May 25, 2022

Clothing and Closures - Apparel Sector Challenges

Clothing and Closures - Apparel Sector Challenges

What pressures face clothing supply chains in 2022? This is the first in a two-part report which considers recent data for apparel supply chains and identifies logistics congestion, high commodity prices, pandemic-related supplier closures and risks to sales as ongoing pressures. The second report will consider tactical and strategic options for apparel sector operators including logistics strategies, inventory levels and reshoring opportunities.

Apparel’s No Different From Other Trade-Dependent Industries

Apparel manufacturers and retailers face a host of supply chain related disruptions.

Like most manufacturing industries the ongoing congestion in logistics networks has slowed the delivery of finished products. That can be particularly acute for fashion retailers that have had to rely on expensive air freight to ensure seasonal product lines are available on time in the face of slower—but more economical—ocean freight.

Flexport’s Ocean Timeliness Indicator shows that while handling times for ocean freight in Asia have improved recently, overall delivery times into Europe and North America remain at double their levels before the pandemic. Similarly, airfreight handling times have fallen by as much as a third from their January peaks on TPEB routes but are nonetheless 1.5x their 2019 levels.

Commodity Prices at Decade Highs

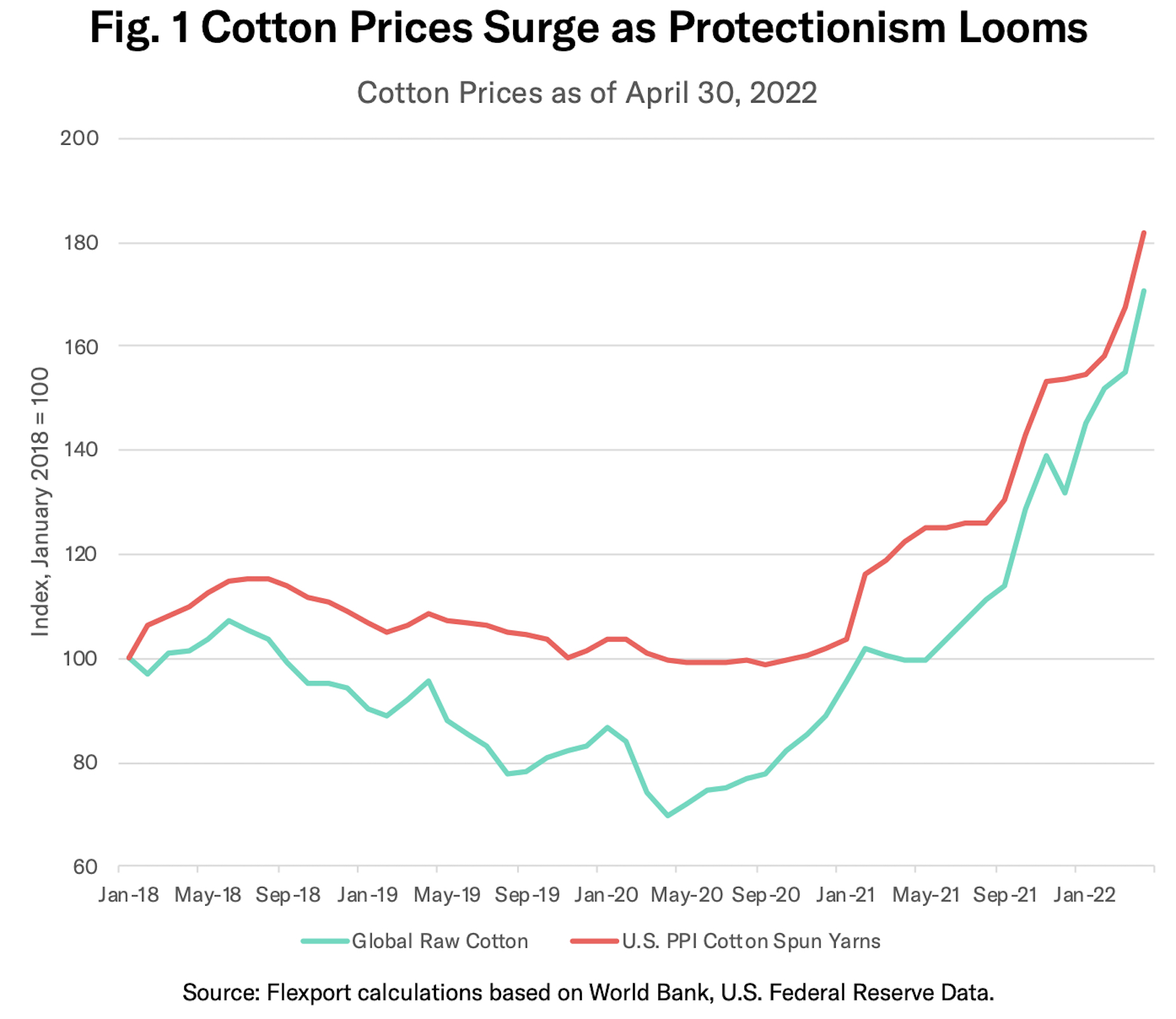

Raw materials prices have surged during the pandemic in response to elevated demand across the energy, metals and agriculture sectors—most recently because of the conflict in Ukraine as discussed in recent Flexport research. That’s led to a resurgence in export protectionism across the commodity groups.

In the case of one key fashion ingredient—raw cotton—that’s taken the form of the Indian government calling on domestic firms to focus on fulfilling local demand for raw cotton, yarn and fabric before exporting the surplus. This has the potential to limit global supply. India accounted for 9.8% of global exports of all cotton products in 2020 according to UN Comtrade data, including 14% of cotton yarn exports.

Elevated demand and protectionism worries have led cotton prices to rise by 29% year-to-date in 2022 as of April 30, 2022 and by 71% year-over-year, as shown in Figure 1. They’ve since risen by a further 10% during the first half of May according to press reports.

There’s been a direct impact on producer price inflation, with U.S. cotton yarn prices having risen by 18% year-to-date at the end of April and by 48% year over year. This will eventually make its way into consumer prices, assuming the apparel manufacturers and retailers believe they have sufficient pricing power.

Pandemic Related Factory Closures

More recently, the pandemic has also had a direct impact on apparel supply chains because of factory closures among manufacturers of both components (yarn, fabric and fasteners) and finished products.

A local industry association has noted that apparel factories in Vietnam are facing a shortage of raw materials due to factory closures in China. That followed a similar round of factory closures in Vietnam in 2021 linked to pandemic cases.

At least two of the major sports apparel manufacturers have also noted the impact of a couple years of pandemic-related factory closures on their sales in the remainder of 2022.

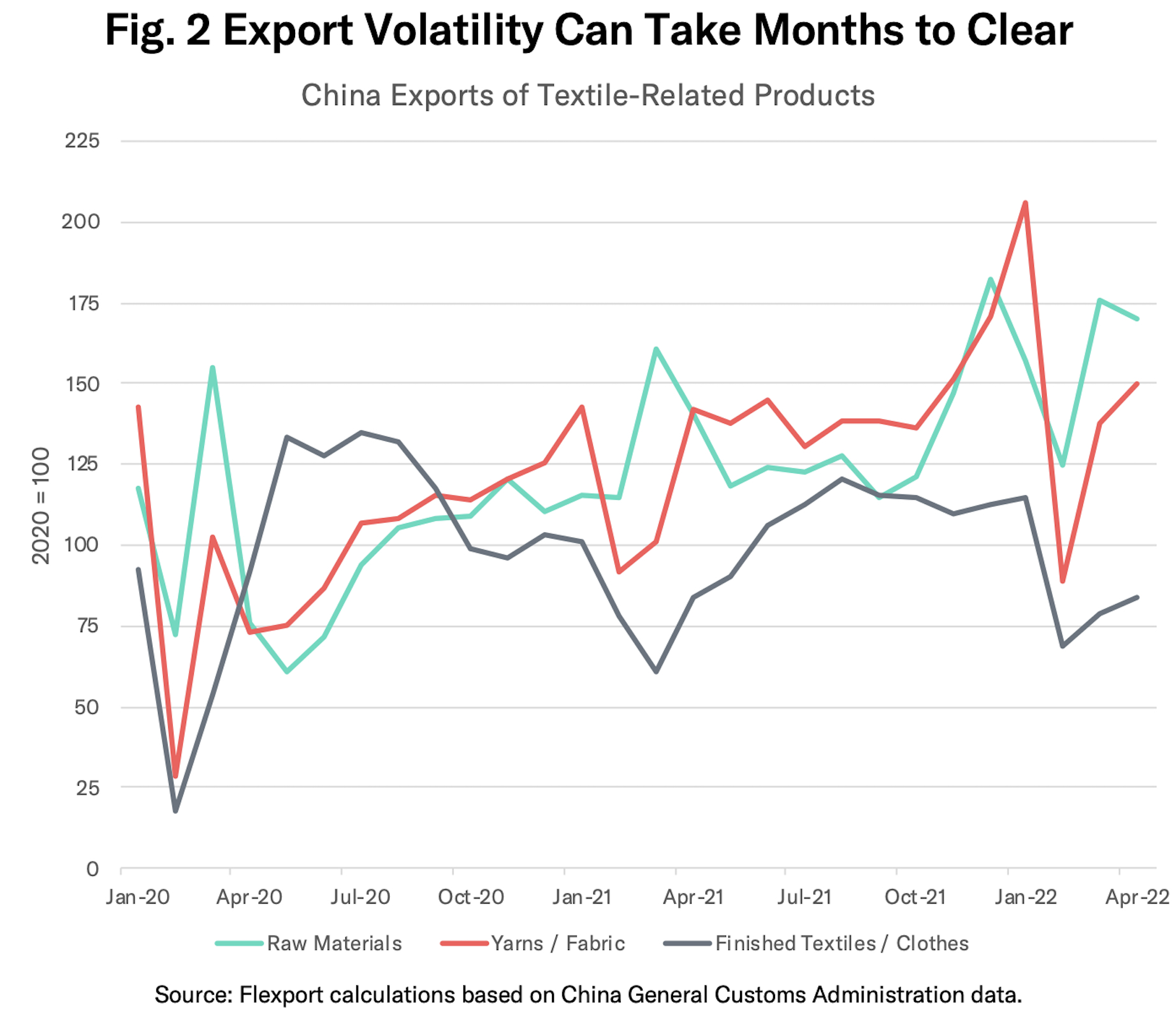

Such disturbances can take several months to fully work through supply chains. Figure 2 shows Chinese exports of textile raw materials, yarns/fabrics, and finished textiles/clothes.

In February 2020, the initial pandemic-related lockdowns immediately cut exports of all three categories with raw materials and yarns/fabric recovering the following month. Exports of finished textiles and clothes meanwhile did not fully recover until July 2020.

More recently, exports of raw materials fell by 3% sequentially in April, while yarns/fabrics increased by 9% and finished products by 6%. It should be noted that the data is denominated in dollars, with the changes in exports therefore reflecting both inflationary and volumetric effects. As the data above implies, raw cotton prices rose by 10% sequentially in April, potentially flattering export values.

U.S. Retail Sales Risks

Clothing retailers have had to deal with store closures during the pandemic, driving many to adopt omnichannel strategies by expanding their direct-to-customer and ecommerce strategies.

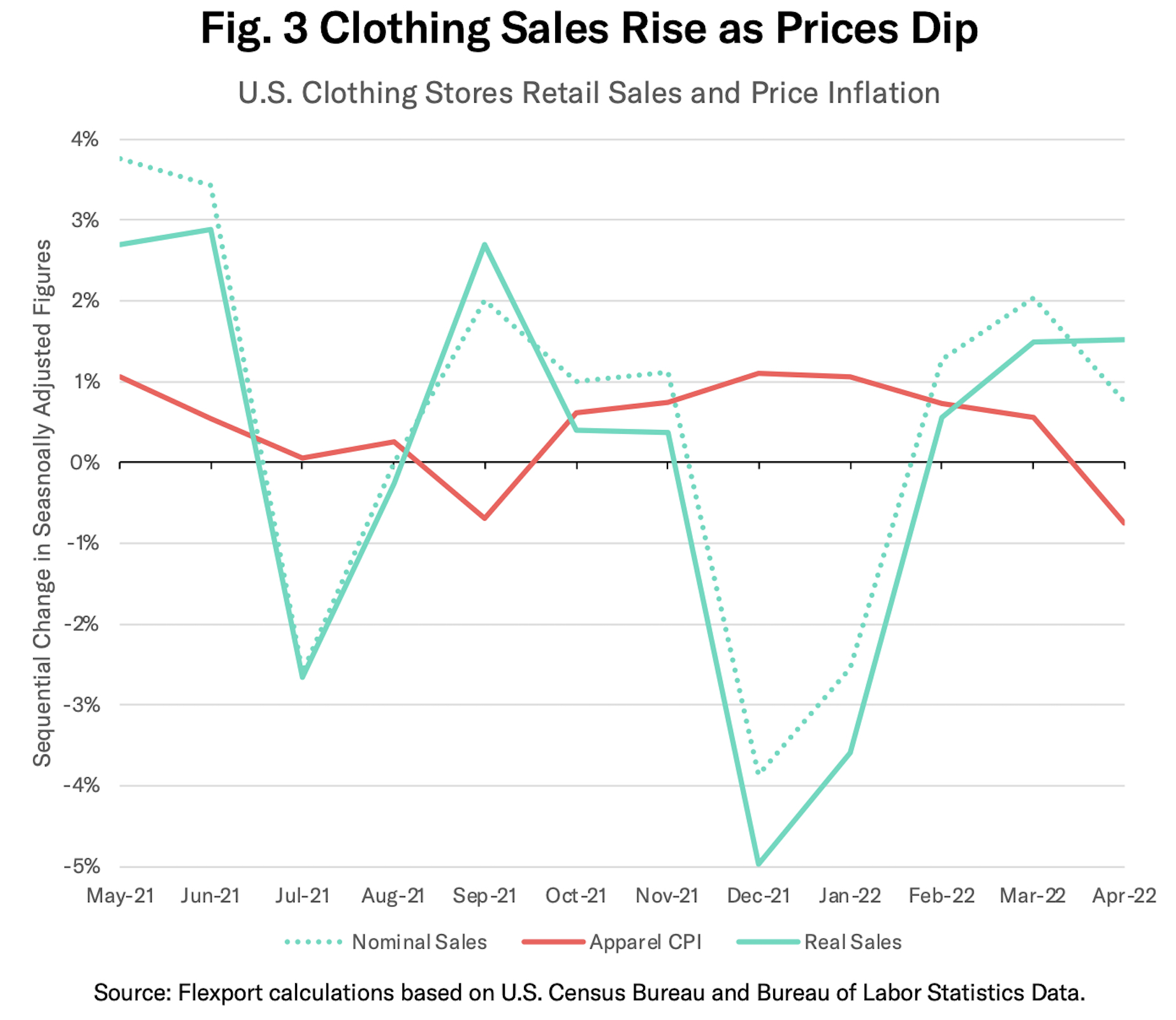

Compared to the pre-pandemic period, though, U.S. retail sales by clothing stores increased by 17.2% in April 2022 versus April 2020 in nominal terms and by 15.5% adjusting for inflation. Note that the apparel category of the Consumer Price Index fell by 7.1% in May 2020 versus February 2020 before subsequently recovering.

More recently, growth has remained solid if lackluster, averaging 1.2% monthly in the three months to April 30 when adjusting for inflation, as shown in Figure 3 above.

Somewhat concerningly, consumer apparel prices fell by 0.8% sequentially in April despite the rising commodity prices flagged above. That may indicate increased use of promotions to continue stock sales. Apparel inventory can have a shelf life measured in a few months given the seasonality of products and vagaries of fashion.

Flexport’s Post-Covid Indicator also shows the consumer preferences for spending on nondurable goods, which include apparel, may fall rapidly heading into Q3’22 in favor of spending on services.

In conclusion: Apparel supply chains have faced a panoply of challenges in the past three years including pandemic-related sourcing interruptions, logistics congestion and elevated commodity prices. They now face risks from declining sales. Options for dealing with these challenges include the mix of transportation modes, inventory management and reshoring of sourcing which will be addressed in a second report.

Disclaimer: The contents of this report are made available for informational purposes only and should not be relied upon for any legal, business, or financial decisions. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. This report has been prepared to the best of our knowledge and research; however, the information presented herein may not reflect the most current regulatory or industry developments. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.