Market Update

Global Logistics Update: January 16, 2025

Updates from the global supply chain and logistics world | January 16, 2025

Global Logistics Update: January 16, 2025

Trends to Watch

[Ocean - TPEB]

- Rates: Shipping lines have reduced short-term rates to both coasts to stimulate demand ahead of Lunar New Year. FAK rates remain higher than NAC rates, plus peak season surcharges (PSSs). Further PSS adjustments are likely to occur only by mid-February.

- Equipment: No significant equipment issues have been reported at origin.

- Space: Due to the Pre-Chinese-New-Year (CNY) rush, space remains constrained, particularly on fixed allocations. However, some strings still have open space, especially to the West Coast and, to a lesser extent, the East Coast. Carriers have planned 11% blank sailings during the CNY period, aligning with network adjustments.

[Ocean - FEWB]

- Demand: Pre-Chinese New Year (CNY) demand has slowed, resulting in low carrier vessel utilization rates and a softening market.

- Capacity: In response, carriers have announced void sailings, primarily targeting WK5, with total capacity reduced to 223k TEU—down from the typical weekly range of 300-320k TEU. Updates to carrier alliance services are planned after the CNY holiday, but no clear strategy for overall capacity changes has been outlined. Meanwhile, carriers are actively promoting space for post-CNY shipments.

- Carrier availability: The new alliance structure set for 2025 is expected to heighten price competition as carriers contend for market share. Reports from origin ports show declining activity, signaling limited pre-CNY rush shipments and a shift in freight demand toward holiday mode. Based on recent pricing trends and port throughput data, it appears the turning point in cargo volume has already passed.

[Ocean - TAWB]

- Labor dispute update: The ILA and USMX have announced a tentative agreement, successfully averting the strike planned for January 16, 2025. As a result, carriers have canceled the ILA disruption charges that were set to apply in the event of a strike.

- Rates: Rates have largely been extended for the second half of January, as the strike will no longer occur. Carriers are also extending rates into February in anticipation of the new network rollout.

- Blank sailings: Blank sailings continue as part of service restructuring and the phased implementation of new services.

[Air Freight Update] Mon 30 Dec - Sun 05 Jan 2025 (Week 1) (Source: worldacd.com)

- Growth moderation signals market shift:

- December 2024 global tonnage grew +6% YoY, with pricing up +7% YoY, marking a slowdown from earlier months.

- Q4 2024 growth softened to +8% YoY, reflecting higher comparison bases and easing demand.

- Regional powerhouses drive rates up:

- Asia-Pacific and MESA spot rates surged by +23% and +59% YoY, respectively, maintaining regional dominance.

- Combined air cargo rates began 2025 at $2.65 per kilo, up +13% YoY.

- Spot vs. contract rates:

- Global spot rates jumped +22% YoY, while contract rates rose more modestly by +6%.

- Short-term seasonal impact:

- Tonnages dipped -8% (2Wo2W) at year-end, driven by capacity cuts (-24% to -48%) and U.S. weather disruptions.

- Transatlantic Westbound rates soared +50% YoY in December, fueled by shifting freighter capacity.

- Deceleration from key regions:

- Asia-Pacific Q4 tonnage growth slowed to +11% YoY, down from +20% YoY in Q1.

- MESA tonnage growth eased to +7% YoY in Q4, highlighting broader demand cooling.

Please reach out to your account representative for details on any impacts to your shipments.

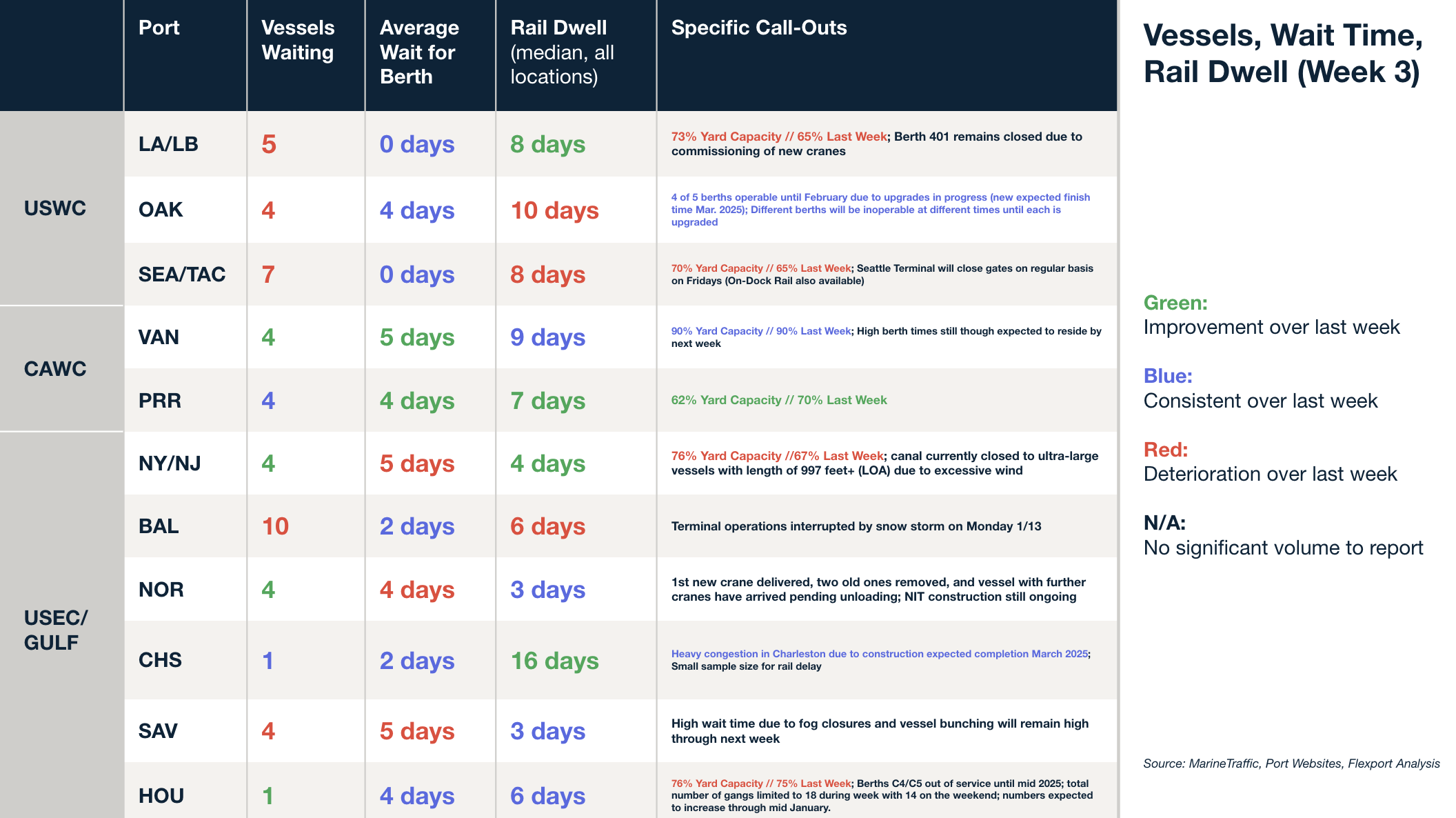

North America Vessel Dwell Times

Upcoming Webinars

North America Freight Market Update Live

(Today) Thursday, January 16 @ 9:00 am PT / 12:00 pm ET

This Week in News

2025’s logistics risks include tariffs, labor strife

The year 2025 brings significant challenges for logistics strategies, with tariff uncertainties, labor disruptions, and shifting pricing dynamics across all transport modes. Ocean shippers must prepare for the ratification process of the ILA-USMX contract and potential tariff impacts, prompting some to frontload imports. Rail shippers face capacity constraints and elevated U.S.-Mexico trade demand, while air cargo may see short-term boosts due to regulatory changes and tariff timing.

US LTL truck pricing flat, but still elevated despite low demand

LTL pricing has plateaued since late 2024, with rates still elevated post-Yellow's 2023 collapse but stable due to soft demand. Shippers now have leverage to resist steep rate hikes in 2025 contract negotiations. Freight volumes remain flat, with no signs of increased demand, though LTL carriers' strong cost management supports modest rate increases. Fuel surcharge savings have provided some relief for shippers amid the stagnant freight market.

Carriers extend spot rates in bid to avoid further rate erosion in eastbound trans-Pac

Eastbound Trans-Pacific spot rates are being extended into mid-February by several ocean carriers, signaling weakening pricing power amid declining demand and upcoming Lunar New Year factory closures. Planned rate hikes for mid-January have been shelved, and carriers are offering guaranteed rates and promotional discounts to secure volumes. Spot rates to the U.S. West and East Coasts have dropped 10% and 7%, respectively, reflecting overcapacity and a slowing market. Customers may delay non-essential bookings in anticipation of further rate declines.

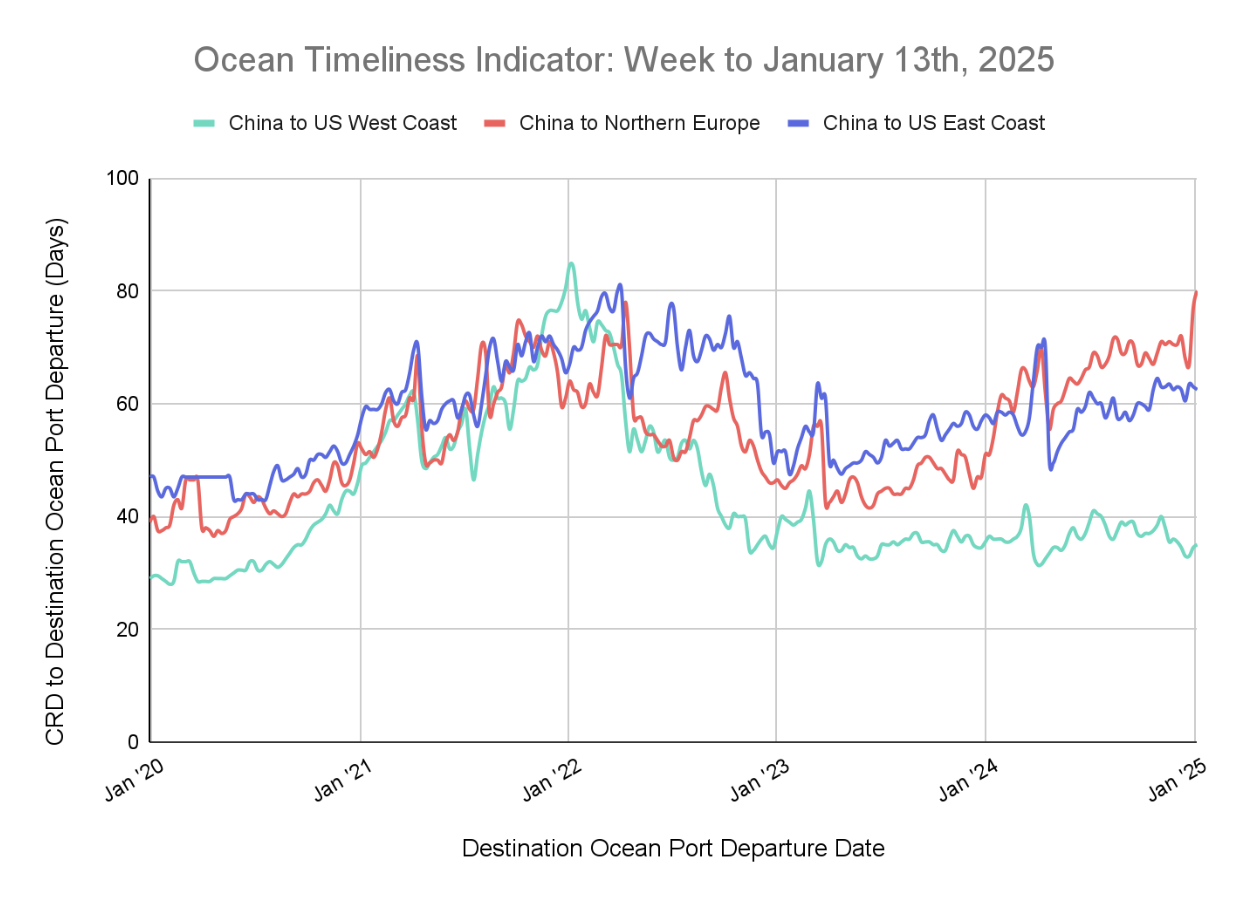

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI for China to North Europe continues its ascent, while China to the U.S. East Coast sees a small downtick. Meanwhile, China to the U.S. West Coast is back with an uptick.

Week to January 13, 2025

This week, the Ocean Timeliness Indicator (OTI) has continued its jump to a new high for China to North Europe, rising from from 77 to 80 days. Meanwhile, China to the U.S. West Coast broke its descent by moving from 34.5 to 35 days. Meanwhile, China to the U.S. East Coast showed a small downtick, falling from 63 to 62.5 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?