Market Update

Global Logistics Update: February 6, 2025

Updates from the global supply chain and logistics world | February 6, 2025

Global Logistics Update: February 6 , 2025

Trends to Watch

[Tariffs/De Minimis Exemption Update]

- Effective Tuesday, February 4, an additional 10% tariff has been imposed on goods from China and Hong Kong under President Trump’s executive order, which also eliminates the de minimis rule for Chinese-origin goods.

- The executive order also suspends duty drawback on these additional duties for goods originating from China (Mexico and Canada deferred). However, businesses may still recover the standard duties, including Section 201 or Section 301 duties.

- In response, China swiftly announced a series of retaliatory measures against the U.S.

- Meanwhile, tariffs on Canada and Mexico have been deferred for 30 days after President Trump reached a last-minute agreement with Mexican President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau.

- For more details on the latest tariff updates, read our blog.

[Suez Canal Update]

- As of February 4, 2025, the Suez Canal is experiencing a return to stability following previous disruptions caused by attacks in the Red Sea.

- The Houthis have pledged to honor the Gaza ceasefire reached last month and have suspended attacks on commercial shipping in the region. Despite this, major shipping lines remain cautious, prioritizing security before resuming regular operations.

- The Suez Canal Authority (SCA) is actively working to restore traffic through the canal, given the improving security situation.

- On Monday, the SCA issued new navigational maps for a planned 10-kilometer extension of the canal. This project aims to increase capacity, allowing an additional six to eight vessels to transit daily.

[Ocean - TPEB]

- Demand remains weak post-Lunar New Year in February, with floating rates expected to decline further. By Weeks 9 and 10, we can see a slow recovery.

- Capacity: Blank sailings announced before the holiday are now impacting market capacity. However, with deferred shipments built ahead of LNY, most carriers report good vessel utilization in February despite the slowdown in demand. Given the anticipated rate decrease, carriers are expected to accept over-bookings in preparation for March.

- Equipment: No shortages have been reported.

[Ocean - FEWB]

- Demand remains weak post Lunar New Year in February, with floating rates expected to decline further.

- Capacity: Blank sailings announced before the holiday are now impacting market capacity. However, with deferred shipments built ahead of LNY, most carriers report good vessel utilization in February despite the slowdown in demand. Given the anticipated rate decrease, carriers are expected to accept over-bookings in preparation for March.

- Equipment: Occasional equipment shortages at origin persist due to blank sailings and vessel delays. Timely Equipment Interchange Receipt (EIR) printing to ensure that documents are generated and processed promptly to avoid delays in equipment pickup and early equipment pickup can help mitigate the risk of missed cargo-loading.

[Ocean - TAWB]

- Service updates: Recent changes in ocean carrier alliances and vessel deployments, which temporarily reduced available capacity and caused service disruptions in recent weeks, have now been fully implemented. These strategic realignments within major carrier alliances are expected to stabilize schedules and enhance service reliability going forward.

- Blank sailings have decreased in both North and South Europe.

- Rates: Some carriers have implemented a Peak Season Surcharge (PSS) starting March 1 for shipments from North Europe to the U.S., Canada, and Mexico.

- Demand remains stable in February, with carrier capacity at healthy levels.

[Air - Global] (Mon 20 Jan - Sun 26 Jan 2025) (Week 4) (Source: worldacd.com):

- Global air cargo rates and volumes: Average global air cargo rates increased by +4% week-on-week (WoW) in Week 4 (Jan. 20-26) to $2.52/kg, marking an +11% year-on-year (YoY) increase. Tonnages from the Asia-Pacific rose +2% WoW, now +6% YoY, though still -8% below the Week 49 peak.

- Asia-Pacific to Europe and USA trends: Asia-Pacific to Europe tonnages surged +10% WoW, now +5% YoY, with China to Europe up +11% WoW and +12% YoY. Spot rates from the Asia-Pacific to Europe ($4.32/kg) and China to Europe ($4.29/kg) were stable, but +30% YoY. Asia-Pacific to USA rates rose to $5.30/kg, up +28% YoY, while China to USA rates ($4.49/kg) were up +5% YoY.

- Worldwide tonnages stabilizing: Global tonnages remained broadly stable (+1% WoW) in Week 4 after rebounding +28% in Week 2 and +11% in Week 3. Current levels are -7% below December averages, but are similar to levels last October and this time last year, indicating slower YoY growth in 2025 compared to +11% YoY growth in 2024.

- Central and South America (CSA) growth: Outbound tonnages from CSA soared +17% WoW in Week 4, with a +62% increase in the first four weeks of 2025, mainly driven by flower shipments ahead of Valentine’s Day. Flower shipments more than doubled (+114%), with 92% destined for North America.

- Colombia and Ecuador leading flower exports: 98% of CSA flower exports to North America originated from Colombia (61%) and Ecuador (37%). Flowers accounted for 77% of Colombia’s and 63% of Ecuador’s total air exports in early 2025, reinforcing their reliance on the North American market.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Upcoming Webinars

The Ripple Effect of U.S. Tariffs: What Global Companies Need to Know

Thursday, February 6 @ 8:00 am PT / 11:00 am ET/ 16:00 GMT / 17:00 CET

Scenario Planning: 3 Key Developments Shaping The Freight Market

Monday, February 10 @ 7:00 am PT / 10:00 am ET/ 16:00 CET / 15:00 GMT

Navigating the 2025 RFP Season: A Beginner’s Guide to a Successful RFP

Tuesday, February 11 @ 11:00 am PT / 2:00 pm ET

North America Freight Market Update Live

Thursday, February 13 @ 9:00 am PT / 12:00 pm ET

Navigating the 2025 RFP Season: An Advanced Guide to Upscaling Your RFP

Wednesday, February 19 @ 10:00 am PT / 1:00 pm ET

This Week in News

Flexport CEO breaks down the complex and uncertain global trade landscape

As global markets face uncertainty amid President Donald Trump’s tariff hikes, Flexport CEO Ryan Petersen discussed how businesses are navigating the rapidly shifting trade landscape in an interview with CNBC’s Jim Cramer. According to Petersen, many companies have been rushing to import goods in anticipation of escalating duties, particularly on Chinese imports.

USPS Resumes Accepting Packages From China After Unexpected Suspension

The USPS abruptly halted package acceptance from China and Hong Kong on Tuesday following China’s retaliatory tariffs on U.S. goods. The ban was quickly reversed on Wednesday, with USPS and Customs and Border Protection (CBP) working to enforce new tariffs with minimal disruption.

Flexport CEO outlines real impact of tariffs on shipping, consumer prices

On Tuesday, Flexport CEO Ryan Petersen sat down with Blake Burman at NewsNation to discuss the latest on U.S.-China trade—specifically, the new 10% tariff and the suspension of the de minimis exemption, both of which took effect yesterday. “I don’t think this is the end of it,” Ryan said. “The treasury secretary has until April 1 to put in a formal recommendation for the president on Chinese trade, so I’d expect barriers to trade to ratchet up.

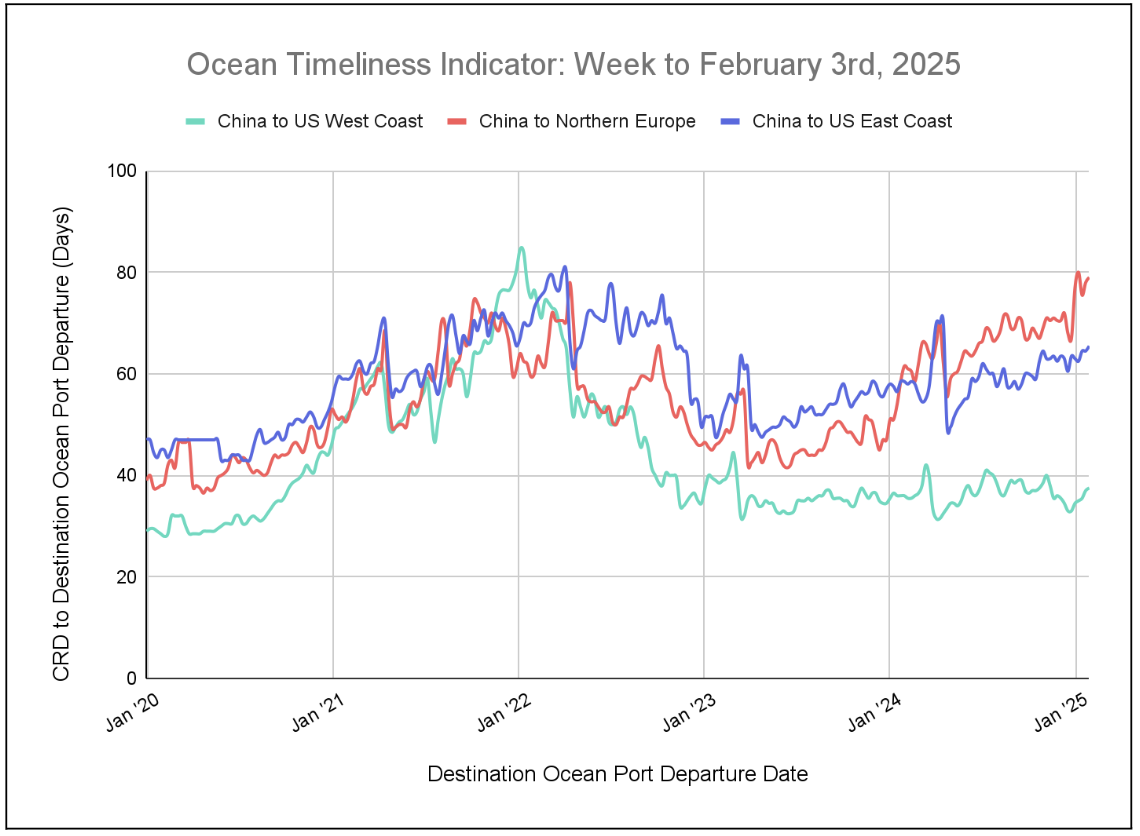

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI is on the rise across the board.

Week to February 3, 2025

This week, the Ocean Timeliness Indicator (OTI) for China to North Europe has risen considerably in the past month: despite a small decrease in the last few weeks, it has been on the rise for two consecutive weeks, increasing from 78 to 79 days. Meanwhile, China to the U.S. West Coast and China to the U.S. East Coast have also been on the rise, increasing from 37 to 37.5 days and 64.5 to 65.5 days, respectively.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?