Market Update

Freight Market Update: July 18, 2024

Updates from the global supply chain and logistics world | July 18, 2024

Freight Market Update: July 18, 2024

Trends to Watch

[Ocean - TPEB]

- Volumes remain strong, exceeding last year’s numbers on Transpacific routes. We’re seeing structurally blank sailings due to Cape of Good Hope (COGH) routings and port congestion in Asia and North America. Severe weather conditions around the COGH caused further delays and will add capacity challenges for the U.S. East Coast. Since extra loader (XL) space was injected into the Transpacific trade lane, we see less space pressure on the West Coast, specifically Pacific Southwest (PSW) from China's main ports.

- Floating rates: General Rate Increases (GRIs) for July were successfully implemented on all Transpacific Eastbound gateways based on peak conditions from May onwards. Nevertheless, we noticed that shipping lines are starting to slightly reduce and adjust their West Coast / East Coast pricing to maintain full vessels and XL support.

- Fixed rates: Carriers shared the new Peak Season Surcharge (PSS) for July 1, which marks an increase after two successful implementation rounds. No further PSS increase was shared for the second half of July, and we see an overall stabilization of rates.

[Ocean - FEWB]

- Port congestion in Asia is improving, but on-time performance (less than 50%) remains below 2023 levels. Equipment is still tight in North China and Central China.

- Bookings remain strong, with July void sailing plans in place that impact total available market capacity.

- Floating rates rose again for the second half of July. THE Alliance will be back to near-full capacity in August. More to follow after the Shanghai Containerized Freight Index (SCFI) is announced on July 19.

- Premium options are still available in the market to get cargo loaded on earlier departure dates with higher equipment priority, mitigating the risk of rolling or no equipment.

- Port congestion in Europe, coupled with the strike in Germany and France, are impacting terminal operations and last-mile delivery. We highly recommend communicating with Flexport to track container movements.

- Flexport continues to monitor the situation. We advise booking early, placing bookings in smaller slots, and picking up empty containers as soon as possible. For urgent cargo with a target delivery date, we recommend choosing premium options as early as possible.

[Ocean - TAWB]

- Blank sailings in the Mediterranean will continue due to congestion and delays outside of West Mediterranean (WMED) ports.

- North Europe rates will remain stable for August and September.

- In the Mediterranean, certain carriers have announced increases beginning in early August due to fully utilized vessels and blank sailings.

- To ensure the smoothest loading experience, we recommend booking 1-2 weeks in advance for bookings departing from North Europe, and 2-3 weeks in advance for bookings departing from the Mediterranean that are loading at a coastal port.

[Ocean - U.S. Exports]

- Ocean rates for Q3 are increasing in corridors of the U.S. export market due to rising demand in global container markets.

- Congestion at critical transhipment hubs is reducing effective capacity for U.S. exporters.

- Navigating the ever-changing earliest return dates (ERDs) has become increasingly challenging due to current market congestion.

- To ensure the smoothest loading experience, we recommend booking 3-4 weeks in advance for shipments loading at a coastal port, and 4+ weeks in advance for shipments loading at an inland rail point.

[Air - Global] (Source: WorldACD)

- Global air cargo demand dropped by -5% in the first week of July, with a significant -13% decrease from North America, -8% from Central & South America, -4% from Europe, and -3% from the Asia-Pacific, primarily due to the U.S. Independence Day holiday.

- Year-on-year (YoY), worldwide tonnages increased by +11% in week 27 and +13% in weeks 26 and 27 combined, consistent with the figures for June and Q2 2024.

- Average worldwide air cargo rates in week 27 were $2.57 per kilo, a +2% increase from the previous week and a +14% rise YoY. These rates are +48% higher compared to July 2019 (pre-COVID levels).

- Spot rates from the Asia-Pacific to the U.S. saw significant YoY increases: +$5.72 per kilo (+68%), with China at $5.34 per kilo (+38%) and Hong Kong at $4.84 per kilo (+12%).

- Rates from Vietnam to the U.S. reached $6.62 per kilo (+147% YoY), Thailand at $6.46 per kilo, and Singapore at $7.02 per kilo, all exhibiting substantial increases. Rates from Japan to the U.S. are slightly above $6 per kilo, up +64% YoY.

[Canada Rail Strike Update] (Source: Trains.com)

- Bargaining between Canadian Pacific Kansas City (CPKC) and Canadian National Railway Co (CN), who are represented by the Teamsters Canada Rail Conference (TCRC) union, has resulted in disputes over rest periods between worker shifts.

- According to the union, the rail companies were attempting to remove rest provisions that are critical to safety.

The Canadian Industrial Relations Board (CIRB) has informed CN that they intend to make a decision by August 9, 2024. A TCRC strike could begin 72 hours after a final ruling is made. - A rail strike in Canada could prevent cargo from moving on rail from all major sea and inland port locations, directly affecting imports and exports into Canada via rail, apart from essentials.

- If a potential strike does go into effect, recommended solutions include transloading cargo at wet ports, diverting cargo to route via U.S. coastal ports for any cargo routing to the United States, and using east coast or all-water services to Montreal/Halifax to service Toronto and other major east coast cities.

Please reach out to your account representative for details on any impacts to your shipments.

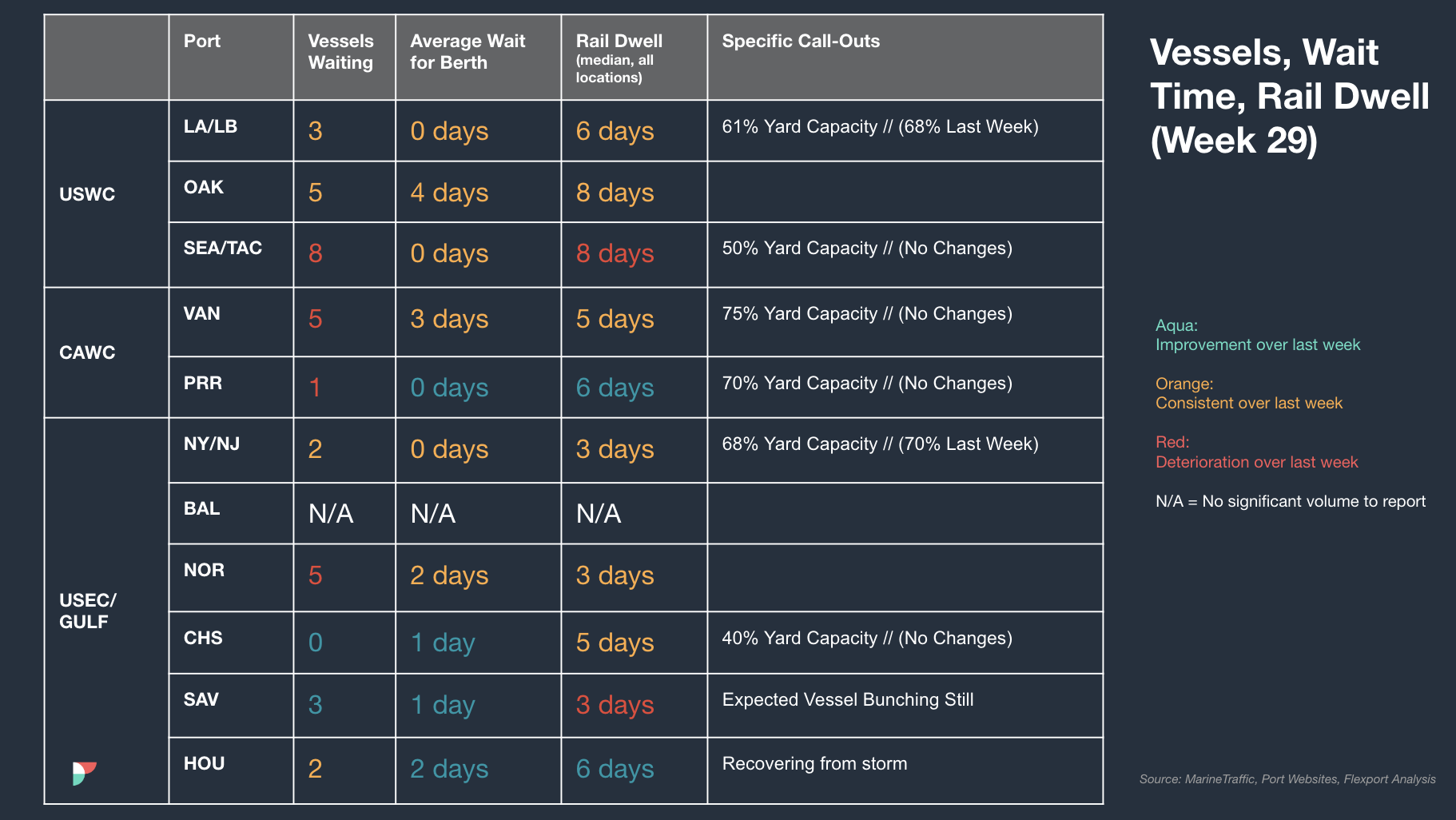

North America Vessel Dwell Times

Webinars

Revolutionize Your Fulfillment: Grow with Walmart Marketplace

July 25 @ 9:00 am PT / 12:00 pm ET

North America Freight Market Update Live

August 8 @ 9:00 am PT / 12:00 pm ET

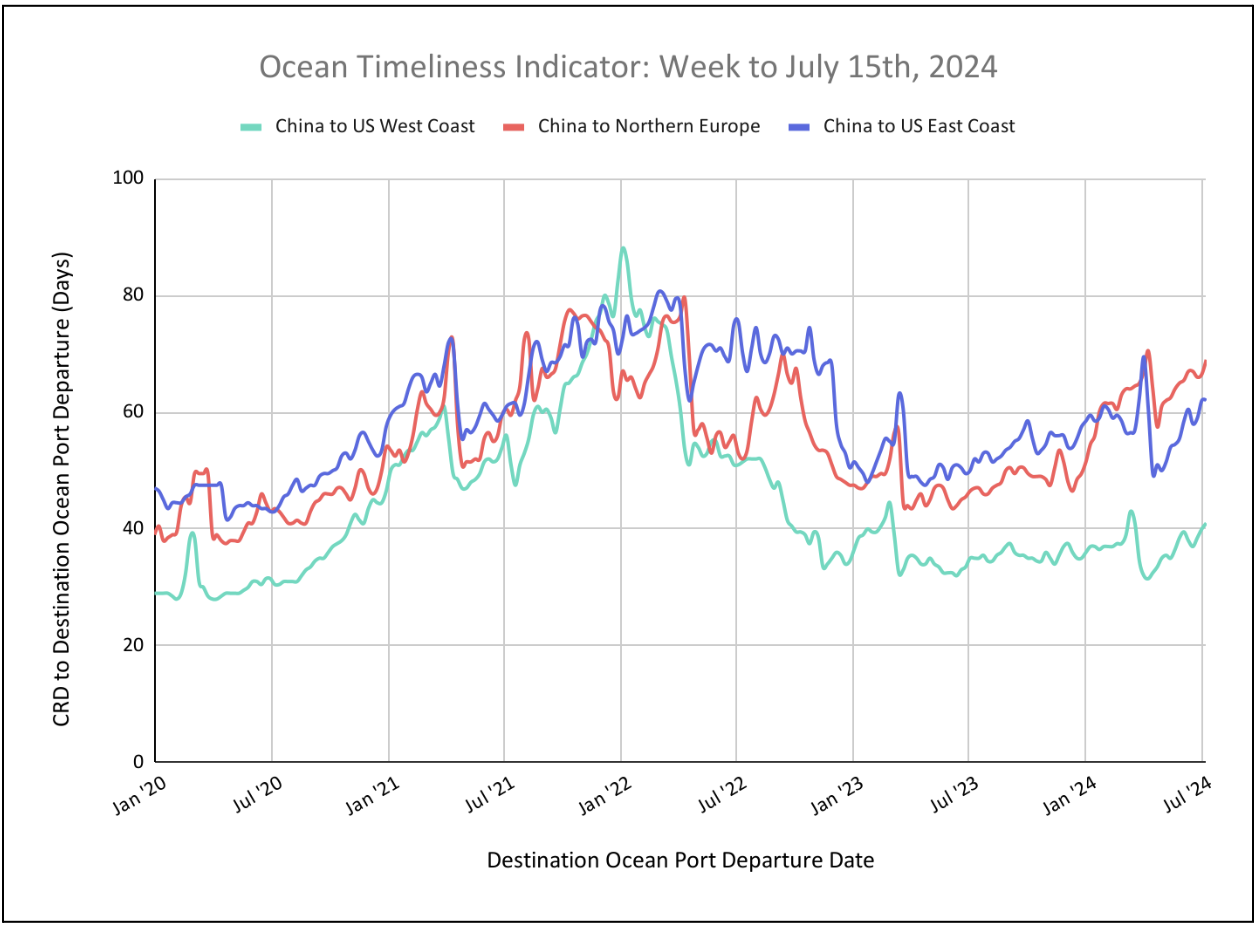

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators increase for China to the U.S. West Coast and China to Europe, while stabilizing for China to the U.S. East Coast.

Week to July 15, 2024

This week, the Ocean Timeliness Indicator for China to the U.S. East Coast have plateaued, stabilizing at 62 days and concluding an increase that began in April 2024. Meanwhile, the OTI for China to the U.S. West Coast increased from 40 to 41 days. Last but not least, China to Northern Europe OTIs also rose from 66.5 to 69 days due to port congestion nearing pandemic highs, as well as delays caused by extreme weather around the Cape of Good Hope this past week.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?