Market Update

Global Logistics Update: January 30, 2025

Updates from the global supply chain and logistics world | January 30, 2025

Global Logistics Update: January 30, 2025

Trends to Watch

[Tariffs Watch]

- President Donald Trump told reporters on Monday that he intends to impose universal tariffs “much bigger” than 2.5%, shortly after pledging tariffs on semiconductors, steel, aluminum, pharmaceuticals, and copper.

- Additionally, over the weekend, President Trump threatened Colombia with emergency tariffs. That standoff was quickly resolved after the Colombian government agreed to the Trump administration’s terms.

- The Senate Committee on Commerce, Science, and Transportation met this week to discuss the Panama Canal’s impact on U.S. trade and security. At last week’s inauguration, President Trump reiterated his plan to “take the Panama Canal back.”

- For more details on the latest tariff updates, read our blog.

[Ocean - TPEB]

- Demand: Demand reductions due to the Lunar New Year holiday have put downward pressure on rates. The SCFI has declined for its third consecutive week.

- Rates: No rate adjustments are expected in the next 1-2 weeks due to holidays in China. Further short-term rate adjustments are anticipated in early February, following a pattern similar to Peak Season Surcharge (PSS).

- Vessel utilization: To prevent vessel underutilization, carriers have established roll pools at major origin loading ports, leading to expected rollovers in the coming two weeks. No equipment shortages have been reported at origin.

[Ocean - FEWB]

- Carrier announcements: To prevent under-utilized vessels, carriers have announced void sailings before and after the Chinese New Year holidays. This has resulted in the buildup of roll pools at major origin loading ports. Rollover cargo is expected in the next two weeks.

- Service updates: New alliance services will fully launch in February, with more updates to follow regarding service reliability.

- Equipment availability: Occasional equipment shortages are occurring at origins due to blank sailings and vessel delays.

- Client advisory To minimize the risk of missed cargo loading, we recommend timely Equipment Interchange Receipt (EIR) printing and earlier equipment pickups.

[Ocean - TAWB]

- Service updates: New alliance services are set to begin in February.

- Blank sailings The frequency of blank sailings has decreased in Northern Europe. However, some blank sailings persist in specific services, primarily in the Eastern Mediterranean.

- Space availability Carriers are observing slight increases in available space on routes to the U.S. East and West Coasts.

- Equipment challenges Equipment shortages continue to affect Central Europe, including Austria, Switzerland, Hungary, Slovakia, the Czech Republic, and southern Germany. Carriers recommend utilizing carrier haulage to better monitor and manage demand.

[Air - Global] Mon 13 Jan - Sun 19 Jan 2025 (Week 3):

- Air cargo demand trends: Global air cargo tonnages increased by +8% week on week (WoW) in Week 3 (Jan 13-19), following a +29% rebound the previous week. Tonnages have now recovered to ~90% of pre-Christmas levels, after a sharp -35% decline in late December and early January. Year-on-year (YoY), global tonnages rose by +3% in Week 3 and +2% for Weeks 2 and 3 combined.

- Spot rate developments: Average global air cargo rates were stable at $2.43/kg in Week 3, +7% YoY. Global spot rates declined by -3% WoW, but remain +16% higher YoY, with notable increases from the Middle East & South Asia (MESA) (+54% YoY) and the Asia-Pacific (+20% YoY).

- Asia-Pacific market performance: Asia-Pacific tonnages rose +5% WoW in Week 3 and are +5% YoY, but still -10% below peak Week 49 levels. The post-peak demand decline in the Asia-Pacific (-33%) is similar to last year (-30%), but recovery to Europe is lagging, with Asia-Pacific to Europe down -20% vs. Week 49 and China to Europe down -15%.

- Regional rate trends: Asia-Pacific to Europe spot rates dropped by -4% WoW to $4.35/kg, which is -15% lower than Week 49, but still +31% YoY. Asia-Pacific to USA tonnages rose +7% WoW, now -16% below Week 48 peak, while rates fell for the fifth consecutive week to $5.21/kg, though still +29% YoY.

- Market drivers: The seasonal recovery is underway but faces headwinds due to an early Lunar New Year (Jan. 29), affecting demand patterns.High spot rates persist YoY, reflecting capacity constraints and sustained ecommerce demand, especially on major trade lanes.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

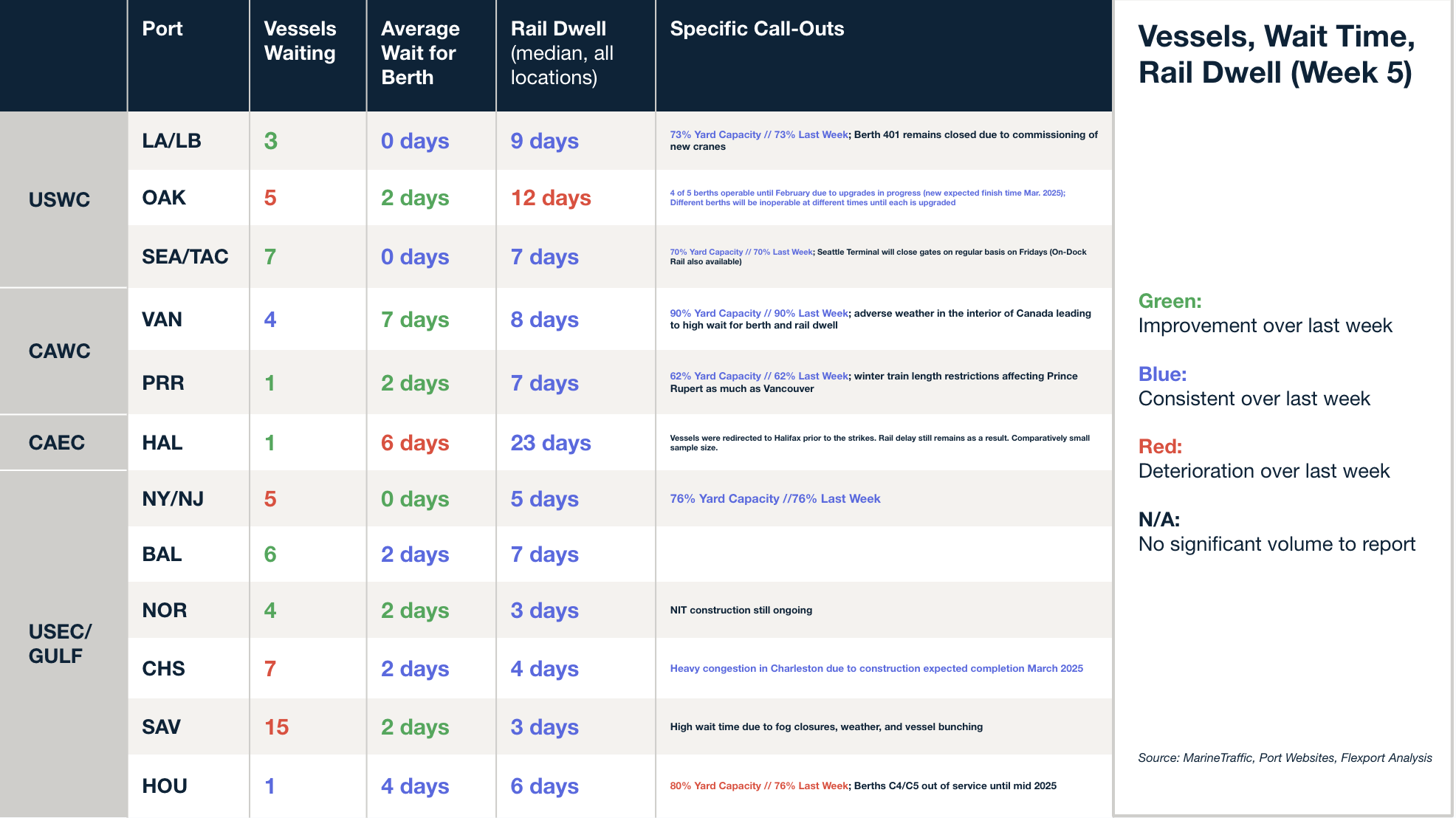

North America Vessel Dwell Times

Upcoming Webinars

The Ripple Effect of U.S. Tariffs: What Global Companies Need to Know

Thursday, February 6 @ 8:00 am PT / 11:00 am ET / 16:00 GMT / 17:00 CET

Navigating the 2025 RFP Season: A Beginner’s Guide to a Successful RFP

Tuesday, February 11 @ 11:00 am PT / 2:00 pm ET

North America Freight Market Update Live

Thursday, February 13 @ 9:00 am PT / 12:00 pm ET

Navigating the 2025 RFP Season: An Advanced Guide to Upscaling Your RFP

Wednesday, February 19 @ 10:00 am PT / 1:00 pm ET

This Week in News

Asia-Europe ocean rates fall as weak demand sparks battle for market share

The Asia-Europe trade lane is experiencing intense competition between forwarders and carriers, with falling rates and slowing demand leading up to the Lunar New Year holidays. Many Chinese factories shipped orders early, resulting in a quiet market since mid-January. Short-term Asia-North Europe rates have dropped 21% since late December, settling at $3,963/FEU, while Asia-Mediterranean rates are down over 10%.

Sailing cuts slow pace of decline for India-USEC spot ocean rates

Spot rates on the India-U.S. East Coast trade have slowed their decline, supported by reduced capacity from blank sailings by major carriers. Current rates average $1,350–$1,500 per FEU, with Platts reporting $1,480 as of Jan. 24, down slightly from earlier in the month. Despite plans for February GRIs and surcharges, carriers remain doubtful of their success amid volatile market conditions. Any partial reopening of the Suez Canal could add further pressure to rates due to overcapacity.

Carriers eye Red Sea transits after Houthi rebels pledge restraint

Ocean carriers remain cautious about resuming Red Sea transits despite a Houthi announcement limiting attacks to Israel-affiliated vessels. Carriers like Hapag-Lloyd and Maersk insist they will only return when the region is deemed safe. The Red Sea crisis, which began in late 2023, forced most ships to reroute around Africa, reducing available fleet capacity and driving up freight rates. Analysts warn that a return to the Suez route will flood the market with capacity, leading to supply chain disruptions and sharp declines in spot rates. While carriers may mitigate overcapacity through scrapping and slow steaming, a market downturn appears inevitable.

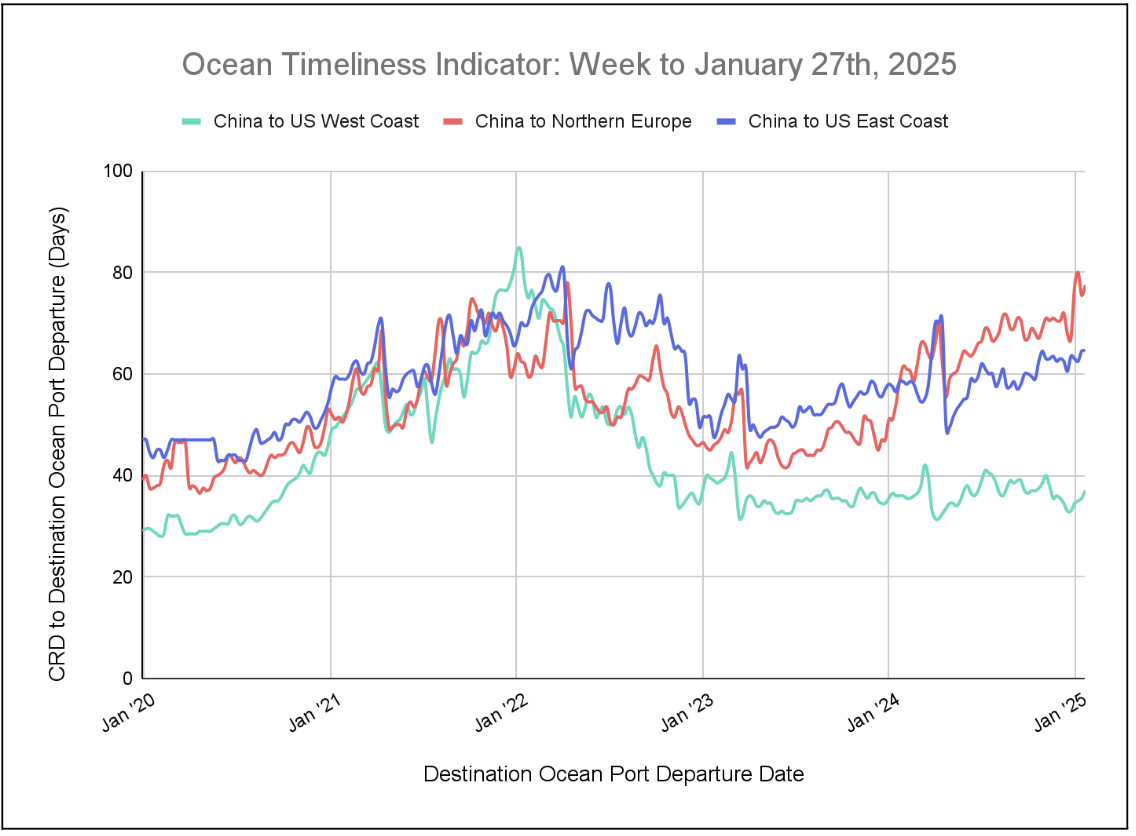

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI is on the rise for China to North Europe and China to U.S. West Coast, while China to the U.S. East Coast has plateaued.

Week to January 27, 2025

This week, the Ocean Timeliness Indicator (OTI) for China to North Europe had risen considerably in the past month, showing a small decrease last week by falling to 75.5 days, and is once again on the rise this week—up to 77.5 days. Similarly, China to the U.S. West Coast increased from 35.5 to 37.5 days, while China to the U.S. East Coast has stabilized at 64.5 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?