lines to Add Capacity

Delta Air Lines plans to add to overall capacity by 3-4% in 2019, with plans to launch additional services to Europe from Boston and New York. Domestic growth will diminish, however, to compensate for the additional capacity.

**India’s Jet Airways Reduce Operations **

Jet Airways, India’s second largest airline by market share, has canceled all of its international flights as it searches for an investor to alleviate some of its debt. The airline’s flight cancellations have contributed to increasing prices and slowing passenger growth.

Trucking Market Updates

Drayage Capacity Not Suited for 2019 Market

Driver wait times have decreased across the nation after the trade war frontloading rush, but the drayage market is still underprepared for what’s ahead. Vessel sizes and container volumes are increasing and without planning for the need for drayage growth, ports are likely to become more congested with a worsened driver shortage.

New York Congestion Plan Productivity May Offset Costs

The congestion-pricing plan, expected to begin in 2021, will require that trucks and cars pay a fee to enter a congestion zone. The charge, estimated to be between $9 and $15 per vehicle, may end up benefiting logistics managers if productivity is sufficiently increased.

Customs and Trade Updates

**Importer Pays $62.5M in Antidumping Evasion **

Univar USA will pay $62.5M to settle antidumping evasion allegations. Univar shipped Chinese saccharin through Taiwan in order to avoid the 329% antidumping duties on the goods, resulting in $36M in evaded duties.

United Arab Emirates Marking Determination

CBP released a ruling on February 28th on the country of origin marking for products in the United Arab Emirates, determining if U.A.E. or Emirates is an acceptable abbreviation for “Made in” marking purposes. Customs determined that these abbreviations are still not a valid origin marketing, 14 years after its first determination.

First Consumer Product Safety Prosecution

The Department of Justice ruled against two corporate executives in the first-ever criminal prosecution under the Consumer Product Safety Act. The two failed to inform the government and continued to sell their dehumidifiers even after learning from consumers and internal testing that they contained a fire risk. A 3-count indictment of fraud was levied against them.

For a roundup of tariff-related news, read our Tariff Insider_. _