Market Update

Freight Market Update: February 12, 2020

Freight Market Update: February 12, 2020

Flexport is monitoring developments of the Coronavirus and its impacts on supply chains. The Chinese New Year (CNY) holiday is officially over, but supply chains are still struggling to bounce back. Learn more about the latest supply chain impacts from the coronavirus, and steps you can take to mitigate them here.

Want to receive our weekly Market Update via email? Subscribe here.

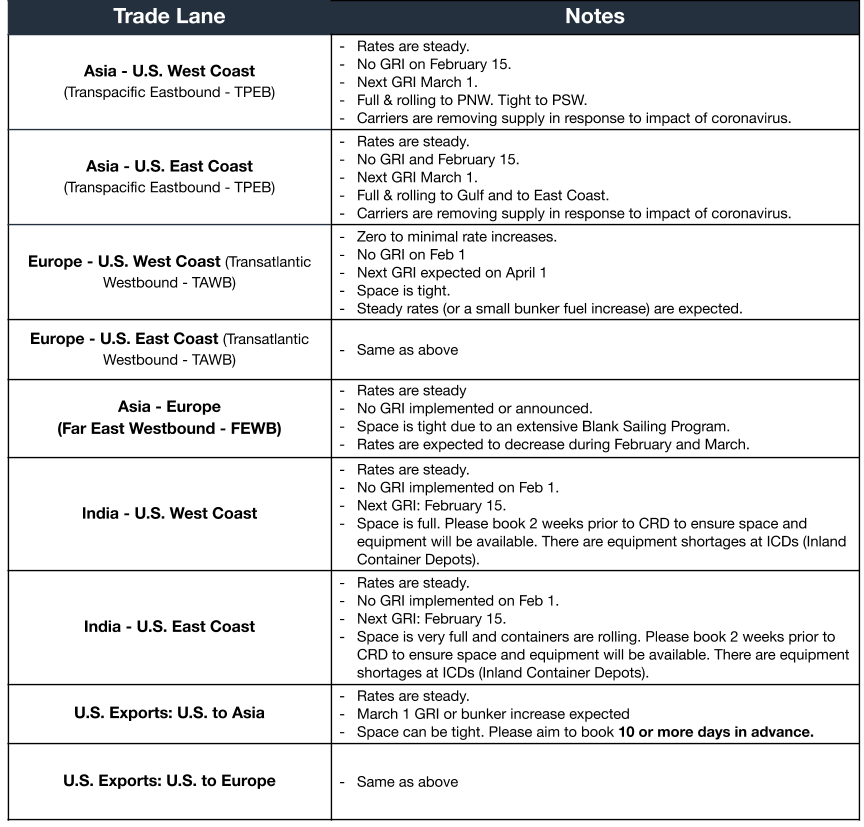

Ocean Freight Market Update

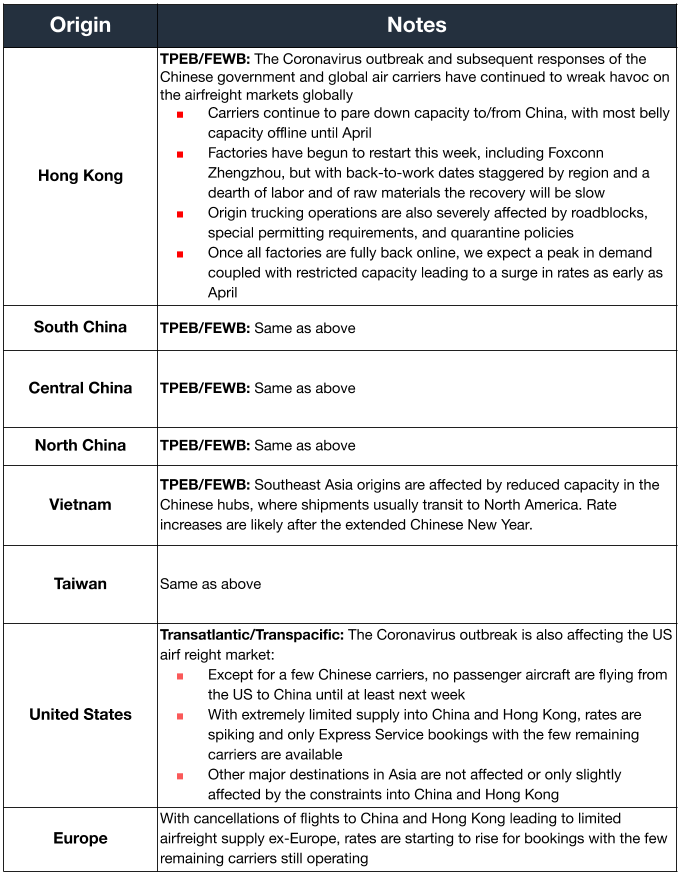

Air Freight Market Update

Freight Market News

Coronavirus Tanks Ocean Shipping An already slow season is taking drastic hits from Coronavirus, the respiratory disease now infecting over 28,000 people in China. An in-depth review by American Shipper reports shipping stock prices collapsing to their lowest point in 10 years, force majeure claims accelerating commodity slumps, and blank sailings and low spot rates shorting revenue up to $350m per week.

Storm Ciara Hits Europe In the past week, Northern Europe has been struck by Storm Ciara. The Port of Rotterdam, Port of Antwerp, and ports in the UK had suspended operations, causing delays for both import and export cargo. All ports have recently opened but are now dealing with a large backlog. More specifically, the Port of Antwerp has announced a minimum delay of 72-hours for cargo moving through the port. Although Storm Ciara has passed, another storm is expected this weekend, escalating the current situation.

E-Commerce Warehouse Boom Slows The WSJ details how new e-commerce warehouse construction may outstrip demand in the US, Canada, and Mexico as early as this year—but it’s still a landlord’s game. Projections of vacancy rates increase from 4.6% in 2019 to just 5.2% in 2021, well below a ten-year average of 6.2%.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy noted the following economic highlights:

- US Trade Decline In December, U.S. goods imports rose by 3.1%, while goods exports rose by 0.9%. Oil was the biggest monthly mover in imports and exports. For the full year 2019, U.S. exports were $2.5tn, down $1.5bn from 2018. Annual imports were $3.1tn, down $12.5bn from the year before.

- China cut tariffs on $75bn of imports from the United States, and the number of Coronavirus deaths surpassed those from SARS in 2003.

- Factories in Hubei entered a third week of shutdown, while the US Federal Reserve warned that the virus’ disruptions could “spill over to the rest of the global economy.”

- US Job Market Strength Nonfarm payrolls rose by 225K in January, reflecting a large increase in construction jobs—potentially due to unusually warm weather. The unemployment rate blipped up to a still-low 3.6%, as more workers returned to the labor force.

- Gallup polling numbers show US optimism about personal finances at an all-time high in early January. 59% of Americans say they are better off than they were a year ago, up from 50% at the start of 2019. 74% predicted they would be better off financially a year from now.

German Factory Slump Factory orders fell in December at their fastest monthly pace since 2009.

- Gallup polling numbers show US optimism about personal finances at an all-time high in early January. 59% of Americans say they are better off than they were a year ago, up from 50% at the start of 2019. 74% predicted they would be better off financially a year from now.

Customs and Trade Updates

Section 301 List 1 Updates

The USTR published new product exclusions from the first list of Section 301 tariffs for products originated in China. As with previous lists, the exclusions will apply retroactively to the July 6, 2018 implementation date and will be in effect until October 2, 2020. The USTR is also seeking comments on extending the third set of exclusions granted in April 2019. The comment period will last from February 16 until March 16, 2020.

Section 232 Additional Guidance

CBP issued a CSMS message on the additional steel and aluminum tariffs that were recently enacted under Section 232. The duties will apply to certain nails, certain bumper stampings, and various wire cables. None of the Section 232 duties are eligible for drawback. GSP and AGOA are also not allowed to be treated with a duty preference when the goods are subject to Section 232 duties.

China Announces Reduced Tariffs

China released a statement that it would reduce its retaliatory tariffs imposed on the US from 10% to 5% on February 14th when the US is also scheduled to lower tariffs as part of the "Phase One" agreement between the two countries.

**For a roundup of tariff-related news, visit Tariff Insider.

Also, pre-register now for FORWARD 2020, a three-day event that brings together the greatest minds in global trade for ideas and insights to advance the industry.