Market Update

Freight Market Update: June 20, 2024

Updates from the global supply chain and logistics world | June 20, 2024

Freight Market Update: June 20, 2024

Trends to Watch

[Ocean - TPEB]

- Volumes remain very strong and exceed last year’s numbers on the Transpacific route, despite structurally blank sailings due to Cape of Good Hope (COGH) routings and port congestion in Asia and North America. We’re seeing more premium offerings from shipping lines, featuring expedited services and guaranteed equipment and space, while other carriers attempt to reduce the backlog in Asia with extra loader space.

- Floating rates: All General Rate Increases (GRIs) for June have been maintained, with further rounds to be implemented on all Transpacific Eastbound gateways, based on the peak conditions anticipated for June and July. Carriers expect these rate hikes to persist and accelerate in the short term, as vessels departing Asia are expected to be full through June. The Pacific Southwest is at full capacity, while the Pacific Northwest will be near full capacity by the end of month and into July. The route from Vietnam and South/East China (Yantian/Shanghai/Ningbo) to the Pacific Southwest is particularly tight.

- Fixed rates: Carriers successfully raised the Peak Season Surcharge (PSS) on June 15, with additional increases already announced for July.

[Ocean - FEWB]

- Equipment shortages have become severe in most of Asia's main loading ports. Liners are repositioning empty containers to improve the situation, but with the continued delays on vessels rerouting via the Cape of Good Hope, we foresee this issue persisting in the coming weeks.

- Port congestion in Asia remains high due to elevated yard utilization, unexpected bad weather, and vessel bunching, leading to low terminal operation efficiency and long wait times. This situation has led to last-minute port omissions by carriers trying to catch up with transit timing.

- The port strikes at Bremerhaven, Hamburg, and Le Havre have not affected schedules yet, but hinterland networks are at risk of delays. Clients importing cargo to Germany and France should closely monitor deliveries, as the strikes could extend into July if the unions do not receive a satisfactory response from the government to their demands.

- Demand continues to be stronger than usual, and rates rose again for the second half of June ($1,500-2000 increase per 40-foot container). With equipment shortages, customers are likely to keep pushing cargo out to avoid further delays. Liners are preparing for the next General Rate Increase in the first half of July by another $1000 per 40-foot container.

- Shippers are pushing cargo for earlier departures to avoid further freight cost increases. Unless space has already been secured, all vessels are full. To push cargo out at earlier estimated times of departure (ETD) and avoid delays, more carriers are open to premium options to get cargo loaded on the first available departure date with higher equipment priority.

- Flexport continues to monitor the situation and advises booking early, placing bookings in smaller slots, and picking up empty containers as soon as possible. For urgent cargo with a target delivery date, it is recommended to opt for the premium option as early as possible.

[Ocean - TAWB]

- In Northern Europe, demand remains stable, and carriers are responding by extending their rate levels until July.

- There are equipment issues in Southern and Eastern Germany and the Hinterlands (Austria, Hungary, Slovakia, Czech Republic, Switzerland).

- In the Western Mediterranean (WMED), congestion and equipment issues at key ports, along with reduced schedule reliability, are impacting the market. Carriers are planning to implement General Rate Increases from July, following the demand (250-350/TEU).

- The Eastern Mediterranean (EMED) is also experiencing the effects of congestion at Mediterranean ports. Some carriers have announced equipment imbalance and operational charges due to increased costs on routes from the Mediterranean to the US and equipment availability issues in specific areas of Turkey, Greece, and Egypt.

- To ensure the smoothest loading experience, it is recommended to book 2-3 weeks in advance.

[Ocean - Indian Subcontinent]

- Capacity is constrained due to blank sailings and increased demand from Indian Subcontinent (ISC) countries, as well as Southeast Asia and China. Rising demand from Southeast Asia and China has created a capacity crunch for the ISC region, since many services are shared.

- Rates continued to increase week over week, except for the Northwest India to US East Coast (USEC) lanes.

- Outlook continued blank sailings are expected from Northwest India to USEC. As a result, we can expect stabilized rates and potentially some upward momentum if the rate of blank sailings increases.

- News: CMA and HPL have announced that they will no longer cooperate on the INDAMEX and IN2 services. Instead, they will each launch their own services, both named the INDAMEX. This increase in services will not significantly impact available capacity, most of which already existed in the market and is merely being redistributed.

[Ocean - U.S. Exports]

- Extended transit times caused by routing around the Cape of Good Hope and growing congestion at key ports in Asia and Europe are further exacerbating the container equipment situation for US exporters, particularly for shippers loading at inland rail points.

- Congested key destination transhipment hubs for US exporters include Asia base ports and Strait of Gibraltar ports Tanger-Med and Algeciras.

- Due to operational constraints at the Port of Charleston, we are seeing vessel omissions for Transatlantic and Transpacific services, with some shifts to services calling at the Port of Savannah instead.

- With schedule reliability impacted by global disruptions, irregularities in managing earliest return dates (ERDs) for delivering laden containers to loading point are expected.

- To ensure the smoothest loading experience, it is recommended to book 3-4 weeks in advance for bookings loading at a coastal port and 4+ weeks in advance for bookings loading at an inland rail point.

[Air - Global] (Data Source: WorldACD)

- Asia Pacific air cargo surge: Air cargo demand and rates from Asia Pacific origins increased year-on-year (YoY) by 20% in tonnage and 16% in rates for the last two weeks (weeks 22 and 23) up to June 9, 2024. Spot rates from Vietnam to Europe rose by 143% YoY, reaching $4.47 per kilo, with tonnages up 28% YoY.

- Spot rate variations: Significant YoY increases in spot rates to Europe were observed from several Asia Pacific origin markets in week 23, including China (+32%), Hong Kong (+18%), Malaysia (+83%), Indonesia (+46%), and Thailand (+43%). The average spot rate from Asia Pacific to the USA stood at $5.23 per kilo (+51% YoY), and from China at $5.30 per kilo (+38% YoY).

- Middle East & South Asia (MESA) boom: MESA origin rates to Europe more than doubled YoY for the last ten weeks, driven by high prices from India and Bangladesh. Overall, rates from MESA origins worldwide increased by 50% YoY in weeks 22 and 23, while average worldwide rates remained firm at $2.52 per kilo, despite declines from Europe (-16%) and North America (-11%).

- Global air cargo trends: Despite a slight decline in worldwide chargeable weight flown (-1%) compared to the previous two weeks, worldwide tonnages rose by 12% YoY in weeks 22 and 23.

- Capacity shortages: Air and ocean freight capacity shortages, exacerbated by disrupted sea freight services due to Red Sea attacks, port congestion, and vessel capacity shortages, have driven more cargo owners to opt for air cargo solutions, significantly impacting spot rates and demand across various Asia Pacific origin markets.

Please reach out to your account representative for details on any impacts to your shipments.

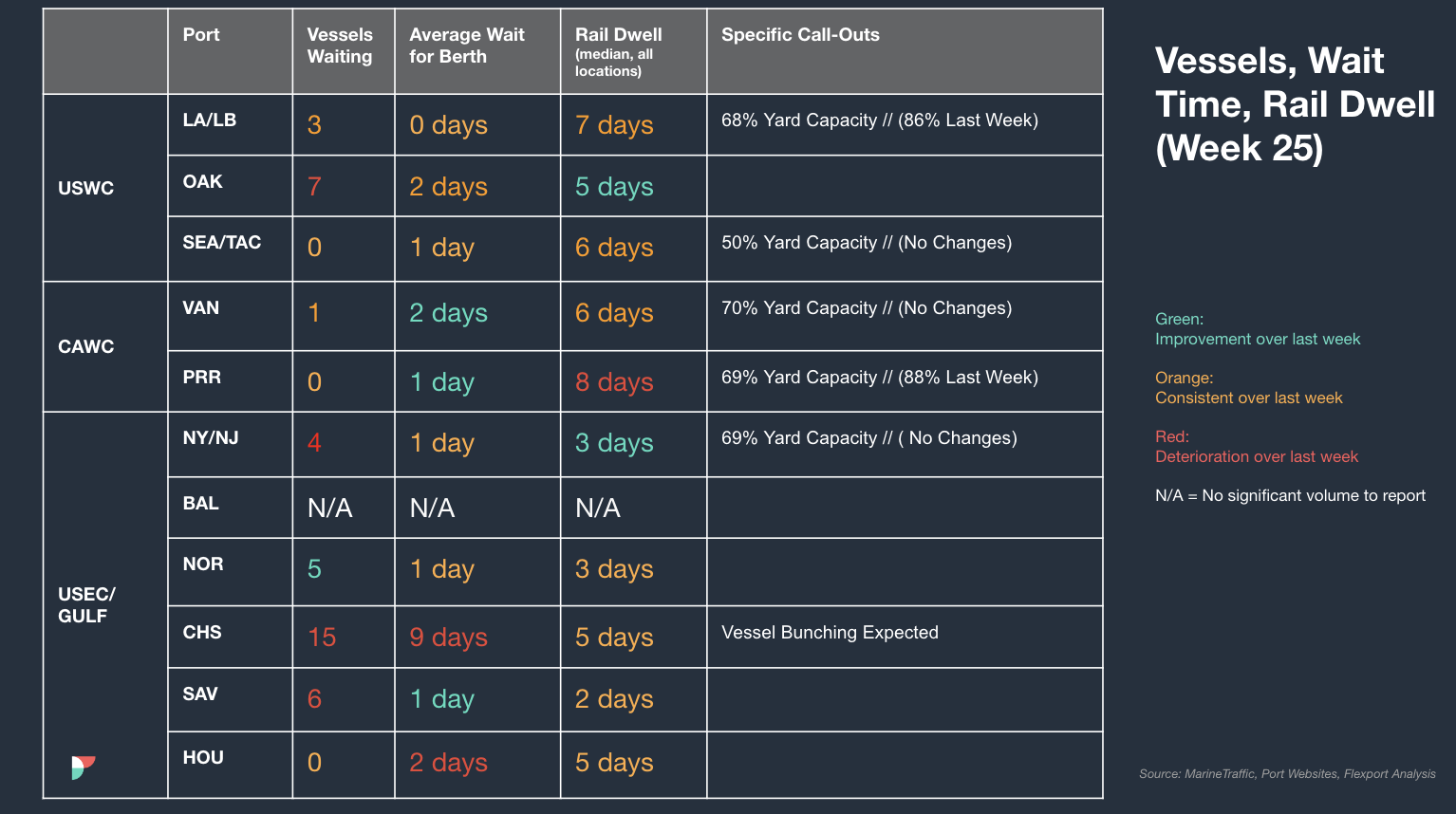

North America Vessel Dwell Times

Webinars

European Freight Market Update Live Special: Port Congestion Deep Dive

Tuesday, June 25, 2024 @ 15:00 BST / 16:00 CEST

Revolutionize Your Fulfillment: Scale with SHEIN Marketplace

Wednesday, June 26, 2024 @ 9:00 am PT / 12:00 pm ET

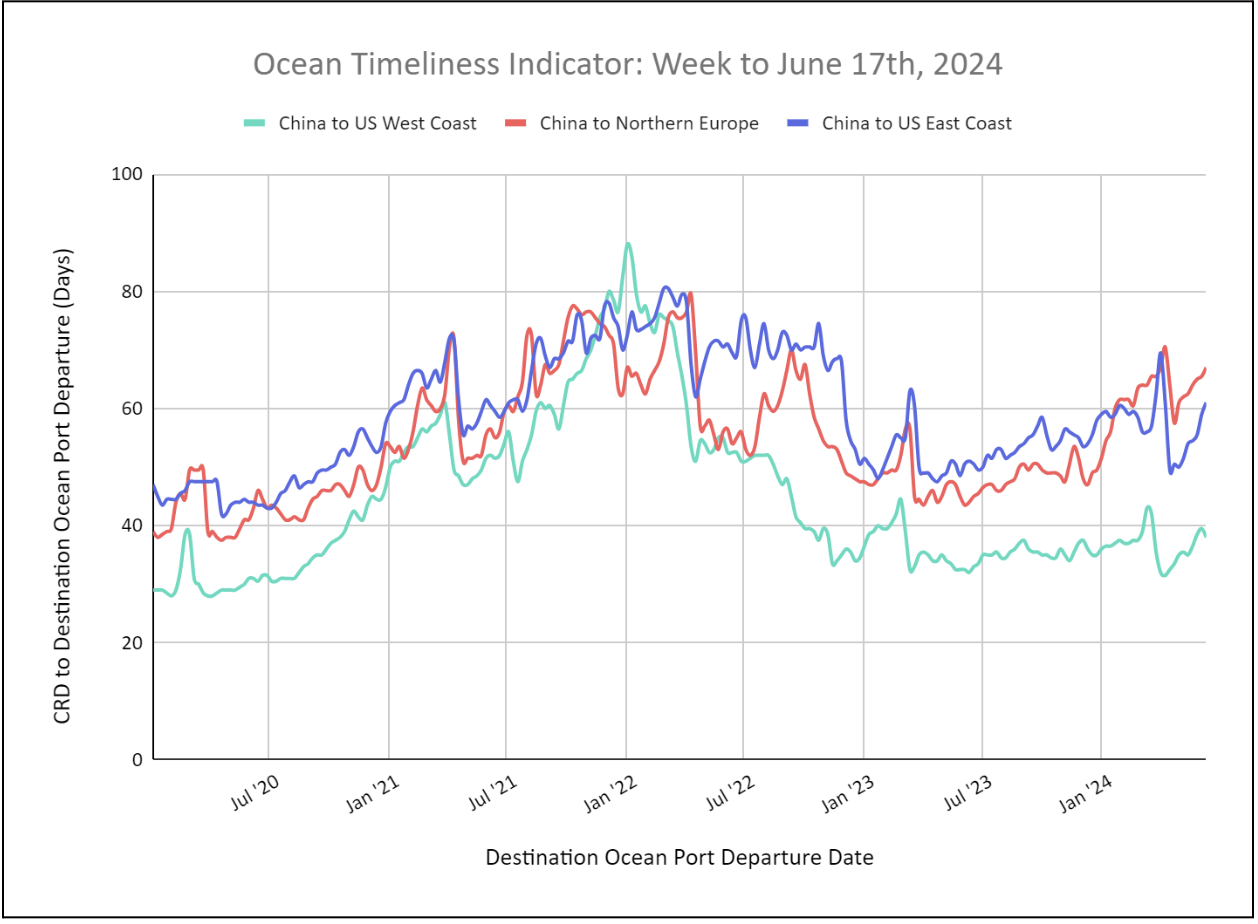

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators for China to U.S. East Coast and China to Northern Europe Increases for the Fifth Straight Week

Week to June 17, 2024

This week, the Ocean Timeliness Indicator for China to the U.S. East Coast and China to Northern Europe continued an increase seen throughout May and June. The China to the U.S. East Coast OTI increased to 61 Days, and the China to Northern Europe OTI increased to 67 days due to routing around the Cape of Good. However, the China to the U.S. West Coast OTI decreased to 38 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?