Market Update

Freight Market Update: June 13, 2024

Updates from the global supply chain and logistics world | June 13, 2024

Freight Market Update: June 13, 2024

Trends to Watch

[Ocean - TPEB]

- Volumes continue to be very strong and above last year’s numbers on Transpacific while we see structurally blank sailings due to Cape of Good Hope (COGH) routings and port congestion in Asia and North America.

- Floating rates: All general rate increases for the month of June have stuck, with further rounds to be implemented on all Transpacific Eastbound gateways based on the peak conditions we are seeing in June and July. Carriers expect these rate hikes to stick and accelerate in the short term, since vessels leaving Asia are expected to be full through June: Pacific Southwest is full; Pacific Northwest is close to full into the end of month and into June. Particularly Vietnam + South/East China (Yantian/Shanghai/Ningbo) into the Pacific Southwest is especially tight.

- Fixed rates: Carriers successfully implemented a Peak Season Surcharge (PSS) on June 1, and the PSS will be increased again on June 15 while further adjustments are already announced for July.

[Ocean - FEWB]

- Equipment shortages became severe in most of Asia's main loading ports and liners are repositioning empty containers to improve the situation, but with the continued delays on vessels rerouting via Cape of Good Hope, we foresee it may continue in coming weeks.

- Port congestion in Asia remains severe mainly due to high yard utilization, unexpected bad weather and vessel bunching, leading to low terminal operation efficiency and long waiting times, causing last-minute port omission by carriers to catch up with the transit time.

- Demand continues to be stronger than usual and rates rose again for the second half of June ($1,500-2000 increase per 40-foot container). We expect the increase in demand to be driven not only by consumer demand but also by companies building stock due to the longer than anticipated lead times and companies trying to secure space.

- Carriers are increasing the PSS quantum to $1000-1500/TEU, aiming for existing long-term fixed deals.

- Shippers continue to push cargo for earlier departure to avoid further freight cost increases. Unless space has already been secured, all vessels are full. To push cargo on sooner estimated time of departure (ETD) and avoid delays, more carriers are open to Premium options to get cargo loaded on the first available departure date with higher equipment priority.

- Flexport continues to monitor the situation and we advise to book early, place bookings in smaller slots and pick up empty containers as soon as possible. For urgent cargo with a target delivery date, it is recommended to move on the Premium option as early as possible.

[Ocean - TAWB]

- In North Europe, the demand is stable and carriers are following the trend by extending their rate levels until July.

- There are equipment issues in Southern and Eastern Germany and the Hinterlands (Austria, Hungary, Slovakia).

- In the Western Mediterranean, congestion and equipment issues in certain main ports, along with reduced schedule reliability, have impacted the market. Carriers are implementing GRI/PSS from July following the demand.

- In the Eastern Mediterranean, equipment availability is good and there is no severe congestion in the ports.

- To ensure the smoothest loading experience, we recommend booking 2 to 3 weeks in advance.

[Operations - Canada]

- Border-Agent Union Negotiations: At the time of publishing, a tentative agreement has been reached for 9,000 workers at Canada Border Services Agency (CBSA) and a strike has been avoided. Full details of the agreement are to be announced on June 13.

[Ocean - U.S. Exports]

- Extended transit times due to routing around Cape of Good Hope and growing congestion at key ports further devolves the container equipment situation for U.S. exporters, especially shippers loading at inland rail points.

- Congestion at key destination transhipment hubs for U.S. exporters include ports in Asia and Strait of Gibraltar ports Tanger-Med and Algeciras.

- Due to operational constraints at the Port of Charleston, we are seeing vessel omission for Transatlantic and Transpacific services.

- To ensure the smoothest loading experience, we recommend booking 3-4 weeks in advance for bookings loading at a coastal port and 4+ weeks in advance for bookings loading at an inland rail point.

[Air - Global] (Data Source: WorldACD)

- Air cargo rates from Middle East & South Asia (MESA) to Europe averaged over twice their level from May last year, with May's average spot rate at $3.35 per kilo, up 128% YoY.

- Elevated spot prices from India to Europe ($3.78 per kilo, +160%) and Bangladesh to Europe ($4.38 per kilo, +189%) contributed to increases in overall average rates from MESA origins to Europe (up by 77% YoY).

- Asia Pacific origins saw a 21% rise in tonnages in May YoY, with air cargo rates rising nearly 12%, marking the first significant YoY full-month increase this year.

- Global average air cargo rates remained steady at $2.51 per kilo in week 22, up 1% WoW and 7% YoY, with overall rates in May up by 3% YoY and chargeable weight up by 13% YoY.

- Global average air cargo rates in week 22 were $2.51 per kilo, up 1% week on week and 7% year on year, and significantly above pre-COVID levels, up 42% compared to May 2019.

Please reach out to your account representative for details on any impacts to your shipments.

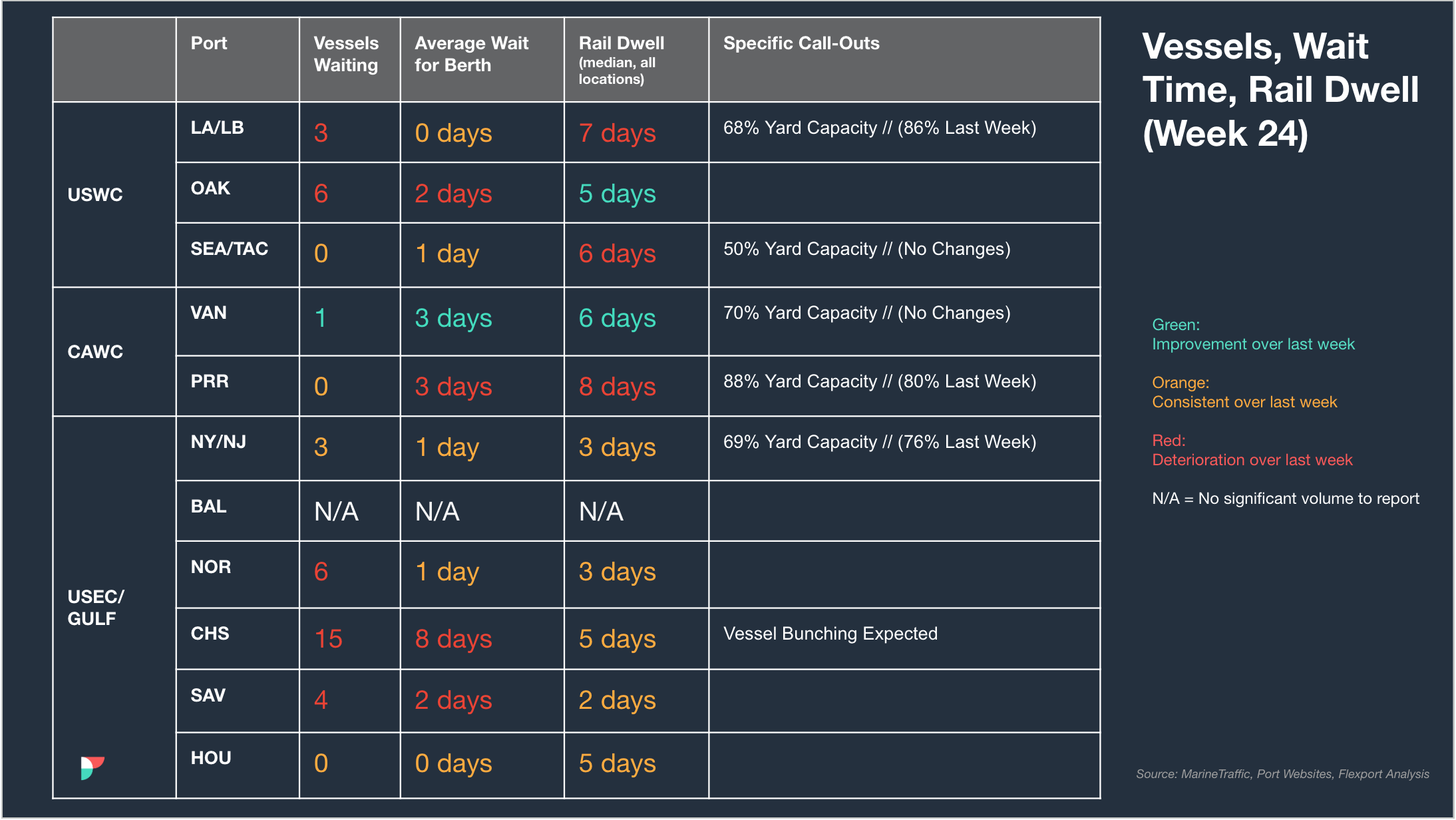

North America Vessel Dwell Times

Webinars

European Freight Market Update Live

Tuesday, June 25 2024 at 16:00 CEST

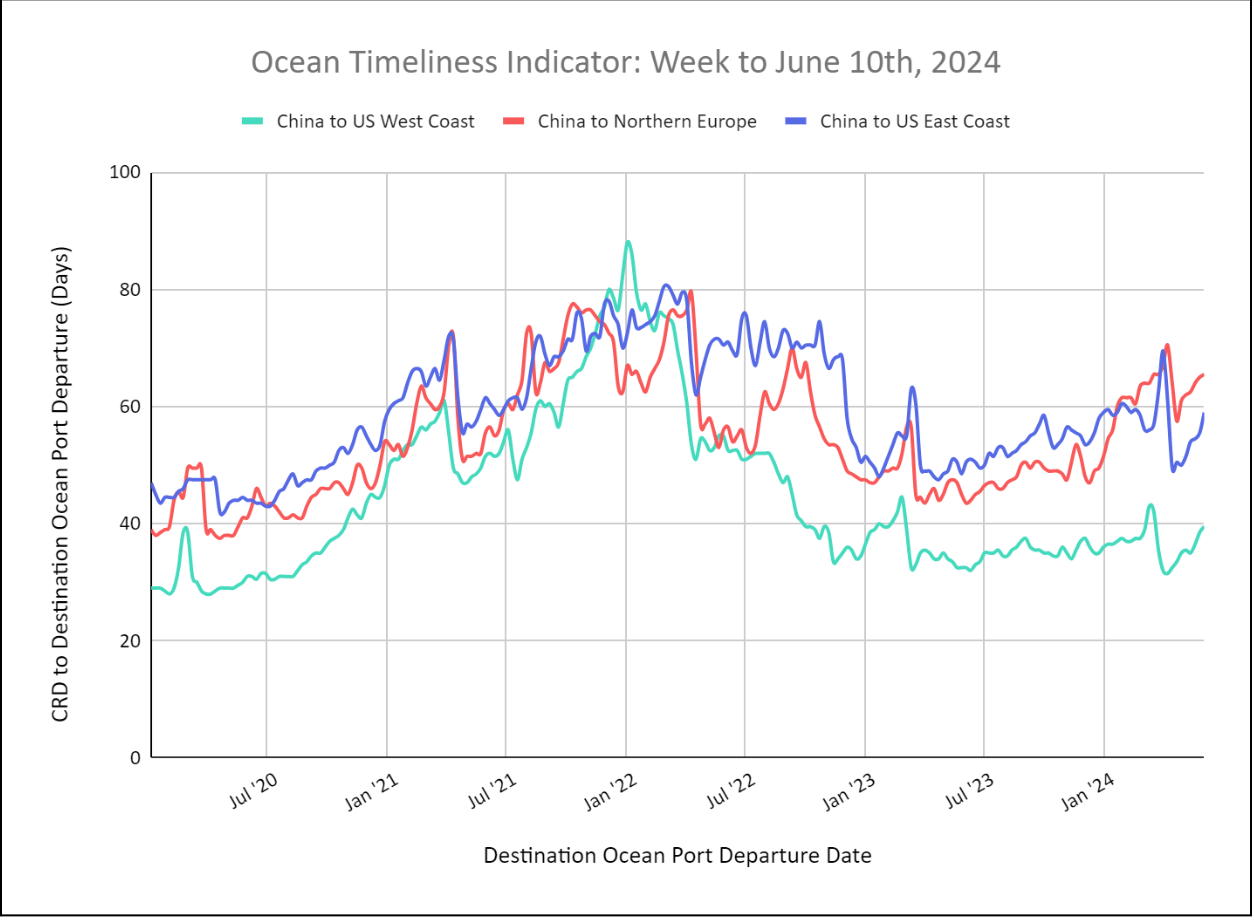

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators Across All Major Trade Lanes Increases for the Fourth Straight Week

Week to June 10, 2024

This week, the Ocean Timeliness Indicator for all major trade lanes continued the upwards trend seen throughout May. The China to the U.S. East Coast OTI saw the biggest increase to 59 days, the China to Northern Europe OTI increased to 66 days due to routing around the Cape of Good Hope, and the China to the U.S. West Coast OTI increased to 39 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?