Market Update

Global Logistics Update: December 12, 2024

Updates from the global supply chain and logistics world | December 12, 2024

Global Logistics Update: December 12, 2024

Trends to Watch

[Ocean - TPEB]

- Rates: Shipping lines are pushing for a General Rate Increase (GRI) on December 15th due to strong bookings ahead of the holiday season in the USA and the typical Lunar New Year cargo surge.

- Peak Season Surcharge (PSS): Initial PSS announcements indicate a rate increase for January 2025.

- Equipment: Equipment is fluid with no issues reported by carriers.

[Ocean - FEWB]

- Space: Demand remains modest, and additional loaders are scheduled for the second half of December. Space is manageable, so carriers may extend or reduce 2H December FAK rates to ensure optimal vessel utilization.

- Rates: The Shanghai Containerized Freight Index (SCFI) declined by $9/TEU in Week 50. With slowing demand, further decreases are expected until the January GRI is implemented.

- Equipment: To avoid equipment shortages caused by vessel delays or blank sailings, we highly recommend picking up empty containers immediately after carriers release them.

- Weight restrictions: Most carriers continue to impose weight restrictions to optimize vessel capacity. Please avoid loading heavy 20’ containers, as they may be rejected.

[Ocean - TAWB]

- Capacity: January vessel capacity is expected to remain full for departures from both Northern and Southern Europe.

- Blank sailings: Blank sailings are anticipated during Weeks 51, 52, and 01, primarily affecting the U.S. East Coast and Canada services.

- Equipment availability: Equipment availability remains tight in certain areas of Central Europe and Southeast Germany.

- Rates: Most carriers are extending their FAK rates through the end of January, coinciding with the conclusion of the current network.

[Air - Global] Mon 25 Nov - Sun 01 Dec 2024 (Week 48):

- Global air cargo rates: November rates reached $2.76 per kilo, the highest of 2024, up +6% MoM and +11% YoY. Spot rates rose to $3.09 per kilo (+21% YoY), while contract rates averaged $2.67 per kilo (+10% YoY). Week 48 saw further rate increases (+2% WoW) to $2.84 per kilo, with spot rates up +3% WoW to $3.22 per kilo.

- Tonnage trends: Global tonnages in November declined -2% MoM, driven by a sharp drop in MESA (-11%) and Europe (-4%), linked to reduced passenger belly capacity. Week 48 chargeable weight dipped -3% WoW, largely due to a -17% WoW decline from North America during Thanksgiving week. Excluding the USA, global tonnages were stable.

- Asia-Pacific and Americas trends: Strong performance in rates and tonnages continued in Asia-Pacific origins to Europe: Rates from key origins such as China, Hong Kong, Japan, and Taiwan rose +3% to +9% WoW, with a YoY increase of +24% to +46%. Tonnages to Europe from the Asia-Pacific were also significantly up YoY (+20%-29% from China, Hong Kong, and Japan).

- From the Americas: Central and South America (CSA) rates increased +9% MoM, reflecting robust demand. North America spot rates rose +3% WoW, despite Thanksgiving disruptions.

- Tonnage growth to Europe: Week 48 saw YoY tonnage increases from multiple regions to Europe: Asia-Pacific (China +24%, Hong Kong +27%, Japan +29%, Vietnam +25%). Americas: Steady growth from CSA origins, contributing to overall market strength.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Webinars

European Freight Market Update Live

Tuesday, December 17 at 15:00 GMT / 16:00 CET

This Week in News

Trans-Pac settles into sedate December before New Year’s uncertainties

The Trans-Pacific freight market has slowed in December after heavy frontloading, and faces potential disruptions from labor negotiations, potential tariffs from the incoming Trump administration, and an early Lunar New Year. Spot rates to the U.S. West Coast have dropped sharply, with variable pricing intensifying market complexity. A potential January 15 ILA strike and elevated inventory levels add pressure as importers prepare for spring shipments. Despite these challenges, record container volumes are projected for January, driven by strong Asia-West Coast trade.

How Generative AI Improves Supply Chain Management

Large language models (LLMs) are revolutionizing supply chain management by enabling rapid insights, scenario analyses, and updates in minutes rather than days. These tools help planners understand system decisions, analyze trends, and answer "what-if" questions by translating human queries into actionable data insights. Early adopters like Microsoft have seen significant efficiency gains, with LLMs supporting server deployments and cost analysis across global data centers.

Trump’s tariffs could spark price hikes, supply chain disruptions, experts say

President-elect Trump’s proposed tariffs on imports from China, Mexico, and Canada could disrupt North American supply chains, raising costs and prices for consumers. Businesses are concerned about timing and implementation, particularly in sectors like automotive and ecommerce. Experts predict increased costs, inflation, and supply chain shifts to regions like India and Vietnam. Small and medium-sized retailers are likely to face the most challenges, and may struggle to manage profitability amid these changes.

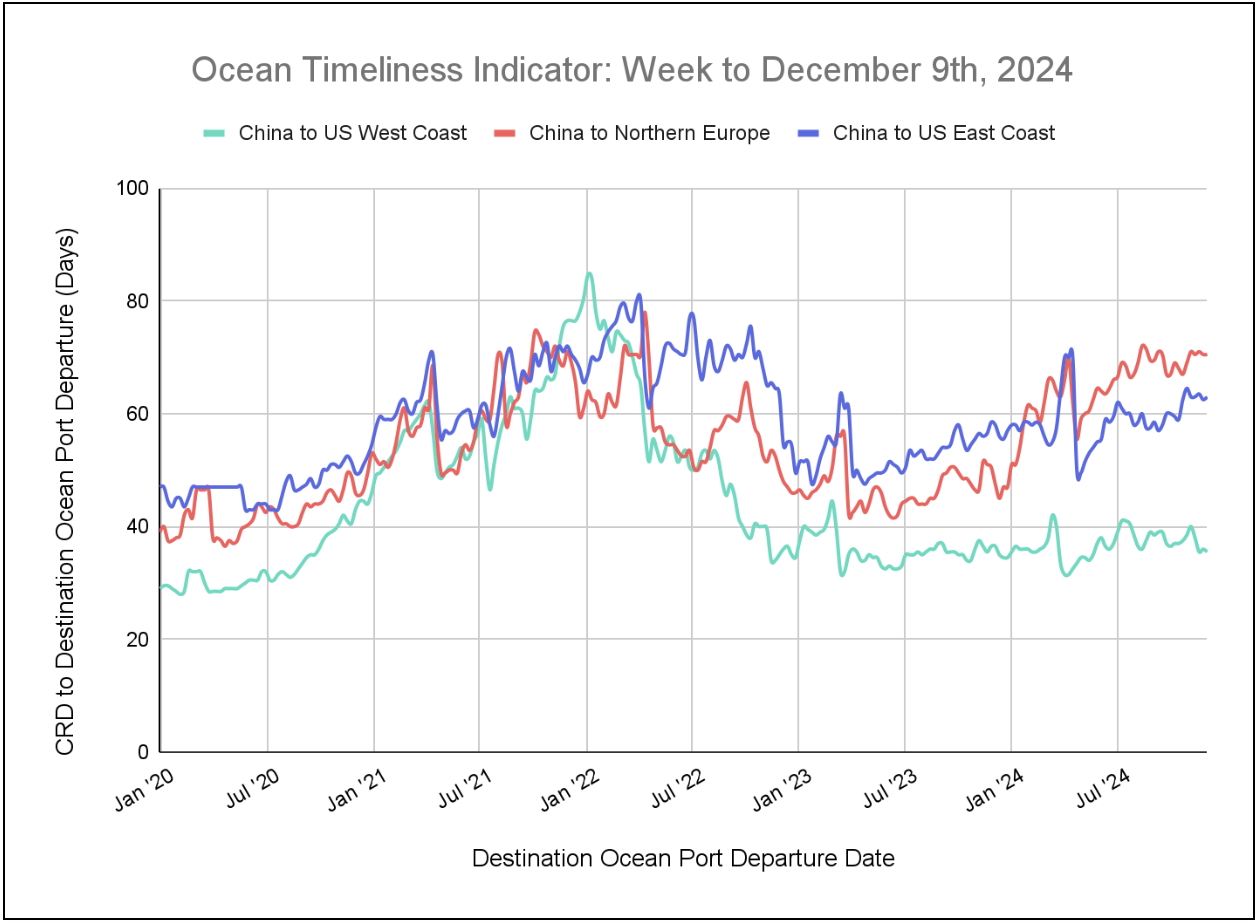

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI is showing minor fluctuations. China to the U.S. West Coast has exhibited a small drop, China to the U.S. East Coast has shown a small uptick, and China to North Europe has plateaued.

Week to December 9, 2024

This week, the Ocean Timeliness Indicator (OTI) has dropped for China to the U.S. West Coast, falling from 36 to 35.5 days. China to the U.S. East Coast has shown a minor uptick, moving from 62.5 to 63 days. Meanwhile, China to Northern Europe remained stable at 70.5 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?